Bitcoin & Ethereum To Break Their All-Time High Values

#

Bitcoin & Ethereum – the top two cryptos in market capitalization are approaching their all-time high values. Both these coins currently dominate about 70% of the entire crypto market. In this article, let’s go through BTC and ETH’s technical analysis and understand the fundamental reasons behind their price rallies.

Bitcoin (BTC/USD)

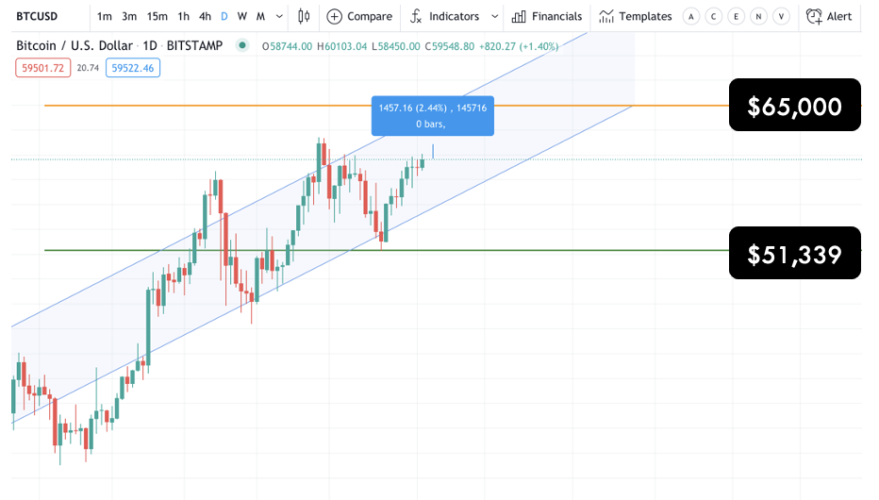

Bitcoin continues to print green candles on the daily timeframe indicating a clear bullish trend. The recent news about the industrial adoption of cryptos by PayPal and VISA positively impacted BTC/USD price. At the time of writing, the price of Bitcoin was around $59,590, which is just about 2% below its previous all-time high value. The support and resistance levels on the daily timeframe are at $51,339 and $61,149 (previous ATH), respectively.

According to the expert predictions, Bitcoin could reach the $65k level shortly. However, looking at the buyer strength and the price momentum, there is a slight possibility of price reversal at the current all-time high value. Looking at the previous buy rally, the buyer strength can be seen as the price continued to print consecutive green candles one after the other. In the current buy rally, the decline in buyer strength can be noticed as time progressed. In the case of a reversal, BTC/USD’s price could reach its 4-hour support zone at $57,472.

Looking at some of the recent long-term forecasts on Bitcoin, JP Morgan suggested that the price of BTC could reach $130,000 in the long term. This prediction is based on the decrease in Bitcoin’s volatility over the years. According to the analysts at this investment bank, this decrease in volatility could eventually spur strong institutional adoption of this crypto.

As the volatility decreases, professional investors could show some keen interest in holding BTC in their portfolios. In any scenario, the price of BTC could boom beyond the predicted levels by JP Morgan if BTC manages to match the volatility of Gold. There is still a long way to go for this to happen as the percentage difference of volatility between these two asset classes is broad. To put it in perspective, BTC’s volatility in the past three months stands at around 85%, while it was a mere 15% for Gold.

Interested in taking a long shot and advantage from the future price movements of Bitcoin? You can now invest in this crypto by owning it in less than a few minutes. Visit our list of the most credible Exchanges in the market, choose Bitcoin, compare the prices among the available options and pick the ones you find most appropriate.

Ethereum (ETH/USD)

Ethereum has crossed the $2k mark for the second time in the past couple of months. The ETH/USD crypto-fiat pair is about to break its previous resistance levels, which is also its current all-time high value. The support zone for this crypto is at $1,408 in the daily time frame. The price action continues to make lower highs indicating strong bullish momentum. The recent news by VISA to use the Ethereum network for settling transactions in USDC have significantly impacted the price of Ether.

The orange line in the middle is where the news of VISA got released, and we can see the price printing four strong bullish candles after that. Ether token reached $2,004 today, showing a 4% increase compared to the previous daily candle. The overall week has been great for Ethereum investors as this crypto saw an increase of 18% in just this week alone. The breakout at the second orange line indicates that the consolidation on this pair has finally ended, and the uptrend is about to be resumed. According to technical analysts, Ether has outperformed Bitcoin in many aspects to date in 2021.

Looking at the first quarter of 2021, Ether’s price surged by over 160%, which is about 60% more than Bitcoin’s price surge. It is crucial to know that ETH is more than just crypto that is used as a store of value. It is a credible platform for other crypto startups to make their own cryptos and do many other things.

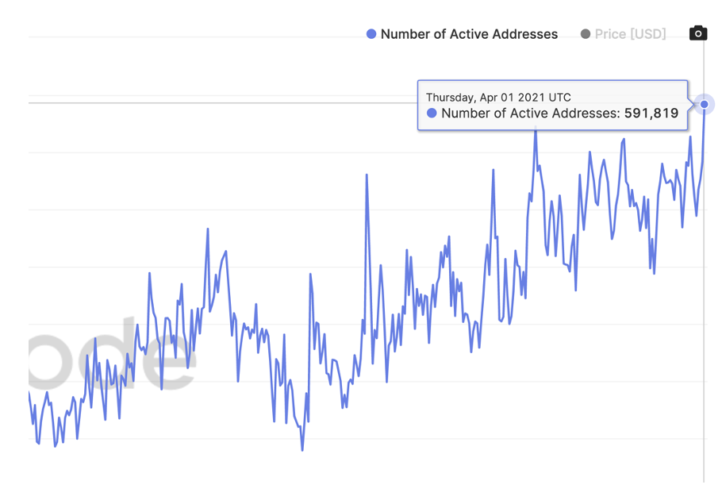

The demand for the Ethereum network is also increasing with the surge in Ethereum’s price. This can be proved by a simple statistic on DeFi lending – The total value locked on the Ethereum network surged by over $45 billion since the beginning of this year. Also, we have observed the increased user activity on the Ethereum blockchain. The below chart indicates the rise in active ETH addresses over time.

Chart Credits – Glass Node

This is a great statistic to have for any blockchain company because the valuation of its native token is directly proportional to its user activity. With all of these considerations, we can expect Ether’s price to reach $2500 very shortly. Looking at the correlation between ETH and USD, the former asset class tend to rise if the USD’s value depreciates. So, the current USD’s performance is also favourable to the price of ETH.

#

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Who are the biggest influencers in the NFT space across the various social media platforms.

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.