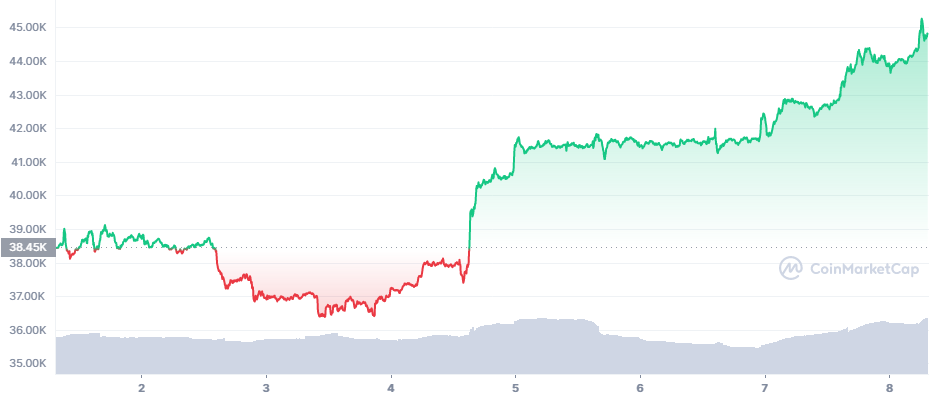

Bitcoin (BTC) Recovers with Rally Close to $45,000

Bitcoin (BTC) did not conform to the predictions of falling rapidly in the new week, staging a rally to break above $44,000. With this move, BTC got closer to the scenario of another upward move with the potential to regain previously lost ranges. BTC had a rapid appreciation within hours, reaching $44, 802.14 early on Tuesday, as the rally intensified once prices broke above $41,000.

BTC triggered a rally across the market, with some of the more active altcoins growing by leaps. Ethereum (ETH) continued with a rapid recovery, gaining on $3,200. The recent rally is happening on a relatively small uptick in trading volumes, though even the small uptick in activity is driving up prices.

ETH trading with leverage is picking up, as the asset is promising a higher potential for appreciation.

Despite this, data show a lower gas usage on the Ethereum network, as more users try to move to smart contracts and off-chain computation to avoid high gas fees. ETH market cap dominance is now back above 18%. The recent market crash was also more smoothly absorbed by DeFi protocols, with most of the value locked intact and automated contracts avoiding some of the liqudations.

Price Move Triggers Short Liquidations

Any attempts to short BTC in the past 24 hours led to more than 60,000 traders being liquidated, with a total of more than $38M. OKEx Exchange had the largest daily liquidation at $3.8M, with a prevalence of short liquidations on Binance, FTX and other derivative exchanges.

BTC remains unpredictable, with the potential for trades to be attacked if there is a significant accumulation of leverage. The recent activity raised open interest on the Binance exchange to above 80,000 BTC late on Monday.

What is the Next Stop for BTC

The latest move of BTC closer to $44,000 happens under conditions of overselling, noted already when BTC set lows under $33,000. The same upward pressure applies, and may be amplified by new attempts to short the coin on fears of breaking the trend.

The recent rapid appreciation of BTC also led to a reassessment of resistance levels, leading all the way up to $50,000. With February just getting into full swing trading, the Chinese new year behind and no upcoming futures expiration day, BTC may attempt to regain the $50,000 tier.

The recent rally happens on diminishing reserves on exchanges, with possible whale buying renewed.

Even the recent move of older BTC from the Bitfinex hack wallet is not enough to frighten the markets with an inflow of coins.

The trend to hold onto BTC is preserved, especially with fears of inflation and demand for appreciating assets. BTC remains volatile and can erase value, but has significant upside expectations.

Sentiment shifted almost immediately, with the Crypto Fear and Greed Index reaching 45 points, up from 37 points over the weekend. The index still suggests trading fear, but does not measure exactly the expectations for new upward price moves, especially with increasing volumes.

Lightning Network Grows Capacity

The Bitcoin Lightning network is one sign of increased usage for physical coins. The network grew its holdings to more than 3,400 BTC, with rapid growth in channels and nodes.

Lightning Network is still a tool to send BTC with relative anonymity, especially as a peer-to-peer coin, the initial use case proposed by Satoshi Nakamoto.

Recently, Lightning Network was also added to Cash App, extending the crossover between BTC usage and fintech.

Owning BTC is becoming more valuable, with warnings that holding coins on exchanges may be risky. This is one of the reasons BTC is being withdrawn from centralized markets, where leveraged trading may also dismiss the need of physical coins for derivative products.

KPMG Announces Addition of BTC, ETH to Treasury

Corporate interest in BTC does not end with MicroStrategy and Tesla, Inc. Other entities are adding both BTC and ETH to their portfolios, though with a tentative attitude.

The purchase is limited to KPMG Canada and shows readiness to store digital assets among traditional ones. The firm did not disclose its exact BTC purchase but stated that digital assets are now a mature class.

Interest in cryptocurrency, and especially ETH, is driven also by the NFT trend and blockchain gaming. Holding some ETH is crucial even for using tokens such as USDT or USDC, as well as for participating in decentralized protocols. Crypto brokerages are available for most regions, with some limitations on a list of countries. But most major economic reasons have access to crypto swaps or trading, as well as bank transfers to and from exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.