What Impact Does The US Stimulus Package Bill Have on Bitcoin’s Price?

#

Bitcoin’s bull run is getting stronger with time in 2021. Recently, this crypto has become the first-ever digital currency to reach one trillion dollars in market capitalization. Yes, the total number of Bitcoins available to transact and trade is now collectively worth more than a trillion dollars. The price of one Bitcoin as of today (March 10th, 2021) is about ~$56,800, and there are currently over 18.6 million Bitcoins in circulation.

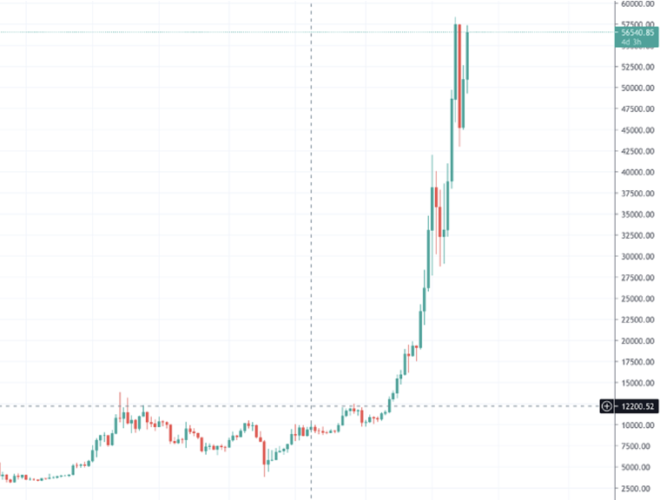

According to crypto experts, Bitcoin could hit an all-time high of $60,000 this week as the United States House of Representatives is expected to pass Democrats’ stimulus bill of $1.9 trillion. Keeping that in mind, let’s analyze the price charts of this crypto in different time frames and make an attempt to forecast its price movements for the upcoming days accurately.

BTC/USD | The Daily Time Frame

The current all-time high value of Bitcoin is $58,464 and this number is pretty close to $60k. We believe that this particular level could be a potential psychological and number resistance. From the above price chart, we can see a clear buy momentum in the past few days. After a slight pullback from its all-time high value, the price of BTC has been closing above its previous day’s high, and this has been the case in the past six days. This indicates the current buyer strength in the market.

The only level of potential resistance for BTC at this point is at ~$58,400, which is its current all-time high value. We can expect a possible pullback from this level, or if the buyer momentum continues to be strong, the pullback may occur at the $60k level. Please note that the psychological support for BTC on the daily timeframe is at $49,676.

BTC/USD | 4-Hour Time Frame

On the 4-hour time frame, the buyer momentum started from the previous higher low – $46,221. Buyers managed to make a higher high by breaking the $51,771 resistance level. In this time frame, the possible psychological support is at $53,917. In case of strong selling pressure in the next few days, the price might come down to this area and then find its way to the $60k level. There is no potential buy opportunity at this point. If we enter the market now, we would be chasing the price, which is not a great idea. A lucrative buy opportunity could be at the $53,917 support area.

From the current supply area ($56,239), there is a possibility of sellers coming in. They might reach the $53,917 level, and from there, the price could take support and reach the current all-time high or the $60k psychological area. In the case of sellers coming strong from the supply area or the current all-time high, the support might not hold. The price could come down to $49,676, which is the support area of both Daily and 4-Hour timeframes. If that happens, we can see a strong buy set-up in this region.

How Does the BTC Transaction Volume Look?

Although the momentum of the buyers from the previous low to the current price is high, the buyer volume seems to be flat. If the volume of the sellers from the supply area comes aggressively till the recent support of $53,917, there could be a potential sell set-up. The sells might go down to $49,676 support area.

BTC/USD | Weekly Time Frame

There is no logical way to analyze the current BTC weekly chart as it is a proper parabolic curve at this point. We can see the eccentric growth of BTC since the beginning of this year.

Expert Opinion

Talking about the Bitcoin forecast, Nigel Green (Founder, deVere Group) said

The price of bitcoin, the world’s most dominant cryptocurrency by market cap, is climbing again this week following its impressive bull run earlier this year. It’s already closing in on its record high hit in February, and I believe that we can expect it to surpass this – likely reaching $60 000 – this week.

Nigel Green

Speaking about the Stimulus package, he said there could be a risk of defilement of the dollar from such an enormous stimulus package. He continued his argument by saying,

‘Bitcoin, of course, cannot simply be printed. Indeed, it is living up to its reputation as ‘digital gold’. Like the safe-haven precious metal, it’s widely accepted as being a store of value, a medium of exchange, and is valued for its scarcity.’

He also believes that the US relief plan will eventually trigger longer-term inflation. On a lighter note, he suggested the public to use their stimulus checks to invest in cryptos for the first time or expand their existing crypto portfolios.

Anthony Pompliano (Founder, Pomp Investments) tweeted that he believes Bitcoin could reach $100,000 very soon.

Institutional investments could be one of the factors to contribute to Bitcoin’s new rally. This week, the payments giant ‘PayPal’ confirmed acquiring Curv, a crypto-security firm. This is followed by PayPal’s announcement last year to allow all US users to buy, sell and hold cryptos directly through PayPal using their Cash or Cash Plus accounts.

We hope you find this article useful and informative. Interested in buying Bitcoin before it reaches $60k? Follow this link (Buy Bitcoin) for the lowest possible prices. Cheers!

#

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

Who are the biggest influencers in the NFT space across the various social media platforms.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.