Bitcoin at $300k by 2023? Here’s What Experts Think!

#

There has been a little less noise about Bitcoin in the past few days. Ever since BTC achieved its new all-time high value (~10 days ago), its price action has been consolidating. The volatility of Bitcoin got declined by 75% compared to the annual average numbers. Also, few credible analysis says that this crypto’s forecasted price swings are currently at their lowest since the beginning of this year. This decrease in volatility could direct the market to move in a range and continue the consolidation.

BTC Technical Analysis | 23rd March 2021

On the 4-hour timeframe, we can see the momentum of sellers building up. There is no ideal resistance level for the price, with the exception of its previous all-time high. The next round number resistance is at $65k. The support level on the daily timeframe is at $49,825. With the momentum of sellers being strong, the price might reach this level before taking off to the north.

BTC/USD pair’s price action has printed a clear channel with a few fake-outs on the top and bottom on the daily timeframe. The breakout may happen on either side, but in any case, the price of this crypto tends to go up and make a brand new higher high soon. If the breakout happens to the downside, the price may reach the daily support zone, take support, and aim for $65k levels. In the case of an upside breakout, the price can reach $65k much faster by making a higher high.

In the event of any abnormal selling pressure, the price action might undergo a deeper pullback. The price could drop to its daily support at $49,825 if the 4-hour support is breached at around $52k. This, however, is the short-term technical analysis based on the BTC’s price action and buyer/seller momentum. Now let’s see some credible expert forecasts of Bitcoin’s price in the upcoming years.

Peter Brandt | Renounced Analyst & Investor

(Forecast – $200k by the end of 2021)

Brandt is a popular financial market analyst and is well known for rightly forecasting Bitcoin’s steep price correction after 2017’s crypto boom. He said he has been following Bitcoin ever since its inception. In a recent interview with CoinDesk, he shared his technical analysis of Bitcoin and was pretty optimistic about its current bull-run. He said that BTC could still be in the middle of its bull run, and the price of BTC will continue to rally till the end of this year. His analysis was on a liquidity index of Bitcoin, as shown in the image below.

He mentioned that BTC (Buy BTC) is currently in its fourth parabolic move on the weekly log-scale chart. He was confident that the price could reach between $180k – $200k by the end of 2021.

We got to say that these forecasts are way too steep and a tad unrealistic. But it also gives a lot of hope as the person who gave us these forecasts is extremely credible.

Jiang Zhuoer | CEO of Chinese Largest Crypto-Mining Company

(Forecast – $150k – $300k by Sept 2021)

In a series of tweets, Jiang summarized his recent interview where he forecasted the price of BTC. His opinions were similar to Brandt’s forecast that we discussed above. Jiang said the price of BTC might go beyond $150k and might even reach $300k before the fourth quarter of 2021. Although these weren’t his exact words, this was the context.

He specifically mentioned that there could be a potential bear market for BTC during the fourth quarter of 2021, and it might go till June 2022. He backed his statements by saying that the traditional markets may recover by then, which might take the attention away from cryptos. Jiang also said that many of the blockchain CEOs he spoke to have a similar thought process. These numbers are even more optimistic than Brandt’s, aren’t they?

On a concluding note, Jiang said that industrial interest could help BTC tackle the bearish market. According to him, the bull market can be achieved back only by increased industrial adoption of this crypto. He said, more companies like Tesla, Microsoft, PayPal and Visa should venture into the crypto space for Bitcoin to be stable at that price point (his forecasts) in the long run.

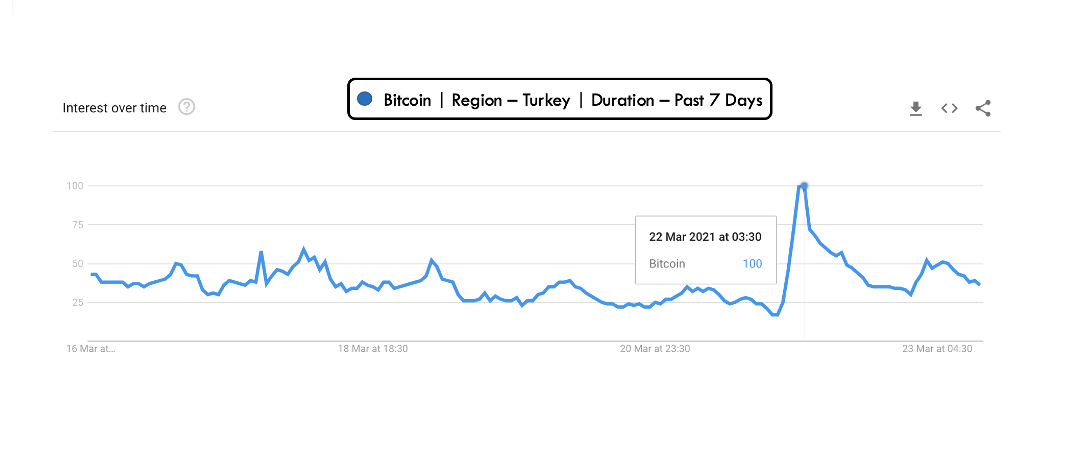

Increased Interest Over Bitcoin In Turkey

Although this news is out of context, we thought it would be great to mention it here as we are discussion Bitcoins’ future potential. Turkey’s central bank chief has been fired recently, and the country’s official currency – Lira, plummeted in the Forex market. What was surprising is that the search results for Bitcoin during this period have skyrocketed, as we can see in the chart below.

(Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means that there was not enough data for this term.)

This explains that there is a possibility of Turks seeing Bitcoin as a potential store of value in case of Lira’s further inflation. Overall, this is a good sign for Bitcoin to see the transition of public trust from fiat currencies to cryptos. Are you still thinking of investing in cryptos or not? Buy top growing cryptocurrencies from a wide list of exchanges we support. Cheers!

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.