Bitcoin (BTC) Takes One More Dip, Will Rally Follow?

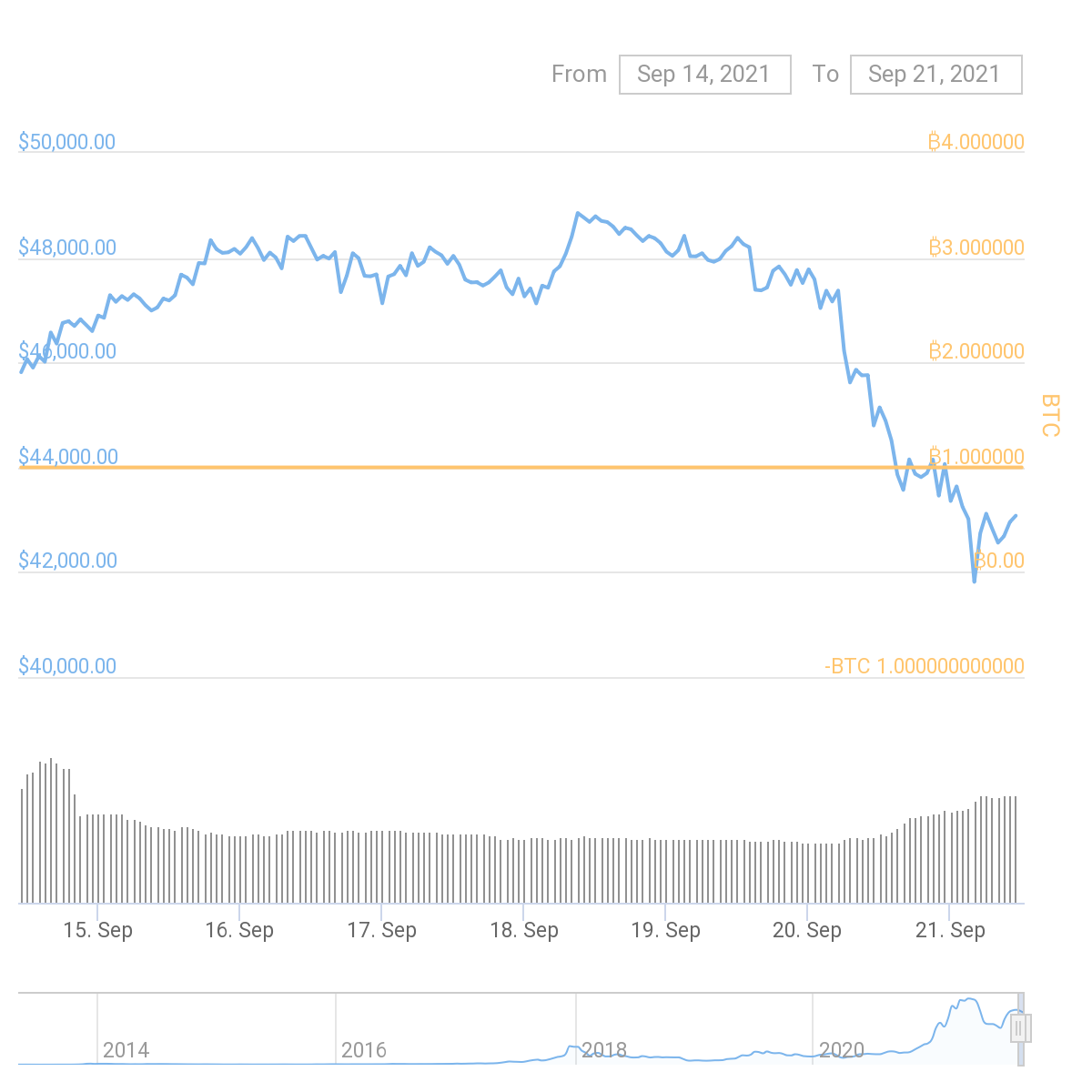

Bitcoin (BTC) broke down below the suggested support level of $44,000, potentially entering a scenario with a bigger price slide. BTC crashed to $42,492.95, on rapidly expanding selling that brought volumes to above $46B in the past 24 hours.

The slide extended Monday’s losses, as BTC dipped below several tiers, losing support at $45,000 and lower levels. The losses spilled over to altcoins, which saw even deeper cuts. ETH prices dipped under $3,000 for the first time in eight weeks, dragging down tokens and side projects.

Funds Flow Back to Stablecoins

The recent market crash is still smaller and slower in comparison to the August dip to $28,000 per BTC. The recent slide, however, once again pushed traders to seek a safe haven in cash-like positions.

During the market dip, the supply of Tether (USDT) increased by a leap, adding 400M tokens in one minting session. With that, the total supply of USDT is near an all-time high of 68.7B tokens.

In the past day, USDT trading exceeded $100B in volumes, absorbing BTC trading, as well as altcoin activity on centralized exchanges.

The Binance exchange also achieved a small boost to its native stablecoin, adding liquidity to some of its trading pairs and derivative instruments. Binance USD (BUSD) remains an influential dollar-pegged coin, which has boosted several trading pairs on Binance.

BUSD now takes up more than 6.8% of all trading volumes, decreasing the share of USDT to 87% from above 97% in the past years. Stablecoin liquidity has supported the market and ensured the current high levels, by providing a fast and transferable source of liquidity.

Will BTC Bull Market Continue

A possible scenario envisioned by traders is that BTC may continue to dip, breaking down under the $40,000 level. But as the markets remain highly liquid, with an increased supply of USDT that can flow back into BTC.

For this reason, there are still expectations the current dip is a short-term shakedown before a bigger rally.

While those opinions remain speculative, BTC has shown it can change direction fast and resume the climb.

BTC is also affected by the current Chinese stock market situation, caused by the crash of Evergiven shares and the company’s insolvency. However, the market shocks are also viewed as boosting BTC in the long term.

Liquidations Accelerating for BTC Traders

Derivative trading keeps amplifying the BTC market swings. During the Monday sell-off, liquidations remained relatively tame under $300M in the past 24 hours.

After the price slide, more positions saw margin calls, liquidating more than $1.4B in value. On the Binance exchange futures market, longs were getting liquidated around the $42,800 range.

The shift in trading sentiment brought down the Bitcoin fear and greed index. In a matter of weeks, the index fell from 79 points signaling greed, to 27 points, within the “fear” category. Sentiment was neutral just days ago, before the rapid attack against derivative positions.

BTC Remains Attractive to Miners

BTC mining has survived several setbacks over the past years, including a prolonged bear market where miners were producing new coins at a loss. But after the halving of the block reward, mining is again a profitable activity, despite the highly competitive difficulty levels.

A new measurement for BTC profitability over time sets the current value of the network at nearly 30 times the costs of BTC production.

BTC mining has been attacked for its negative ecological profile, including a high level of electricity usage and electronic waste. However, BTC and digital assets often use cloud infrastructure for node operations, thus becoming part of the overall usage of online resources.

Is BTC Offering a Buying Opportunity

The most recent BTC slide was used by El Salvador to increase their stash of coins. However, the decision to buy BTC may be complex.

Based on the Rainbow model, BTC is in the “hodl” stage, where the best approach is to avoid panic-selling. The model does not suggest it is the best time to buy, though a continued price dip under $40,000 may be seen as an opening for new accumulation.

Other models take into account the overall trends of BTC based on mining scarcity, as well as real-time scarcity. At current price levels, BTC may find support around $39,000 based on coin scarcity and spot demand.

BTC available on exchanges is still relatively low at around $2.4M. Whale traders are not idle, and there are indications of strategic selling and re-accumulation.

For now, there is no predetermined path to new yearly highs, as BTC prepares for the final stretch of 2021. Still, predictions for prices above $100,000 have not been abandoned, with multiple long-term holders ready to wait out short-term market fluctuations.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

Is mining crypto still profitable? With more cryptos like Ether switching to POS is the competition going to get too much?

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.