TRON (TRX) Starts Long-Awaited Rally

TRON (TRX) split from the pack of altcoins and tokens, starting on a long-expected rally. TRX added more than 15% overnight, standing out from other altcoins, while the Cardano (ADA) rally from the previous days stalled.

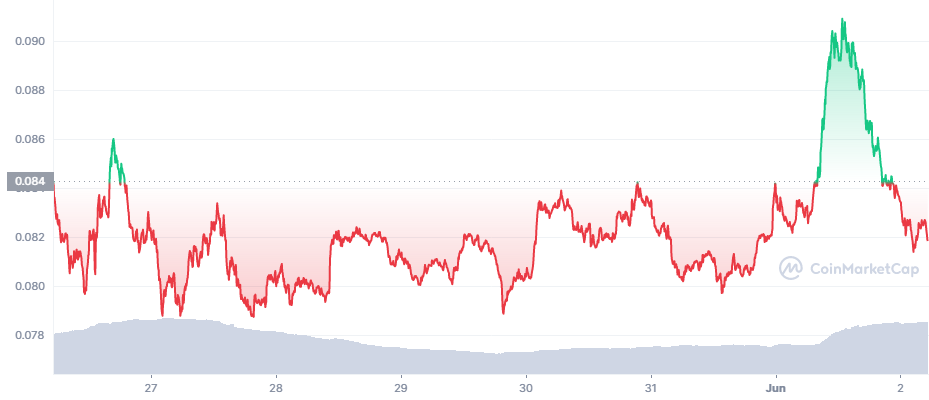

TRX expanded to $0.089, still keeping the token away from the top 10 of all crypto assets. But at this pace, TRX may become much more prominent. TRX also briefly went above $0.09, in what was considered the beginnings of a bigger breakout. TRX cut the rally by returning to $0.082, dragged down by another rapid market downturn.

Will USDD Support TRX Rally

The supply of USDD, the new dollar-pegged asset, is just above 620M tokens. The supply grows every day and USDD is being locked in high-earning contracts.

USDD is backed by multiple assets, but may benefit from a higher TRX price and more prominence for this project.

TRON still holds nearly half the supply of USDT and barring its high supply, can in theory gain much more with available liquidity. TRX is comparable to ADA in their price range, and is starting to look undervalued.

The expansion of TRX may be cautious, especially given the still fearful trading for Bitcoin (BTC). For now, the leading coin treads water above $31,000, but has yet to recover higher positions, with a target of $37,000. BTC remains uncertain, once again returning to $29,796.05 within less than a day.

TRON Grows Value Locked

The goal of TRON is to become one of the top DeFi chains and close to the leaders in terms of value locked. The problem is TRON is less transparent and not tracked by services like DeFi Llama. This limits the potential to track projects inside TRON, and compare it to other DeFi chains.

A few days ago, TRON claimed it has locked in more than 6B in value, comparable to Solana or Avalanche before the recent crash. With Terra for now out of the way, TRON has a market niche to fill. Additionally, TRX tokens are also added to the DeFi ecosystem in a high-return staking contract with NEXO.

There are fears TRON is repeating the approach of Terra, though in an even less transparent manner. The backing of UST could be tracked more easily, as well as the supply of LUNA and the Terra LFG Bitcoin wallet.

TRON DAO, however, will aim to build higher collateral for USDD and avoid the circular backing of UST.

Justin Sun, founder of TRON, stated USDD would be built with lessons learned from Terra LFG.

USDD has a highly ambitious goal of becoming the new settlement stablecoin in crypto – a feat now shared between USDT and USDC, with DAI having a significant influence. But USDD plans to spread widely though the ecosystem, potentially affecting multiple protocols, DEX and projects.

TRON DAO plans to collateralize USDD with some of the least volatile assets – partially in BTC, but also USDT and USDC. This would essentially double the effect of stablecoins, though it will not solve the problem of loss of trust in Tether. During the latest TRX rally, both USDT and USDC deviated slightly from their peg, sinking to $0.99. Panic may come easily as previously trusted assets deviate from their $1 price.

Initially, USDD will also be minted only by TRON DAO members, producing one token for $1 worth of TRX, which will be burned. This generation mechanism is similar to the one of LUNA and UST. The new token will also try to protect itself from aggressive minting, to avoid the fate of Anchor Protocol.

It is still unknown how much USDD will be used for high-returns deposits. One indicator would be a growing TRX price as more tokens are bought to be burned for USDD. The burn-to-mint approach was what boosted LUNA in the past, as demand rose for the high returns of Anchor Protocol.

While the extra liquidity may boost crypto markets, TRX is also compounding risk and linking a lot of new liquidity to USDT. Tether itself continues to face criticism on its real asset backing, and has the potential to crash the crypto markets.

LUNA Relaunch Fails

The LUNA relaunch has created more problems than it has solved. LUNA sank down to $6.60, while the airdrop was insufficient to cover the more significant losses of big buyers.

Additionally, the new LUNA will be airdropped during a 24-month period, adding uncertainty to the overall skepticism that Terra can bring new value.

However, this has not stopped exchanges like KuCoin from encouraging activity for both LUNA Classic and the new LUNA ticker.

Crypto markets are more skeptical, but there is still demand for high-yield operations. Projects like NEXO continue. Even HEX, a long-running project accused of being a Ponzi, managed to survive after a recent steep dip.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.