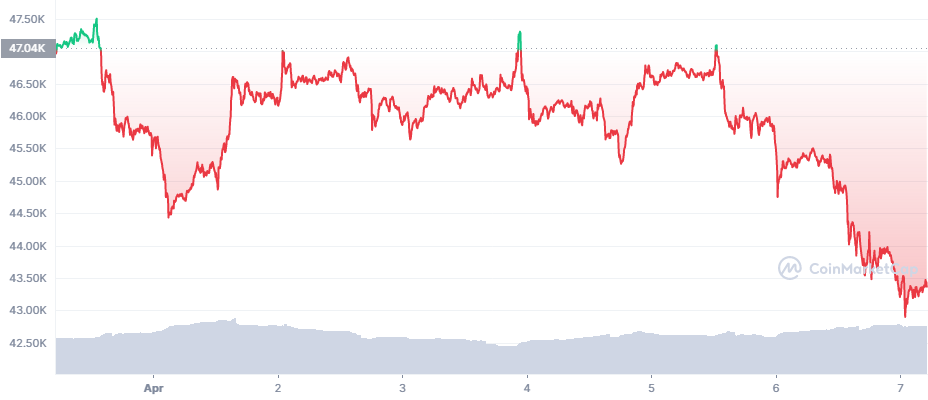

Markets Turn Tide with BTC Closer to $43,000

Bitcoin (BTC) returned to volatility and once again erased the recent gains, abandoning a potential trek to a higher tier. BTC just closed in on $48,000 with repeat rallies to $47,000, before a mid-week crash. Selling accelerated to volumes above $39B in 24 hours, while lifting the BTC dominance to 41.5% as other assets fell more rapidly.

BTC moved down in minutes to $43,391.00, abandoning previous stabilized prices. The downward move recalled that BTC did not guarantee an immediate rally to a new high or even to a higher tier. A bearish scenario has not been completely rejected, while short-term attacks against leveraged positions can cause rapid moves within a certain price range.

The Crypto Fear and Greed Index is down to 48 points from 52 points during the recent hike to $47,000. At the same time, there are some indications long positions are diminishing on the futures market. The price unraveling liquidated $26.52M on BTC markets, of which more than 81% longs on the Binance perpetual futures exchange.

The sudden move dragged down most altcoins and erased the recent gains. But BTC is not losing its appeal, with new buying from the Terra project.

Additionally, MicroStrategy has continued to buy BTC in a more creative way – by receiving a loan against its BTC holdings and buying more BTC with it. The Terra and LUNA economy may soon achieve a similar expansion.

Even at the current lower prices, MicroStrategy is in the money with an average purchase price of $30,700 per BTC for nearly 130,000 coins.

This time, the losses affected altcoins with deeper cuts. The ones that rallied, such as DOGE and ThorChain (RUNE) had deeper losses as high as 19%.

Is BTC Entering a Bearish Scenario

All the factors to boost BTC in the long term are still active, especially the coin’s diminishing freely available supply. Yet BTC may move down to a lower tier as futures trading concentrates on leveraged positions.

One possible concern is that BTC may take longer until another all-time high. The fastest BTC gains to a peak happen within days, but the periods between significant rallies may last for years. Thus, BTC may not be near a significant appreciation this year, while still trading within a range.

However, BTC remains unpredictable and may surprise the market with a short squeeze or the effect of another Tether (USDT) printing.

BTC Swayed by Fed Remarks

The US Federal Reserve remarks of potentially increasing interest rates and unloading the balance sheet added to the pressures on BTC. At this point, inflation effects add to the willingness to hold BTC, even for buyers that are not in the money.

Currently, 57% of BTC holders are in the money, of which 37% of buyers have held for less than a year. Trading analysis also points to a bearish signal, barring unexpected events.

The recent shift in direction is also attacking some of the previous expectations for an April rally, taking BTC again close to $60,000 and Ethereum (ETH) to $5,000.

Was the Market Too Exuberant

BTC traders may anticipate setbacks like the latest price slide. For altcoins, however, some of the latest performances held a bigger element of hype than previously expected.

Waves (WAVES), one of the lead performers in March, erased almost half its price within days. WAVES achieved all-time highs above $60, but sank to $27.22, erasing more than 47% in a week.

The WAVES fiasco follower rumors that a “whale” owner, possibly even Sasha Ivanov himself, sent 300M WAVES to Binance and tanked the price.

Ivanov went on to blame short traders or other forms of speculation. But the timing of transactions and the immediate dump suggested the dumping is a true scenario. Ivanov went on to foster a new agreement on the backing of USDN, while claiming to have bought the underpriced tokens at their lows.

Unlike Terra USD (UST), the Waves stablecoin, Neutrino USD, did not convince the market of its value. USDN was mostly backed by WAVES deposits, for an asset that was yet to repeat the “up only” scenario of LUNA.

This led to USDN breaking its dollar peg, sinking to a low of $0.69. USDN recovered slightly to $0.93, but there are fears it may join the list of failed stablecoins. For now, algorithmic stablecoins have proven to be successful, though even DAI has broken below $1 during periods of volatility.

In a bull market, most of the protocols will face some setbacks, but the older ones had more time to accrue collaterals and avoid the worst of the panic.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

Who are the biggest influencers in the NFT space across the various social media platforms.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.