Bitcoin Holds at Support Despite China’s Crypto Crackdown Iteration

It clearly looks like the bears are not done with their selling business with cryptos. The cryptocurrency market, which has been trying hard to get back up lately, is eventually getting sold into. Ever since the beginning of this month, the sellers have been gaining momentum every step of their way.

Bitcoin crypto, for instance, has been greatly struggling to surpass the $50,000. Despite hitting the $52,000, it did not take a day for the bears to draw the prices down. And Ethereum stood no different in this scenario.

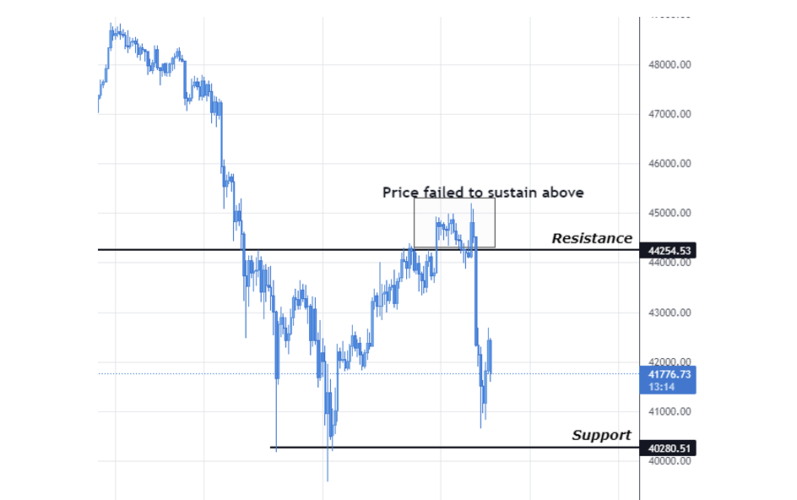

As the initial consolidation kicked in, the buyers seemed powerful enough to make a move to the north. As expected, the sellers used the higher prices as a discount and made their first set of lower low sequences, bringing the price of BTC to as low as $40,000.

As of writing, the prices have continued to drop after the sharp recovery that came yesterday.

China Exaggerates on Crypto Ban, Again

China has come back on cryptos by re-iterating its statement on cryptocurrency trading.

In 2017, China had released a report saying that crypto-related transactions and activities are considered illegal financial activities. And this news had caused an instant to plummet in Bitcoin prices and the rest of the crypto market.

It has been five years ever since this statement, and nothing significant has changed. The fundamentals of Bitcoin have remained the same, and the prices have smoothly recovered from the drawdown.

Although the crackdown was imposed half a decade ago, China occasionally re-iterates on its statements. And its most recent repetition came today.

Based on a Q&A assertion on People’s Bank of China’s website, the bank said that cryptocurrency trading and related transactions are illegal. It also said that it would ban crypto-related financial institutions and payment facilitators in order to eliminate the risk revolving around the usage of cryptocurrencies.

Out of no surprise, the pressure was reflected on crypt prices, including the Bitcoin token. Yesterday, a green day in the crypto market was taken down due to the update from China.

Bitcoin, which saw impressive gains of over 10% from lows of $40,000, is back to the same levels. In fact, the momentum looks stronger on the downside. Besides, ETH and other cryptos took a hit, much harder than Bitcoin cryptocurrency.

Unlike other drawdowns during previous re-iterations, there does not seem to be panic selling from retail investors. As a result, the volatility was relatively lower, and the support levels held as well.

Is China Playing it Clever?

China re-iterating its crackdown on cryptos on this date seems to have a reason behind it.

The PBOC reportedly printed about $100 billion of its currency this week. And in the same week, the crypto crackdown news drops in.

Analysts interpret this as a distraction move from China who is trying to deter the Chinese public from transferring their traditional assets to safe-haven assets, with a fixed supply, like Bitcoin.

Twitter Launches a Bitcoin Tipping Feature

Twitter, on Thursday, announced a feature through which users can tip their favorite content creators with Bitcoin cryptocurrency. They also said that a fund program would be launched to support users who host audio chat rooms.

After passing through its test phase, the tipping feature will soon be rolled out to all the users of Twitter on iOS devices.

Bitcoin Sustains Despite China’s Statement

It has been a rough couple of weeks for Bitcoin. With the prices struggling to head higher in August, the sellers seem to have officially entered the market with the slump that came in the first week of Sept.

Not only are the sellers pushing the market down deeply, but the speed of the sellers have been compelling throughout.

In the entire downtrend phase, the market is in its second retracement, after the prices went for another round of selling from $$48,000. The current lowest point of the downtrend stands at $40,000. During the first pullback, the bears strongly attempted to make a lower low but got snagged back up by the buyers. In fact, the buyers made it up to $45,000 and mildly held above the Resistance as well.

As the market was evidently holding above the supply level, analysts saw this as a clear opportunity for investors to add in some positions considering the bulls coming back in business. But China, with its re-iteration, managed to crash the prices back down to the recent support levels.

Interestingly, the market again seems to have failed to make a lower low. Despite the strong momentum on the sell side, the buyers stepped up much above the support level, showing increased buying interest.

However, it is too early to say that the sellers are done as of yet. As the sellers are currently reacting off from the nearest resistance level, their reign can be considered finished only if the support level at $40,000 sustains again.

Now you can get Bitcoin and most of your other favorite cryptos from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

We look at where to buy and how to buy including limits, fees, security, and verification

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.