Bitcoin (BTC) Climbs Again on Whale Buying

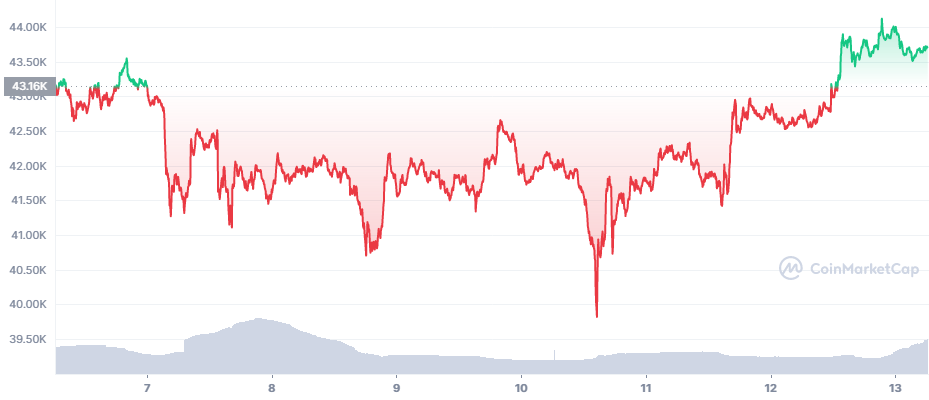

Bitcoin (BTC) showed its ability to bounce fast from its lows under $40,000. The leading coin recovered within days to above $43,700, after signs that the latest dip was oversold.

Once deleveraging happened, BTC rose again by thousands of dollars. It is too early to tell if this will bring about a new rally, but BTC, for now, goes closer to its stability levels from the past few weeks.

The BTC reversal arrived with a series of indicators that the bottom of the crash had been reached. Diminishing liquidations were combined with prices already considered a “buy” signal. Additionally, the Rainbow chart suggests BTC is still comparatively cheap.

Another signal on coin dormancy added to the mix and may be a factor in re-sparking buying.

Almost all other coins, including Ethereum (ETH) benefited from the BTC move. ETH moved up above $3,300 and overnight gains of around 10% were not unusual for less liquid assets. The rally comes as a relief after several days of dipping prices.

The price moves at the start of the year are still raising the question of whether BTC and ETH will continue on track to new all-time highs, or if the year will see the evolution of a new long-term bear market.

BTC Taken Off Binance

The latest price crash was followed by immediate notification of large withdrawals from Binance and other exchanges. It is not unusual for BTC “whales” to buy the dip and lock away the coins for storage outside exchange wallets.

Withdrawal and buying, however, does not exclude some selling near top prices, as big traders realize gains. At the same time, derivative markets still trigger price moves, usually attacking crowded trades to create a cascade of liquidations. A period of growing leveraged positions is seen as a warning to rapid price moves that will liquidate longs or shorts.

BTC Lucky Miner Discovers Block

In a highly unusual event of luck, a solo miner managed to discover a new block header number. The feat was performed despite the near peak levels of Bitcoin network mining.

Discovering a block header number, also known as “mining a block” is a mix of computational power and luck. Usually, pools have higher probability of discovering a block.

The miner beat the odds and gained the 6.25 BTC block reward, showing hashrate is not the sole estimate of probability when mining a coin. The event happened despite the climbing difficulty of the Bitcoin network, which has not been lowered since August 2021.

Miners are also one of the most loyal BTC holders, further increasing physical coin scarcity. Miner balances keep accruing, as they only need to sell a fraction of their BTC to cover electricity costs.

For about three more years, miners will still produce around 900 new coins per day, and the next block reward cut will be more significant. The Bitcoin network has already produced more than 90% of all BTC in circulation, of which as much as 3M coins are considered to be locked forever, probably never moving to the market.

What is the Next Step for BTC

The recovery of BTC above $43,000 raised some questions on the next potential jumps. One of the predictions is a recovery above $47,000.

Sentiment remains shaky, still solidly in fear territory. The Crypto Fear and Greed Index slid slightly to 22 points, as the recovery was still uncertain.

BTC is also slowly regaining trading volumes closer to $30B per day after the latest price slide happened on subdued trading activity. Immediate predictions also allow for a hike to $44,000 before a more significant attempt to get closer to the $50,000 range.

Liquidations Affect Short Positions

The sudden rally liquidated more than $19M equivalent in BTC positions, in most cases affecting short positions. The liquidation event is not unusual at times when BTC adds thousands of dollars in hours.

At the same time, altcoin recoveries continue to go faster, and the BTC market cap dominance is still around 39.9%. ETH market cap dominance also slid to 19.3%, giving more influence to the collection of smaller altcoins.

Bitcoin Developers Set Up Litigation Fund

The core developers of the Bitcoin network have set up a litigation fund, to offer support in cases of attacks through lawsuits.

With uncertainties on how the Bitcoin protocol should evolve, conflicts are not unusual among developers. Even the personality of Satoshi Nakamoto remains a contentious issue that has led to protracted lawsuits.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.