Terra (LUNA) Returns to Price Discovery

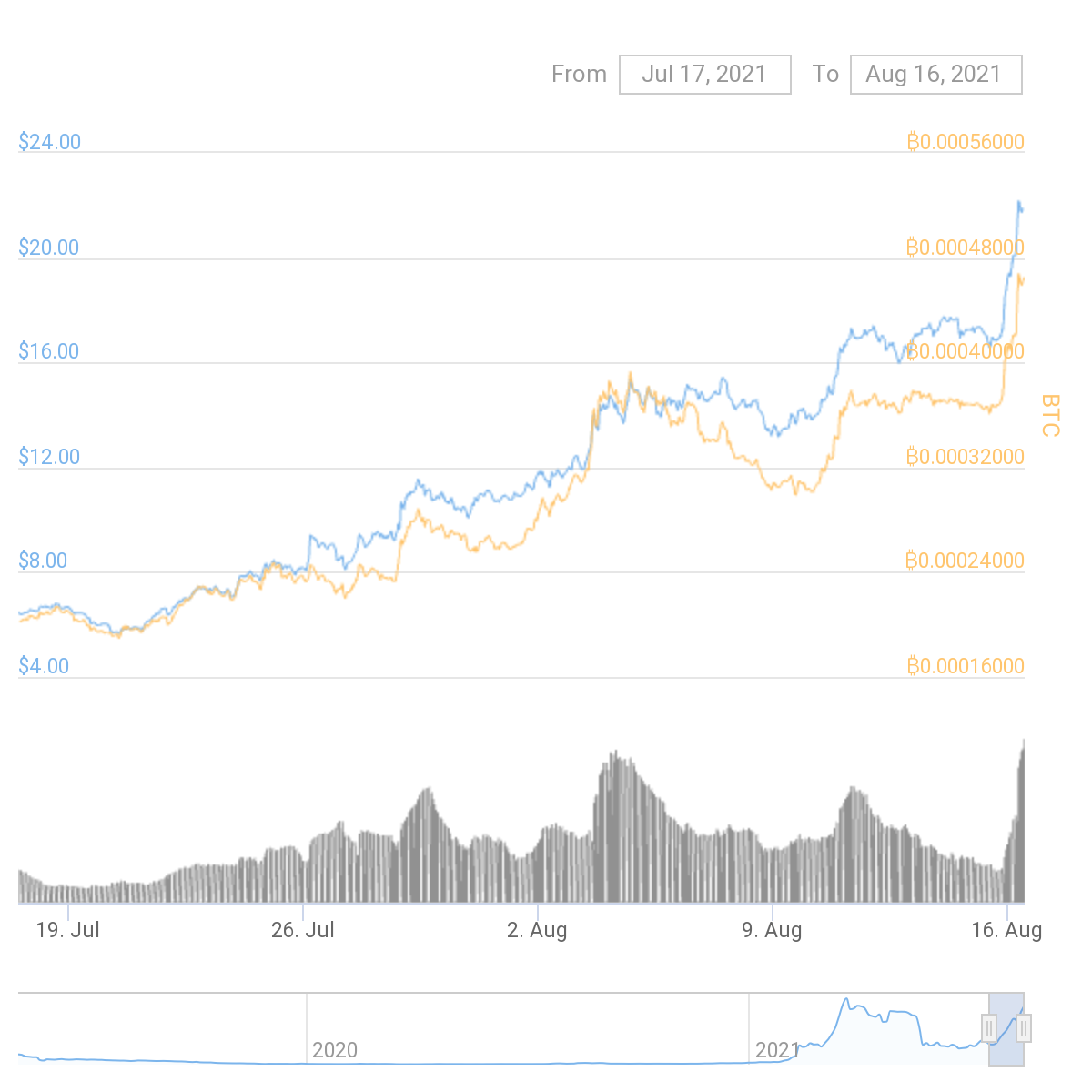

Terra (LUNA), one of the best-performing DeFi platform tokens, reached a series of all-time highs. The asset is now in uncharted territory, going for another stage of price discovery above $20.

LUNA is also about to join the top 20 list of crypto coins, with a market cap above $21B. Trading volumes once again touch the $1B level, extending the success streak for LUNA in 2021. Now, the asset will have to show if its value proposition will lead to genuine expansion, or if the hype will cause a short-term price pump.

The Terra project also rose to prominence among DeFi tokens, becoming the fourth largest platform based on market capitalization. On the Ethereum network, Terra is only surpassed by Uniswap (UNI) and ChainLink (LINK), as well as the vault of Wrapped BTC (WBTC).

What Pushes LUNA Prices Up

The LUNA token has a supply above 411M, all of it reported as being in circulation. However, the chief intention of the Terra project is to provide staking and passive income, while using LUNA to secure its own dollar-pegged asset.

According to different sources, between 37% and above 70% of LUNA are locked in some form of staking. This decreases the coins available to freely trade, potentially creating significant demand on exchanges.

Other statistics count 75% of all LUNA as being locked up and unavailable for transfers and trading.

LUNA is also up in BTC terms, rising above 0.000045 BTC, also getting boosted from a BTC rally that took the leading coin above $47,000.

LUNA Burns Add to Scarcity

The other mechanism for scarcity is that some of the LUNA available is getting burned when creating new Terra USD, or UST. The increased pace of LUNA burning also hinges on new DeFi projects adopting the Terra platform and using UST for their operations.

The collaterals in the form of ETH or other tokens are flowing into Terra projects, using the platform’s cross-chain capabilities.

The Mirror protocol, the chief DeFi hub of the Terra project, currently only locks in $1.79B in value. To compare, the TRON (TRX) DeFi locks in above $9B, and the large Ethereum ecosystem holds above $80B in total value locked. The Terra project has a significant growth upside, as it crosses over to use ETH and tokens as collateral.

The Influence of UST Grows

The Terra USD equivalent is also growing in influence, and has been added for Coinbase Pro deposits. For now, the LUNA asset does not expect an immediate Coinbase listing.

Terra USD is, for now, influential within the context of the Terra DeFi ecosystem. Otherwise, the UST asset only takes up 1.79% of the total market cap for dollar-pegged coins. USDT and USDC remain in the lead. However, the supply of UST is only about 2.12M tokens, with a significant upside for growth.

The Terra ecosystem attempts to create its version of programmable Internet money, with the potential for decentralized financial operations. Unlike earlier projects, Terra will not attempt to displace or compete with Ethereum, instead cooperating with its wide basis of tokens and DeFi projects.

But Terra is also starting to attract its own array of newly minted tokens.

For now, little can be said about the security and liquidity of those assets. DeFi is notoriously prone to exploits, which have so far affected the largest networks, Ethereum and Binance Smart Chain.

Yet Terra remains encouraging, as projects are using the platform to build their DeFi space. At the same time, older networks like Cardano and Tezos are lagging in DeFi adoption and reliable smart contract building.

Is LUNA a Good Investment

LUNA dipped to a low around $5.50 after the sell-off in June. The current rally gave rise to more bullish predictions, possibly seeing LUNA at $50 on continued growth. For now, even prominent DeFi tokens like ChainLink (LINK) have only briefly touched that price range. But LUNA may expand on growing demand during another bullish period for crypto markets.

LUNA is still highly dependent on its Binance trading pair, which gives the asset more than 24% of overall trading volumes. KuCoin brings in significant Korean retail interest, and the Huobi exchange has a less liquid, though still highly active pair.

LUNA adoption may be slower, as it requires the usage of the Station wallet, to access the Terra blockchain. The Terra ecosystem also allows for voting to change the parameters of the protocol.

Currently, LUNA is enjoying significant social media hype, with bullish messaging. The expansion may continue with new price discovery, but there is also the possibility for fast short-term corrections.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

What is cryptocurency? What gives it value? How do you buy and store it? Beginners questions answered in plain English.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.