Polygon (MATIC) Signals Potential for New Record

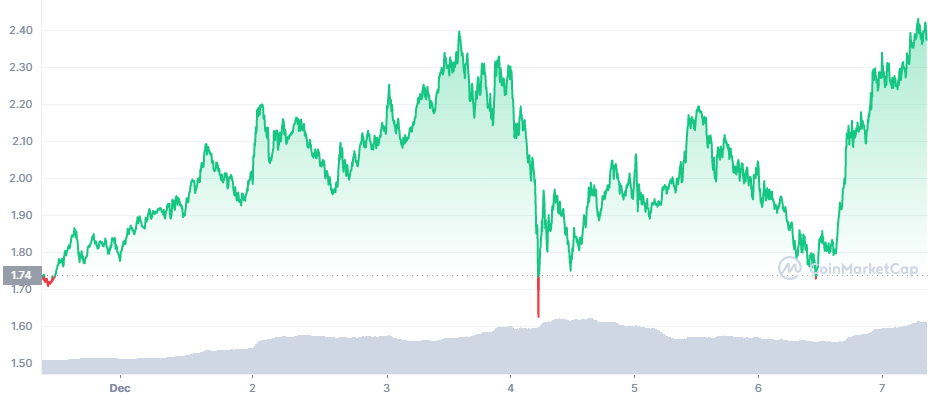

Polygon (MATIC) was one of the fastest recoveries after last week’s liquidations. MATIC leaped by more than 26% overnight to compensate for the losses. Other assets reawakened and renewed their climb, following the lead of Bitcoin (BTC).

MATIC rose to $2.38, regaining more than 38% since last Tuesday. The token is just within a few cents of its previous highs above $2.45, and has many signs it may get the needed boost to set a new record.

Ethereum Pushes Expansion

This time, the leader in expansion was Ethereum (ETH), which keeps making fast recoveries while affecting other tokens and platform assets.

ETH traded at $4,370.45 after recovering from a dip under $4,000, continuing its strong performance against BTC.

ETH is also giving signs of preparing for a bigger rally, with signs of whale trading.

ETH boosts total value locked in decentralized apps and games, and may affect the funds flowing into MATIC. The Polygon network offers a bridge to perform Ethereum operations with much lower gas fees.

Polygon Counts Down to Zk-Day Community Meeting

The Polygon project is one of the most actively developed platforms, with readiness to accept the rising number of transactions for NFTs, DeFi and gamified earnings.

Polygon is counting down to the Zk-Day event, where the protocol will introduce potentially anonymous features.

The hype and mentions surrounding the launch of the technology are adding to the exposure for MATIC. Zk-Day is expected this December 9, and will include a session with the Polygon team. So far, no details are known on the timeline of introducing a new technology. Most of the Polygon hype is linked to an expected announcement to be made during the community meeting.

Polygon Consolidates Value Locked

The Polygon network holds in about $5B in value, based on DeFi Lama data. For a brief stint in the summer of 2021, Polygon expanded the value to above $10B, but so far, it lines up among the smaller platforms.

The MATIC asset has a relatively low per-unit price and has not moved to a new tier for months. The total value locked depends mostly on bridging smart contracts and wrapped assets, which mimic the Ethereum ecosystem with much lower fees.

MATIC Gets Boost from NFT Space

The Polygon network is being actively used for new airdrop campaigns for NFTs. This raises the potential value of MATIC as some coins may be required to pay fees.

MATIC may also boost the adoption of play to earn games, which are the cross-section of DeFi and gaming. The low barrier to entry with relatively reasonable fees bring new projects to Polygon at the end of the year.

Will Altcoins Rally More

Before the Friday sell-off, altcoins managed to achieve higher gains in comparison to BTC and remained the more active assets.

Attention was focused on Terra (LUNA) and Cardano (ADA). LUNA managed to mark all-time highs and recovered quickly from the price drop, rising to $69.18.

ADA is still at $1.44, away from its all-time high, and so far has only unrealized expectations of becoming a hub for decentralized projects. For now, ADA has not managed to rally in one go to the most bullish levels suggested. Some of the extreme predictions for ADA are a price of $10, caused by demand and scarcity due to locked tokens.

The price of LUNA is also rising mostly on the demand for staking, as well as the creation of new UST assets.

Can BTC Lead the Recovery

After a significant deleveraging event, BTC managed to recover to above $51,200. In a single day, the Crypto fear and greed index rose from 16 points to 25 points, still signifying a prevailing trading attitude of extreme fear.

The recent BTC slide was compared to the March 2020 crash, an event triggered by insecurity. BTC bottomed out at $42,000 due to trading anomalies, with significant downside on some futures exchanges like DeriBit.

However, the asset quickly regained the $48,000 level and vaulted $50,000 in less than a day.

The BTC market cap dominance is still below 41%, with no certainty on which asset will lead the recovery. But even at these levels, there are expectations for a continued bull run, as the conditions at the end of 2021 are not similar to other years. With deeper liquidity and more institutional investors, BTC may hope for more significant support.

By the end of 2021, BTC may also be affected by announcements on the decision to launch Bitcoin-based ETFs. For now, the chief price drive does not come from mainstream investment. The Grayscale price equivalent for the GBTC fund gives a notional value of BTC at around $45,000, a significant discount to spot and futures prices.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.