Solana (SOL) Leads Tentative Recovery

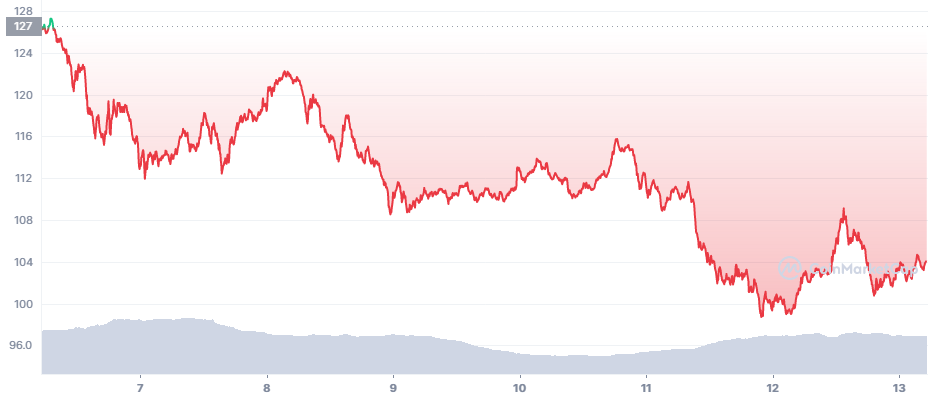

Solana (SOL) led the recovery among the top 10 digital coins and tokens with high market cap. SOL regained positions above $110 and later slid to $104.03, with nearly 5% in overnight growth. SOL inched up while Bitcoin (BTC) managed to return above $40,300, though barely holding the gains.

SOL trading was still around $2.4B in 24 hours, the highest level since the beginning of April. The market cap of SOL is substantial enough to measure its own dominance in the market. SOL is responsible for roughly 2% of the entire crypto asset market value, lining up with other prominent coins and tokens.

What Makes SOL Appreciate

The value locked in various protocols on Solana has dwindled since its peak in October 2021. Currently, Solana carries $6.9B in notional value based on DeFi Llama statistics. At the peak, Solana locked in nearly $14B and competed with Binance Smart Chain.

SOL is also busy adding a vast ecosystem of NFT items, with constant giveaways, mints and promotions. The Solana NFT space is separate from Ethereum collections, though it copies some of the models such as generating limited series with rare or unique items.

SOL also has a big community of supporters, as it has turned many early buyers rich. Holders of SOL also have incentives to hold onto the asset, for future NFT mints and to invest in Solana-based protocols.

The NFT adoption trails the growing number of Solana wallets. Daily Solana users moved between 200K and 300K in the first quarter of 2022.

Solana Moves to OpenSea

Solana will also become the third network to be added to the OpenSea NFT marketplace. Until recently, OpenSea was only listing Ethereum and Polygon collections and items.

The OpenSea market gained enough influence to become the storefront for prominent and verified collections or game items. The advantage of Solana is the very low fixed fee, as low as $0.00025 per transaction.

To compare, users have complained about Avalanche (AVAX) growing its fees on busy days to as high as $6.50, which may add up during multiple repeated orders or game operations. Still, those networks offer a cheaper tool to send value compared to Ethereum (ETH).

Is SOL Staking a Good Strategy

One scenario in staking $1,000 in SOL can bring 6.9% in annualized earnings. SOL has a relatively high return for even simple delegators who lock their coins for a predetermined period.

However, SOL is also volatile and has erased more than 50% since its peak above $258. At this pace, the SOL market price may erase the staking gains.

Will Solana Have an Algorithmic Stablecoin

Unlike Terra (LUNA), the Solana project has not shared explicit plans to build a stablecoin. The only project attempting to build up a collateral and produce a dollar-priced asset is Nirvana Fi, only launching a week ago.

Algorithmic stablecoins have been proposed for most major networks, though the most successful and trusted one is on Terra (LUNA). SOL resembles the LUNA price action in keeping its price close to $100 with smaller fluctuations. The Nirvana Fi token will use a similar model to Terra, by depositing and burning ANA tokens to ensure the value of the stablecoin.

Still, launching a stablecoin is extremely risky, as shown by the example of Waves (WAVES). In the period of stability or appreciation, the USDN stablecoin worked. But once WAVES rapidly crashed, the asset sank down from the dollar peg to $0.69.

The Solana-based stablecoin is still untested and has to prove its ability to move to various protocols without causing fallout effects in case of market volatility.

How High Can SOL Go

Predictions from SOL for the long term see the asset move as high as $1,000. In the coming months, a bullish scenario sees SOL returning to $250.

For now, SOL has followed the usual crypto market script of rallying to a new high and only briefly holding those levels. SOL has shown it easily regains the $100 level, after bouncing from temporary lows around $80. SOL usually keeps close to the price range of AVAX and LUNA.

The SOL/USDT pair on Binance has a liquidity score of 813, allowing for leeway in trading. In the short term, SOL is at risk from another market downturn, especially if BTC revisits lower price levels.

Based on on-chain data, Solana has relatively few whale holders, with even big wallets holding around 0.5% of the entire supply. SOL tokens are widely distributed, as they have been used in giveaways and NFT purchases.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

A review of the many options for crypto exchanges and what the main differences are

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.