Bitcoin and Polygon: Comparative Technical Analysis

##

The crypto market is indeed an evergreen topic in the media. Irrespective of the fundamentals, technicals, and price, cryptocurrency is always in the news. However, the same is not really proportional to the price of coins.

As we speak about the price, Bitcoin token has finally hit $40,000, a major technical Resistance, after forty-two days of intense negotiation (consolidation). Though the price is struggling to head higher, it is quite an achievement for Bitcoin and even altcoins, for that matter, to make an impressive move north.

The price action comparison between Bitcoin, Ethereum, and altcoins is rather interesting on the recent bull run, considering the momentum between them. The Bitcoin Dominance is also in the talk as it has made a two-month new high today.

As altcoins were gaining popularity lately, with respect to their technology upgrades and updates, Bitcoin slightly went underwater despite its incredible price action on the charts.

One misconception among investors is comparing the performance of cryptos based on the percentage gain/loss. Though percentages hold value, it is certainly not a tool for measuring the relative performance between two or more digital assets. It is the charts that speak the truth in this regard. For instance, a +2% on Bitcoin is not equivalent to +2% on Polygon crypto. Besides comparing the percentages, it is critical to consider the relative market cap as well. Thus, the BTC dominance solves the misconception and presents the absolute comparison between Bitcoin and altcoins.

Where does Bitcoin Dominance Current Stand at?

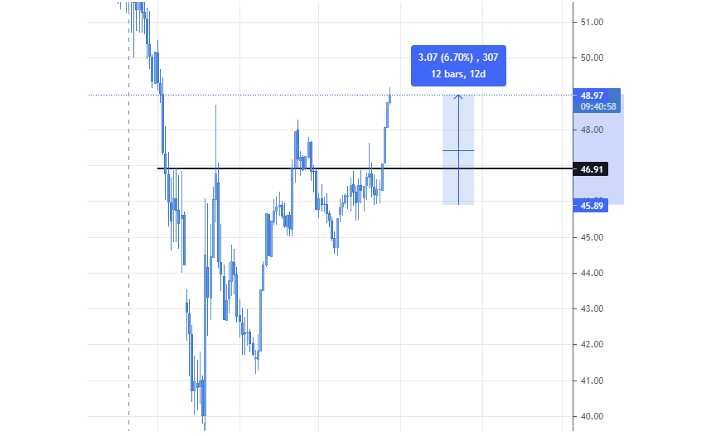

In the below chart, representing the dominance of Bitcoin in terms of market cap, we can clearly observe the volatility in the last three months. However, the recent trend is clearly in the dominance of Bitcoin. Setting a low at 40, the market cap of BTC has been relatively rising much higher for a period of two months.

Shedding light in the last seven days, it is no doubt that Bitcoin has outperformed in the mini bull run relative to altcoins. The BTC Dominance is up 6.70% in the last week, as shown. Despite altcoins moving at a rate of 10% per day on an average, lately, Bitcoin has outshined with a much smaller average.

Technical Analysis Unfolded

After an extended period of consolidation, the markets have made a move north with strong momentum by even breaching a few significant support and resistance levels. Following is the price action and comparative analysis of some cryptos that the big players are deploying their capital into lately.

Bitcoin (BTC)

As mentioned previously, Bitcoin cryptocurrency has been the top performer in the minuscule uptrend that the market is in the past seven days.

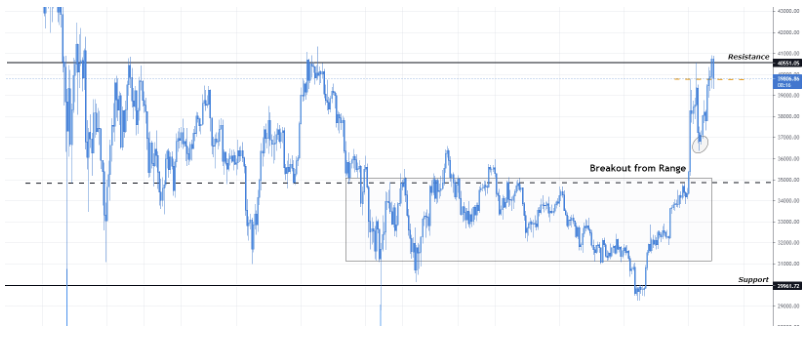

On the bigger picture, the entire consolidation can be broken down into the ranging market. The first range occurred between the price levels – $35,000 and $40,000, while the sequent range hovered between $30,000 and $35,000. And as they say, this sideways movement was the clam before the storm.

The recent upside move proved to be significant it compellingly broke through the Support turned Resistance (level $35,000) – as the bids got significantly higher than the asks. Analysts are also referring to the move as a result of a short squeeze amidst the fake-out below the range – as shown. It is said that the momentum picked up only due to the fact that a large number of retail short positions were gobbled up by the institutions in one go.

Focusing on the current move, the buyers are fighting the Resistance to push the market for another higher high sequence. However, a couple of reactions down is an indication that the psychological level is yet to complete its move. So, if the buyers lose momentum around the current levels, the market could test the price around the encircled area before continuing north.

Polygon (MATIC)

The crypto with firm fundamentals and technicals is perhaps on the watchlist of the institutional players, considering the recent bull run.

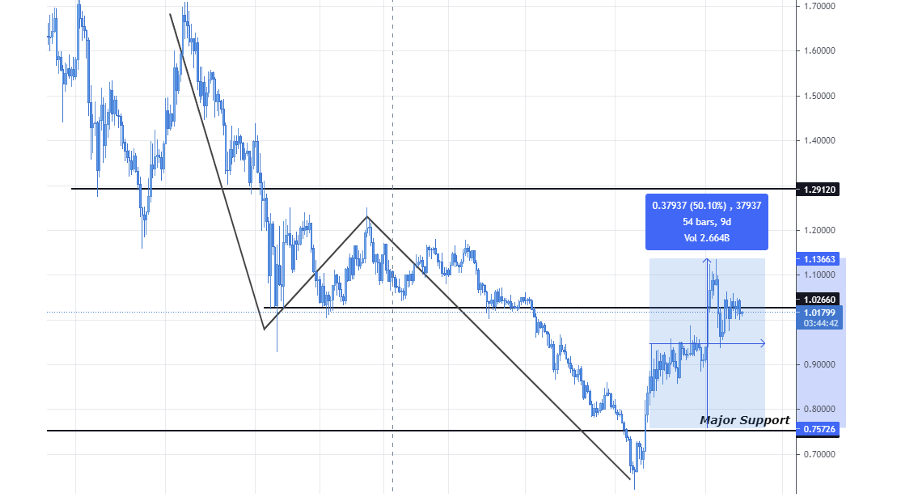

The MATIC crypto was one of the best performing cryptos back at the beginning of 2021. But the May crackdown led the price for a freefall.

As one can clearly observe from the chart, MATIC token has been in a downtrend, making lower lows and lower highs in the past couple of months. And when compared with Bitcoin, the sideways market proves that the buyers are maintaining grounds (Support levels), unlike Polygon crypto and other altcoins.

That being said, as the price approached the higher timeframe Support level, major buying came in, with considerable volume as well. And in the past nine days, the token has trended 50% to the upside.

To conclude, if the market holds above the S&R, there is more potential for it to head higher, but if Bitcoin fails to hold above $36,800, we can expect the market to go for another round of selling, with a possible lower low as well.

Did you participate in the current crypto bull run? If not, you get your favorite crypto from our list of reliable crypto exchanges and be part of it right away.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.