Platform Projects Thrive After Market Crash

The flash crash that brought most assets down caused other coins and tokens to stand out. While Bitcoin (BTC) once again slid to the $46,000 level and Ethereum (ETH) recovered more slowly, some projects held near their yearly or all-time highs.

Algorand Rediscovers Launch Price

After a long time trying to break the $1 range, Algorand (ALGO) took over the $2 level within days. ALGO peaked at $2.17 on Thursday, recovering almost immediately from a dip to $1.75. Within hours, the asset moved closer to all-time highs, locking in more than 24% in daily gains while the market remained stagnant.

ALGO has existed for a long time as a promise to change access to crypto assets through fair, distributed proof of stake. The Algorand network was heavily promoted and gained fast listings to most leading centralized exchanges.

This, however, did not prevent ALGO from drifting sideways and going through a bear market since its trading launch in 2019. Lately, ALGO got a boost from unprecedented outlier trading volumes above $4.2B in the past 24 hours, after years of having just a fraction of the trading activity.

The latest price gains also put ALGO solidly within the top 20 largest coins by market capitalization, with a notional value above $20B. ALGO has the advantage of carrying a part of the supply of Tether (USDT).

Price predictions for ALGO admit the possibility of pushing the price as high as $3.

Demand for active movers has lifted previous favourites like Cardano (ADA), with demand spilling over to other projects.

SOL Returns Above $200

Solana’s native token, SOL also proved resilient to the recent shakedown, adding another 30% to its price to trade above $207.

SOL flippened XRP and is on track to line up among the top 5 coins by market capitalization. A growing ecosystem of projects, significant staking and demand for SOL is driving the rally. The recent price expansion is also happening on near-record volumes.

The success of the Solana project is also expanding the influence of related projects. Saber, the leading DeFi protocol on Solana, managed to double its value locked.

SOL is also hosting a growing array of NFT marketplaces and quickly outpacing previous competitors to Ethereum such as Tezos, Cardano, EOS, NEO and other networks that are still struggling to build their ecosystem.

Terra (LUNA) Continues Upward Trek

Terra (LUNA) is among the top gainers in the past day, adding more than 14% to its value. LUNA now stands above $30, within a small distance of its all-time high. LUNA traded at $30.24 on Thursday, with trading activity close to an all-time high at $1.8B per 24 hours.

The Terra ecosystem of decentralized finance grew rapidly in 2021. The Mirror protocol, the chief DeFi hub for Terra, now locks in $1.85B. This is still a few times smaller in comparison to the funds locked in Solana’s DeFi operations, but Terra is becoming an important part of the ecosystem.

Fantom (FTM) Manages 10X Growth

Fantom (FTM) is yet another coin that recovered from the July crash and has managed to grow 10 times since the recent low. FTM broke above $2 in the past few weeks, fueled by peak trading activity.

Fantom added more than 34% to its price overnight, once again inviting comparisons to the success of SOL.

The Fantom platform offers another option for fast smart contract deployment, as well as building distributed apps. Demand for platform coins has revived in the past weeks, boosting projects like WAVES as well.

Platform coins are in a better position in 2021, when projects can show inflow of value locked into their projects and the potential for significant economic activity. Compared to previous launches, the current crop of platform coins is not built on future promises but can show already working decentralized trading, lending or NFT collectible marketplaces.

The Fantom protocol already locks in more than $1B in value, still small compared to more developed platforms.

Elrond (EGLD) Grows by Leaps

Another platform coin that achieved expansion while the market crashed was Elrond (EGLD). The EGLD native asset supports an additional fast and free distributed computation network.

Elrond Network was one of the early curated projects on the Binance Launchpad program, soon becoming one of the most successful Initial Exchange Offerings (IEOs) to deliver a viable product.

EGLD peaked in 2021 at $239, and currently stands above $206. The asset is still volatile, dipping as low as $56 in previous sell-offs.

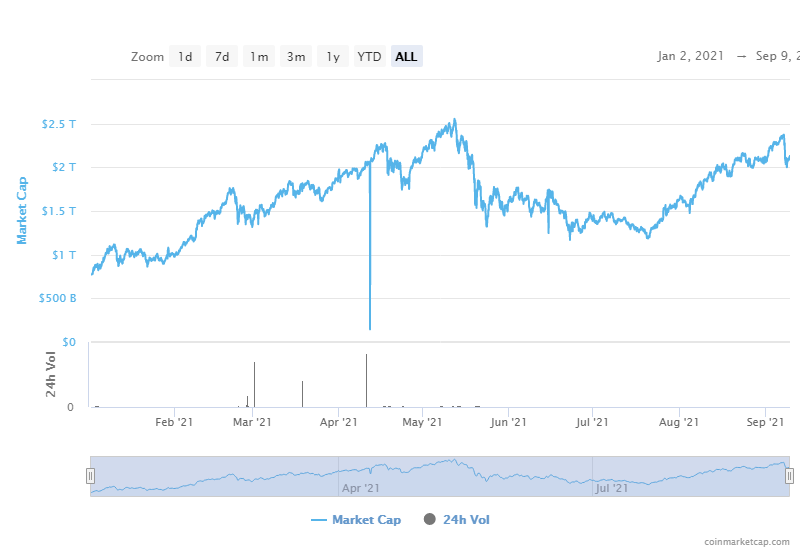

Crypto Market Holds onto Gains

Despite the recent flash crash and BTC liquidations, the cryptocurrency market is valued at more than $2.1 trillion.

The latest expansion gave more influence to new assets, with newer projects outperforming previously popular coins and platforms.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

From Airdrop to Wallet we look at all the crypto jargon and what it really means

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.