5 Reasons Ethereum (ETH) NFTs Took Off this February

#

Non-fungible tokens, or NFTs, took center stage among crypto-based projects. NFTs are tokens with special features, which serve as certificates and do not a use case as digital cash.

The technology, for a long time a small addition to blockchain-based applications, was viewed as a novelty with little potential to achieve meaningful growth. Then the BTC bull market in 2021 renewed interest in crypto investment, and a new wave of token creation took off within weeks. The most of the growth was concentrated in February, and the trend is set to continue for a while.

Here are some of the reasons NFTs came into the spotlight.

DeFi Fatigue

The inflow of funds in decentralized finance and yield farming has reached a plateau. While most of the projects are still active, yield farming is not accessible for small-scale investors, due to high Ethereum (ETH) gas fees.

DeFi still required some upfront investment and the readiness to lock some funds into a smart contract. Often, this led to immediate losses due to rug pulls. Additionally, DeFi suffered hacks and exploits.

The generation of NFTs, however, meant some users could receive the new assets at rock-bottom prices. Others received their tokens as an airdrop during campaigns to popularize new collections.

Hot Projects Arriving on Time

It is difficult to pinpoint what makes an NFT project become the next hot thing. But some of the artworks and collectibles quickly reach cult status and command higher prices.

One of the most active projects, CryptoPunks, started with a simple idea for pixel art. Soon, some of the rare and in-demand collectibles was selling for above 20 ETH.

Other projects hinged on the political media buzz, selling NFT and art based on the USA 2020 elections. One of those tokens sold for a value above $6.6 million.

Hashmasks, another NFT collection, also showed the appeal of digital art created for rarity. Hashmasks are now both used for trading and speculation, but also as online identities. The success of these collections paved the road for new projects to arrive almost daily, with the potential to generate in-demand tokens and resale opportunities.

Collectibles Targeting Buyers Outside Crypto World

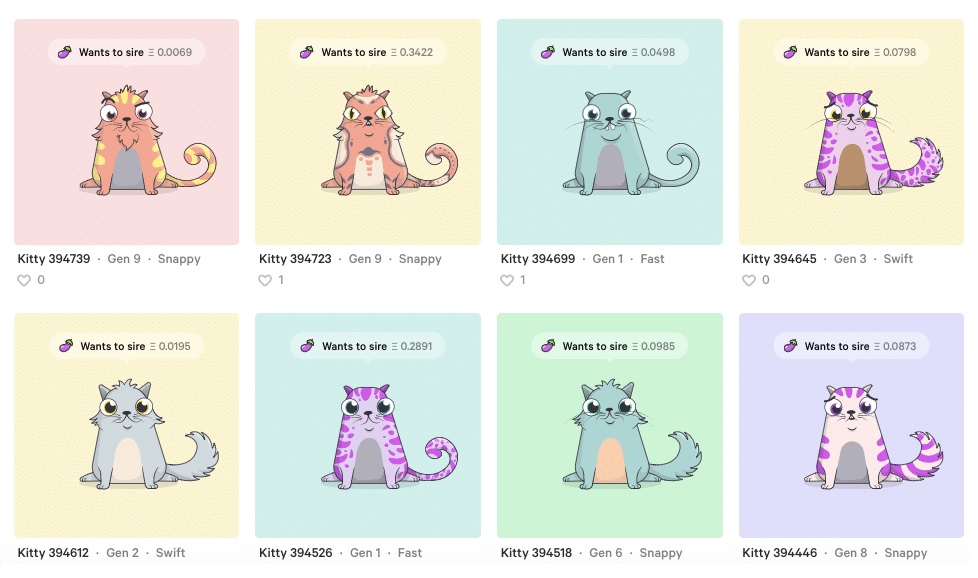

Crypto collectibles have shown their potential to draw in new buyers who are otherwise not interested in Bitcoin (BTC) or other blockchain technologies. The creation of the CryptoKitties game, one of the first collectibles, showed that gamification and collectibles sparked demand for ETH and expanded the popularity of the game beyond the crypto community.

As of 2021, one of the most popular projects is NBA Top Shots, encompassing the sports fandom and generating high valuations for its series of collectibles. NBA Top Shots also attempts to differentiate itself from its connection to crypto assets, and some view it as a project mostly targeted to the collectors’ community.

OpenSea and Gas-Free Marketplaces

The boom of NFTs got help from technology, as OpenSea created a marketplace for existing tokens. Additionally, OpenSea attempts to draw in more assets, by offering a proprietary listing tool and gas-free sales.

One of the biggest drawbacks of NFTs are the unpredictable fees for each operation. Buyers sometimes need to pay double the token’s price just to transfer it to their wallets. OpenSea changes that as much as possible, offering immediate token creation by using a MetaMask wallet.

Regular Tokens Face Competition

Crypto coins and tokens have always offered opportunities for outsized gains. Until recently, altcoins and tokens received attention as sources of speculative gains. But relatively stagnant prices meant money went on search for new opportunities.

Tokens also posed a problem for crypto investors, due to their questionable status as unregistered securities. As a result, multiple token projects faced restrictions from local regulators, shrinking their market reach.

NFTs are still completely unregulated, and there are no restrictions on the resale of collectible items. For now, the tokens are viewed as a workaround for some investment restrictions.

The creation of NFTs does not benefit the Ethereum network alone. Multiple platform projects are gaining users and revenues by opening up for their own versions of NFTs. Beyond the ERC-271 standard on Ethereum, top chains are quickly building up their lists of collectible-related tokens.

Some of the prominent chains include Binance Chain, Ravencoin, Elrond Network. Networks and tokens until recently dedicated to yield farming also reoriented themselves to offer NFT functionalities.

NFTs Spark Criticism Despite High Demand

The popular spread of NFTs also sparked criticism, mostly based on the electricity usage for the Ethereum network. The upkeep of those assets is viewed as an energy use issue and a potential climate risk.

Still, some NFTs can be generated on proof-of-stake networks, which do not require additional electricity for mining. The storage and distribution of images itself is no different from the usual load on data centers and Internet infrastructure.

Still, some tokens may be risky, as artists have pulled a stunt by replacing the rare images with other pictures, to show that unlike certified artworks, the image itself is not connected to the token. So far, there is no technology to ensure that each NFT is related to the exact image it is sold with.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

How do cryptocurrencies stack up against popular stocks and shares?

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.