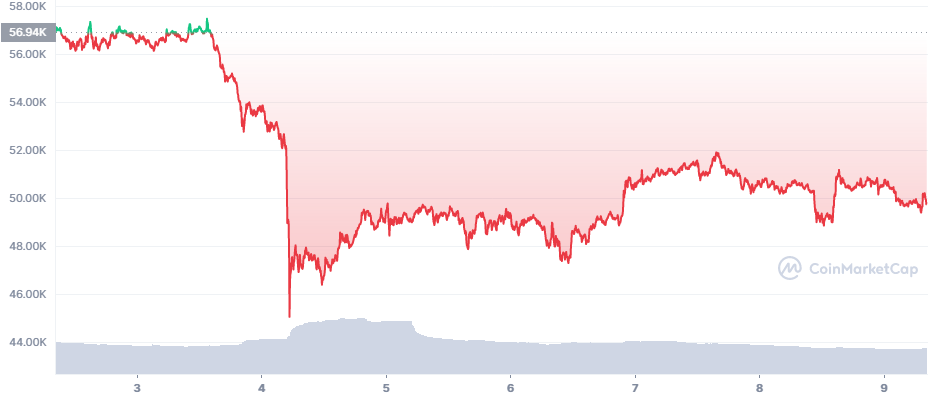

Bitcoin (BTC) Takes Step Back Under $50K

Bitcoin (BTC) stepped back under $50,000 again. This time, the market cap dominance of the leading coin fell to 39.8%, notably losing positions to Ethereum (ETH) and its ecosystem. While BTC showed weakness and abandoned some of the paths to a year-end rally, ETH established more than 22% in market cap dominance, and returned above $4,300.

BTC traded at $49,863.43 on Thursday, on thinned out volumes around $28B in the past 24 hours.

What’s Behind the BTC Weakness

BTC has been supported by the printing of nearly $1B more Tether (USDT), but for now trading remains relatively low.

The liquidations from December 3 are still affecting the market mood, and the Bitcoin fear and greed index is still recovering slowly to 29 points. After the $2.5B in liquidations, BTC funding is yet to recover and is once again negative. It took months for BTC to regain leverage and open a high level of futures positions, and a new cycle may take weeks or months to develop.

At low leverage levels, BTC may stagnate at a lower range, with no moving factor to vault higher price levels. BTC has shown significant spot buying in 2021, along with interest in the newly launched ETF investment vehicles.

However, mainstream interest in BTC has diminished, and the Grayscale Bitcoin Trust (GBTC) trades at a discount for an equivalent BTC price of $45,000.

Spot BTC remains scarce, with continued outflows from exchanges. The latest data show a significant outflow, with little spot selling.

BTC now moves on its separate track, while giving enough stability to altcoins to perform their rallies.

Is BTC Bearish

BTC has raised some concerns that a bigger sell-off may arrive. Despite the actual coin scarcity, leveraged positions may accrue again with expectations of trading to a lower range.

Based on the recent Rainbow Chart measures, BTC is still in the “HODL” stage, where the best strategy is to wait out the turbulence.

BTC has also diverged from the predictions of the stock-to-flow (S2F) model, which anticipated a move close to $100,000. In a bigger sell-off, altcoins will not remain uncoupled for long, and may erase more of their recent gains. In the short term, however, altcoins survived the BTC dip under $50,000 and managed to achieve short-term rallies.

Altcoin Season Won’t Stop

Due to their lower trading volumes, tokens and altcoins are easily swayed by more USDT liquidity entering the market. With the growing retail popularity of crypto tokens and the expansion of platform coins, there are communities and investors going beyond BTC trading.

Terra (LUNA) is one of the hottest assets, once again defying the market stagnation to trade around $75. LUNA managed to peak at $78, with expectations of following the track of Solana (SOL) and Avalanche (AVAX) to reach three-digit prices.

LUNA, along with Polygon (MATIC), line up among the most traded altcoins on the Binance exchange. Binance trading has switched back to big-ticket coins, with BTC and ETH taking the top spots. Shiba Inu (SHIB) is for now lagging, and has fallen away from the most active trading positions.

Open Finance Keeps the Pace

The core of DeFi, or open finance as some projects prefer to call it, is still stable based on the robust prices of ETH and Binance Coin (BNB). BNB hovers above $600, working as the basis for multiple streams of passive income through staking and liquidity mining.

ETH stands at $4,395.83, propping up the $105B in notional value locked within DeFi protocols. While ETH is also traded on centralized exchanges, some of the liquidations come from decentralized protocols.

To avoid liquidation cascades in DeFi, some of the activities get automated. The latest market sell-off affected relatively smaller vaults, as the protocols adapted to market fluctuations.

DeFi vaults are relatively smaller and can be kept without liquidations, boosting ETH stability. Another source of ETH scarcity is the growing number of tokens locked in the ETH 2.0 smart contract.

NEAR Protocol Achieved Fast Recovery

One of the outliers this week was NEAR Protocol (NEAR). After a dip. NEAR recovered to $9.48, adding another 21% to its price.

NEAR is still below its peak levels from the past months, where the price reached above $12. But the protocol is one of the infrastructure projects, potentially attracting side startups and more value.

NEAR gets a boost from NFT products and additional token launches on its protocol.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.