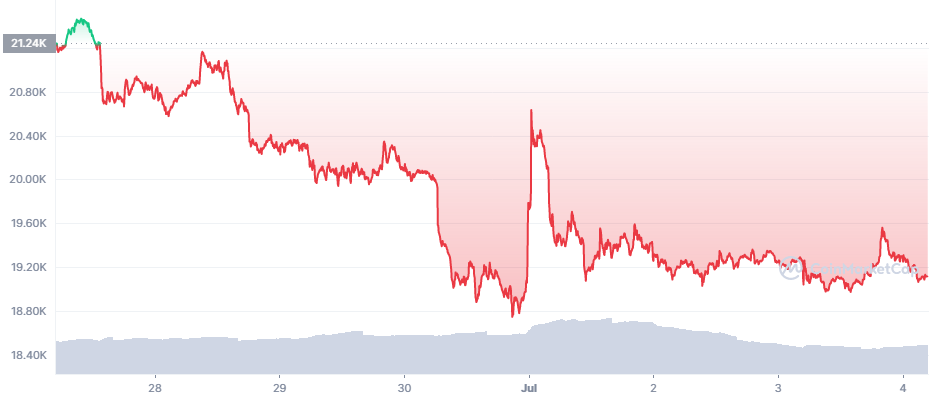

Bitcoin (BTC) Looks Set for Another Downward Move

Bitcoin (BTC) held above $19,000 for most of the weekend, but is entering a zone where a deeper slide is getting more probable. Breaking under the $18,000 mark may also accelerate the slide, with some predictions for touching $12,500.

BTC started the new week at $19,112.97, with a weekly close in the red at $19,297.08. BTC may have more active performance after the end of the long weekend for the US markets.

At the current market price and sentiment, the leading coin has not given all the clear signs that the bottom has been reached. The slide to $19,000 followed days of high trading volumes and an apparent capitulation in the short term, but there are predictions for a long bear market.

3AC, Voyager Weigh on Market

Voyager is yet another crypto finance service to stop withdrawals, weighing on the market sentiment. Voyager has lost some of its liquidity after admitting to giving a loan to Three Arrows Capital, one of the biggest crypto hedge funds.

Over the past week, more of the risky loans of 3AC became exposed, while the fund also applied for bankruptcy. Voyager was yet another fund to promise secure holding of its assets to retail owners, but went on to use those same assets to give out loans.

Crypto lending remains non-transparent and often unsecured. During a bull market, lenders can gains significant earnings, but a slide in prices exposes insecurity and leads to mass effects and losses to all lenders.

Additional rumors abound regarding BlockFi, one of the custodial crypto hubs. For now, the company has denied being bought up for $250M, a small part of its total valuation.

BlockFi has prepared more details on its path forward, but has shown to be one of the risky crypto establishments, for the potential to lose coins held in custody. The recent series of events from Celsius to Voyager shows that holding BTC in a self-owned wallet is still the best strategy.

Nexo, another passive income and crypto lending platform, has assured it remains solvent. However, recent user reports also reveal Nexo is becoming more aggressive in demanding new deposits, raising red flags about its solvency.

There is still demand for crypto lending, but the recent locking of withdrawals is still worrying.

BTC Sentiment, Volumes, Remain Low

BTC trading volumes over the weekend fell toward $15B in 24 hours. Tether (USDT) trading volumes are also on the low side at around $26B in 24 hours, with the new lowered supply of 66.2B tokens.

BTC is now in a stagnant phase, almost touching the lower bound of the Rainbow Chart. More often, BTC bounces from the low range, and the chart suggests the recent price dip may be a good buying position.

But at this price, open interest on futures trading is growing, expecting a bigger price move for BTC. The leading coin remains risky, with the potential for both a rapid crash and a short squeeze.

There are also signs of added BTC to some of the top wallets, though it is unclear if the newly gained coins are bought by whales or represent deposits to exchanges. The biggest weight on the BTC price is its slide under the 200-day MA line.

This slide under 200D MA is the deepest in percentage terms in the history of BTC. The slide follows a negative quarterly results, with June becoming the worst month in the history of BTC. The series of events also suggest this slide may be different, leading to a new estimation of the real value and usability of crypto assets.

In the short term, the next price drop may see BTC at $16,000 with more potential for moves closer to $10,000. BTC can still move by rapid increments, as with a recent $1,000 candle traded in minutes. At the current price range, a breakout of a few thousand dollars is also not out of the question.

It may be possible that during this price cycle, the boom in DeFi and crypto lending is over, leaving only the better-capitalized products and platforms. Without bullish expectations and exuberance, it may be more difficult to draw investors and build up liquidity.

At the same time, Ethereum (ETH) survives just above $1,000, with some of the truly decentralized protocols still working. Decentralized smart contracts, not tied to personal decisions, are possibly a better arbiter of lending practices. However, the ETH market cap dominance is down to 14.2%, making ETH less influential, with more value locked in altcoins. BTC market cap dominance remains around 42.2%.

For now, the market avoids the levels at which more Celsius loans would be liquidated, sparking another round of panic and chaos.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Eight ways to buy Bitcoin without needing ID or giving personal information

Who are the biggest influencers in the NFT space across the various social media platforms.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.