Bitcoin Dominance Reverses Trend While Altcoins Outperform

Time flies – in the crypto market too! The transition from a massive uptrend to a downtrend, and eventually back on the uptrend – happened within a quarter. The crackdown that came in the month of May, fearing out the majority of the retailers, is no more concern after the market began to head to the upside recently.

Only Bitcoin (BTC), Ethereum (ETH), and a very few cryptocurrencies had a positive outlook despite the significant downfall in the market. As the recovery phase initiated, Bitcoin was expected to lead the market showing signs of buyers in the market. And the market did play out in a similar fashion. The prices were firmly held above the Support level and maintained grounds despite the strong seller from the previous crash.

On the other hand, Altcoins went into a downtrend, making evident higher highs and higher lows. In fact, the corresponding Support levels were broken, and the Resistance levels began to dominate as the markets proceeded to go lower.

All that being said, the trends have reversed. For the longest time during the consolidation, Bitcoin led the crypto market by holding its level even during downturns. But as Bitcoin began to transit from a sideways market to an uptrend, the interest of the buyers increased for both Bitcoin and Altcoins.

Though not all altcoins have shifted to an uptrend, a few altcoins are currently performing better than BTC crypto and even Ethereum, for that matter.

Bitcoin Dominance Sets a Short-Term High but Fails to Hold

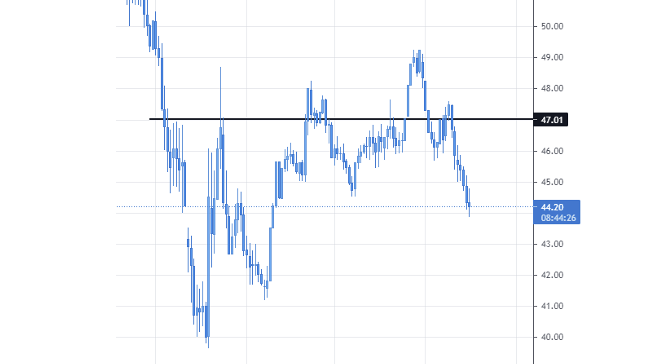

The overall trend of Bitcoin Dominance has always been crashing down since the altcoin began to boom. But usually, as the crypto market plummet kicks in, the BTC dominance starts to rise, favoring Bitcoin over altcoins.

A similar cycle was in action in the recent crash, followed by a reversal. When the entire crypto industry dipped significantly in mid-May, the BTC dominance rose from lows of 40 all the way to 48 within a week or so. It clearly shows that investors, during the downturn, liquidate from their altcoins position and park the capital in stablecoins or Bitcoin. But as the sentiment starts to shift again, the capital is brought into altcoins.

During the Bitcoin consolidation and Altcoin downtrend in the last few months, the dominance hovered between 44 and 48. Recently, the dominance of BTC even hit 49 when the price of Bitcoin shot through the Resistance level at $40,000.

However, at the same time, when BTC was trending higher, altcoins too began to rush north. The Bitcoin dominance lost its current value almost instantly. The dominance yet again failed to hold above the 47 Resistance mark.

Nonetheless, there is an interpretation worth noting. We know that the BTC dominance rises when the Bitcoin crypto prices are heading north and drops when altcoins are leading the market. Bitcoin was perhaps the first crypto to begin the uptrend after a 3-month long consolidation in the current scenario. And surprisingly, the price still being in a healthy uptrend, the BTC dominance levels crashed quite considerably. Thus, it can be concluded that the altcoins are currently outperforming Bitcoin by a huge margin, due to which the dominance is falling briskly.

Bitcoin looks Strong, but not Strong Enough

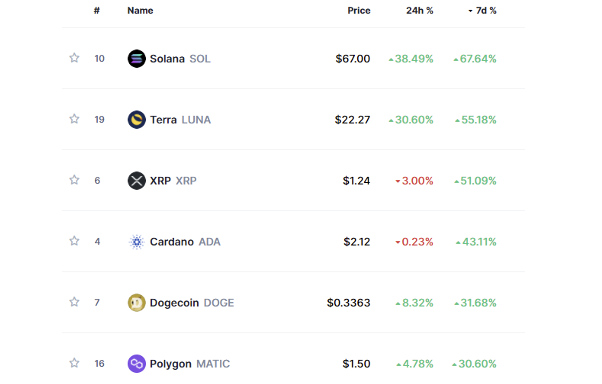

Bitcoin is currently holding at a level of $47,000 for about a couple of days now. But, at the same time, many altcoins are up over 10% in the last two trading sessions. In fact, in the last one week, the altcoins have been skyrocketing individually and relative to Bitcoin.

For instance, in the below chart representing the top performing cryptos in the last seven days, we see that all members in the list are altcoins. And not to mention, Solana token tops the list with a return of a whopping 67% in the past week. In fact, all altcoins in the below list have rallied over 30%, compared to Bitcoin, which is moved only a percent higher since the past seven days.

The daily movement of Bitcoin does not stand bullish either, ad it has been slowly inching lower and lower in the last three days. But altcoins, on the other hand, are having one of their best bull runs after a long while.

Bitcoin Technicals Unfolded

The above context might bring a bearish tone to the performance of Bitcoin. Relatively, it is true that Bitcoin is currently lagging, but on the bigger picture, Bitcoin does live up to the term of it being the biggest cryptocurrency in the world.

In the below chart covering the short-term data of BTC crypto, it can be ascertained that the downtrend turned into an uptrend with consolidation between the two.

Though the markets are slowing down, BTC remains the first crypto to breach above the Resistance, as shown. Since the inception of the recent uptrend, Bitcoin has been a leader.

To sum up, Bitcoin is certainly in a healthy uptrend. And the reason for it not performing as well as altcoins are due to the fact that BTC has already completed the move in the previous weeks.

Now get these three cryptos and several others from our list of reputed cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.