Should Investors Really Stay Out Of The Current Sideways Market?

##

The crypto market has yet again failed to surprise investors with its price action. The market, which is primarily known for volatility and significant price fluctuations, has gone feeble for quite a while.

We all must have heard the phrase – the calm before the storm, but it does not seem to hold true in the crypto market anymore or at least now. It has been almost a quarter since the market has made a gigantic move, be it north or south.

The only group of people benefitting from the sideways market are day/swing traders, as the retail investors are in expectations of higher returns.

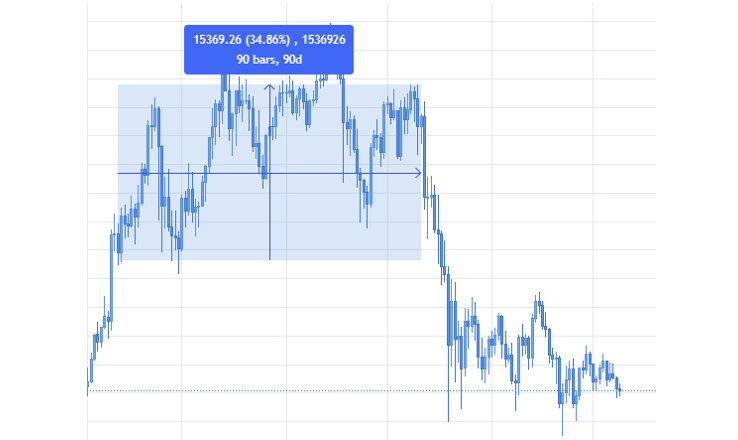

Having that said, the present scenario is not novel in the cryptocurrency market. The mainstream understands that cryptos have the highest percentage movements in short periods relative to stocks, gold, and foreign exchange. But the other side of the grass ignored by the public is that the crypto market has the longest consolidation/retracements in terms of time period. For instance, Bitcoin (BTC) proceeded sideways for 90 days before plunging in May. In fact, the consolidation period lasted much longer before Bitcoin breached the $20,000 mark in late 2020.

Thus, one must understand and acquaint with elongated ranging trajectories as second nature. Although investors cannot expect double digital gains on a daily basis, one could use this consolidation to scale in their positions in the target of long-term gains.

With exceptional altcoins projects existing in the market and much more upcoming, the investment opportunities in the crypto space are never void.

To support the above statement, here are some thriving cryptocurrency projects worth considering despite their dull price movement lately.

Solana (SOL)

Solana is a relatively new blockchain-based open-source project to provide decentralized finance (DeFi) solutions. The revolutionary project brings the unique proof-of-history to the table to allow greater scalability and boost robustness. The protocol has gained immense traction in a very short period as it offers a competitive short processing time for both transactions and smart contract execution.

The native token of Solana – SOL, went live in big exchanges like Binance in 2020 and has performed exceptionally well throughout.

After consolidating for about a couple of quarters in 2020, the price began its bull in 2021 and lasted until May. The SOL crypto has returned over 5200% in its recent move north. Hence, we can clearly ascertain the long wait in 2020 has paid off significantly in the early months of 2021.

Looking at the recent price action, the market is simply hovering between the S&R and the Support area. There has been one official touch on the S&R while two touches at the at Support thus far.

The momentum on both buyers and sellers is balanced as none were successful in breaching through either of the levels.

Currently, the consolidation has been shrinking as the market found another set of S&R in the middle, as indicated by the dotted line.

Hence, based on the price action of Bitcoin and a breakout in SOL would give better clarity on the direction of the price in the long term.

Polygon (MATIC)

The popular Matic Network, now rebranded to Polygon token, has become one of the best projects that address the Ethereum scaling problems. The protocol offers a Layer 2 scaling solution backed by Coinbase and Binance to propel the mass adoption of cryptocurrencies by resolving the problems in the existing systems.

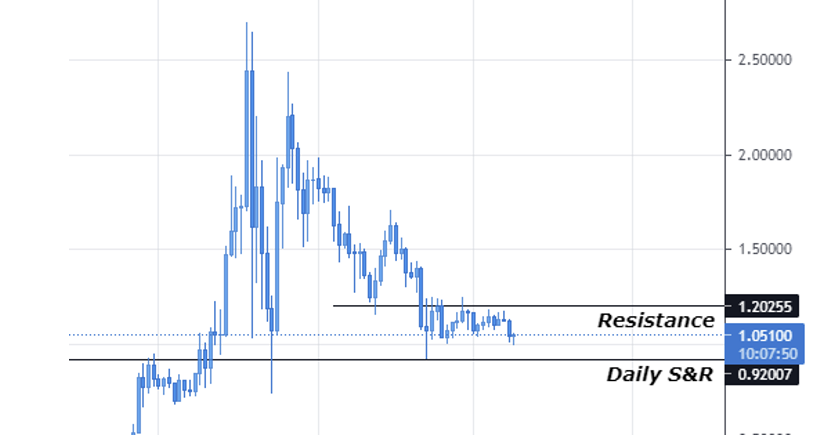

The price action of MATIC crypto is no different from other big altcoins but does look atypical when compared.

The price movement of MATIC has been more on the volatile side lately. Like others, it had its bull run at the beginning of 2021, leaving the all-time-high at around $2.5.

The ATH level failed to hold grounds long enough and crashed on the China crackdown update. The price spiked back up after making a low all the way to less than a dollar. But the price got sold into yet again as the buyers failed to bid for higher prices. And currently, the market is holding at the Daily support & resistance – reacting feebly, as the resistance is strongly into sell mode.

As the markets are diminishing in momentum, the consolidation seems to be coming to an end very soon.

The projects do not end here, as the number of protocols in production is large in number. Each of them brings innovativeness to existing products and keep their technology up and running in the market. Competitions are usually seen in a bad light but have definitely helped evolve the crypto market for the good.

Considering the fundamentals of the blockchain-backed cryptocurrency market, one must not base its prediction only on its price action. Therefore, consolidations in the market must be seen as opportunities for long-term investors, not a game solely for intraday traders.

Now get your favourite crypto from our list of certified and reputed cryptocurrency exchanges. All the best!

##

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.