Bitcoin (BTC) Rides on New “HODL Wave”

#

The mood of owning Bitcoin (BTC) has shifted in 2021, riding on the wave of emerging BTC-denominated corporate treasuries. Increased demand from other entities such as funds, exchange-traded products or BTC-related investment vehicles also mops up available BTC.

Indicators for on-chain activity suggest increased demand for coins, coupled with locking in BTC in idle wallets and less probability for panic-selling. The price spike happening during sessions in Asia, Europe and US time zones show there is still demand for more coins.

The trend to trade BTC or hold onto the coins have been correlated with price moves. Short-term BTC transfers to and from exchanges can sometimes signal price spikes or sell-offs. However, there is also a bigger trend of storing BTC in cold wallets and waiting out short-term turbulence to take part in the coin’s longer-term future.

The wallet activity and owner behavior thus form a pattern known as “HODL waves”, further contributing to scarcity. While corporate BTC purchases are happening on the OTC market, there is also enough retail interest, even noted through Google Trends for the term “hodl”.

BTC Pump Restarted

After slumping to $53,000, BTC restarted its pump to just below $59,000. The leading coin is still within range to attempt new highs, while continuing its growth toward $100,000. The case for an ongoing price expansion in 2021 coincides with predictions from the stock-to-flow model and the rainbow chart on BTC buying risk.

But during this price cycle, even the type of holder has changed. During previous runs, with a much lower market price, most of the trading decisions were due to small-scale users riding the wave of price discovery.

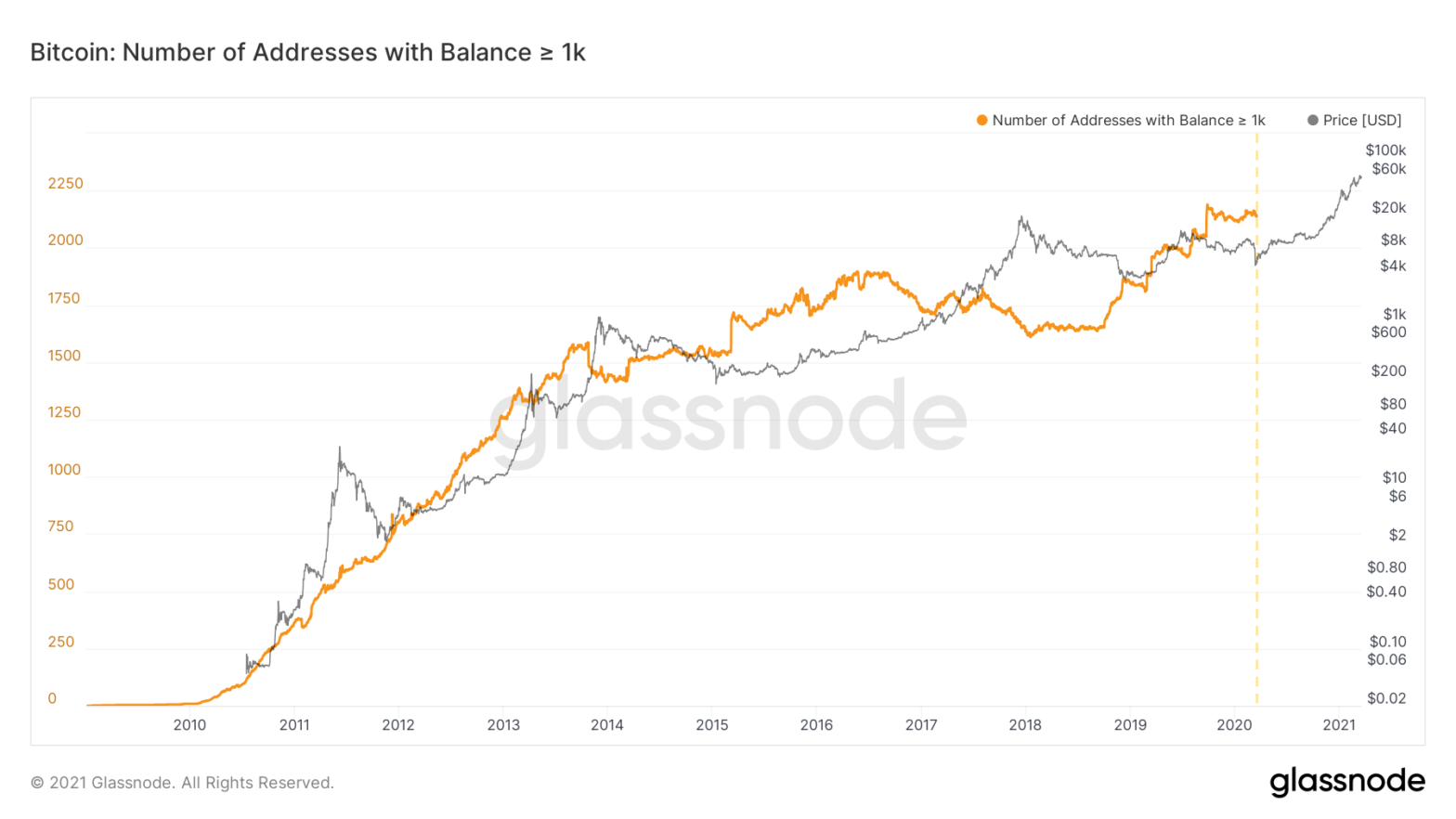

One indicator showing greater confidence is the fact that while smaller BTC wallets diminished, those with more than 1,000 BTC showed significant growth in the past few years. This trend is an accumulation of “whale”-size market players, as well as potential long-term storage building.

Social media commentary envisions this potential large-scale accumulation as the driver behind BTC price growth in the longer term.

Overall, even retail buyers tend to receive the advice to hold onto some BTC for the long ride. This trend omits the speculative investors, and tracks the potential of BTC to break out to higher valuations. In the short term, derivative trading can still bet on price moves in the range of thousands od USD per day, liquidating both short and long positions.

BTC sentiment may diverge when it comes to traders vs long-term holders. For the short term, there are still expectations for price drops. For long-term holders, however, the goal may be to build up a larger stash of coins to participate in the future crypto economy.

Will BTC See Yearly Lows?

While short term predictions envision BTC testing $75,000 soon or going above to $100,000, there are also scenarios where the price takes a downturn to yearly lows.

Current predictions for potential lows range between $30,000 and a potential slide as low as $10,000. However, the market sentiment at nearly $60,000 is different and there are more encouragements that large-scale owners will hold onto their coins. Others believe the yearly low of $27,000 is already behind, when the price briefly crashed in January and continued upward.

The recent news of India potentially banning even the ownership of BTC and other crypto coins was easily absorbed by the market, and BTC is now on track to test new highs.

Closing Q1: BTC Near Top Performance

BTC prices are on track to close a notable Q1 of significant price records. The Kraken exchange notes the last three months’ performance is among the most successful, if counting from 2011.

But the current BTC top remains unique, supported by multiple on-chain and market indicators of relative strength.

BTC mining activity is still about 50% higher compared to a year ago. Trading volumes are also near a peak, going as high as $3B, an anomalously high volume, around March 18. Not all BTC trading, however, is considered realistic volume, and some exchanges are still suspect for inflated bot-based trading.

Scarcity Drives Price

Since the summer of 2020, there are only 900 new BTC produced each day. Some miner pools have even slowed down selling, adding to the scarcity or leaving some of the coins for OTC trading.

Additionally, buying BTC on exchanges is becoming rather competitive, as there are simply not enough coins to go around.

Taking BTC off exchanges can be done for multiple purposes beyond storing it long-term in a secure wallet. Staking or loans are some of the tools to make use of gains, while also preserving access to the coins.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

Who are the biggest influencers in the NFT space across the various social media platforms.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.