Bitcoin (BTC) Hints at Price Drop Based on Celsius Collateral

Celsius, the embattled crypto investment fund, has added new collateral to one of its biggest loans on Maker DAO. This time, Celsius paid in a series of deposits, the first one securing a BTC price drop under $12,000.

But that deposit was not the end, later Celsius apparently added $50M in additional collateral to secure its loan at under $9,000 per BTC. The market may also feel pressure from a diminishing USDT supply, with another 200M tokens retired in a day. USDT remains at $0.99 and lowered activity down to $33B in 24 hours for all trading pairs.

The deposits suggest an expectation for more deep cuts to the BTC price, with still time until a true market bottom is reached. While currently there are still signs of buying and expanding whale wallets, there are also investors in the sidelines waiting to see how the BTC trajectory develops. Those are the most categorical signs of expectation for BTC prices sinking under $10,000.

The Celsius moves are also somewhat risky, exposing the positions that could be attacked to cause additional liquidations and a deeper capitulation. Additionally, not only Celsius has been exposed to collateralized loans. DeFi has no central reportingb and no way to know which organizations have taken out loans.

The most recent deposit fund to stop withdrawals was Syngapowe-based Vauld, built with the capital of crypto investor Peter Thiel.

While market prices rise, funds can afford to give back the deposits as they face no immediate collateral call. With the prospects of a further price crash across the board, funds are reluctant to offer withdrawals, possibly saving as much as possible to top up collaterals.

Are Other Protocols at Risk

The recent freeze of withdrawals has not affected all projects, but there are always suspicions of insolvency. Currently, Nexo continues to ask for more deposits, while skeptics point out the project may also be at risk for margin calls.

The worst part of passive income is that crypto owners are not in control of their coins. The projects do not even keep the funds in transparent cold wallets, instead possibly using them for risky investments. In the past, Celsius was transparent about its funds until days before its crash, when it missed its monthly funds report. Currently, it is unknown how much funds Celsius holds.

Nexo even went as far as offering no-commission crypto buying, though with unknown withdrawal potential.

All coins kept on custodial wallets or exchanges are at a risk for total losses. Despite this, Nexo has also added new incentives for its crypto-based card, with bigger cashbacks in NEXO or BTC.

Will BTC Deepen Bear Market

The latest BTC price moves suggest a deepening bear market, which did not have the marks of previous downturns. Instead, BTC set a record above $69,000 and almost constantly hinted at a possible recovery while also losing key price levels.

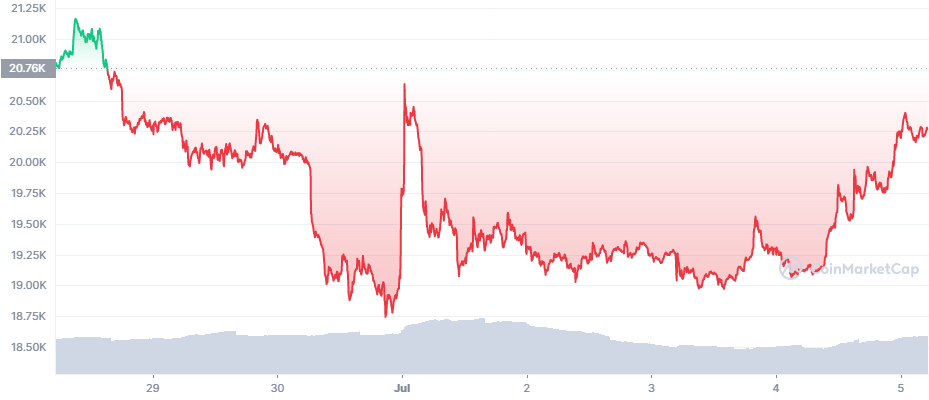

BTC is now still between $19,000 and $20,000, expecting potential dramatic price shifts. BTC is now giving signals for a potential bottom, based on historical price averages during the 2018 bear market and the crash in March 2020.

The waiting for a new price direction also affects trading volumes, which sank to around 18B in 24 hours on a weekday. BTC may trade more actively as US traders return.

Additionally, both small and mid-range wallets keep building up their holdings, with a peak number of 10 BTC wallets.

Even with prices losing more with a deeper capitulation, there are still buyers hoping for a price recovery to a previous price range. BTC can also make surprise hikes above $20,000, attacking the relatively small leveraged positions. At just above $19,000, new long positions were taken, with the potential to be liquidated.

The BTC move from $19,100 to above $19,800 late on Monday also caused more than 84% short liquidations on Binance and other derivative markets. But BTC also rallied to $20,288.51, also showing its potential for recovery.

DeFi Preserves Value

The value locked in Ethereum-based DeFi is actually relatively stable, inching up above $40B in notional value. With ETH above $40B, the sector has not seen significant liquidations. In fact, DeFi can survive better as it holds collateral and can keep it if centralized organizations default on their loans.

The usage of smart contracts and automated decisions also meant DeFi protocols could not hand out unsecured loans, and could liquidate automatically.

ETH recovered to $1,103.07, adding to the valuation. Most liquidations in DeFi are threatened at levels under $1,000, though protocols had time to top up collaterals to a lower range.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.