BTC Above $50K, Ready for More?

The Bitcoin (BTC) market price broke out above the $50,000 range for the first time since mid-May, re-sparking hopes of another rally. BTC found support during the weekend dip toward $48,000.

The latest recovery took BTC above $50,300, on relatively slim volumes around $30B in 24 hours. The BTC market cap dominance remains relatively low at 43.9%, suggesting the recent rally can also boost the positions of altcoins.

BTC traded at $50,185.02 on Monday, sliding to a slightly lower position after the weekend. Predictions from the current level include a climb above $53,000, as well as a temporary retrace. In the longer term, the $100,000 per BTC prediction remains, though with no certainty of the timing.

The bounce from the $28,000 dip also preserved the prediction of the stock-to-flow model.

The predicted continued bull market may add to the overall positive attitude for BTC as August comes to a close.

Derivative Trading Still Sways the Market

The latest BTC expansion reached almost $1,000 in 24 hours. In the past, the leading coin has performed similarly. The latest weekend rally happened on the back of liquidated short positions.

BTC prices were still considered relatively shaky, causing bearish traders to open leveraged short positions. In the short term, BTC may see additional volatility from the CME futures expiry, with last trades on August 27. Additional volatility may come from low-volume weekend activity, as well as more dramatic weekday price shifts.

In hindsight, August was a month of accumulation, with significant exchange outflows. BTC reached monthly lows under $29,000, opening a potential buying spot for those intending to hold long-term.

The last month also saw a dramatic shift in sentiment, from a metric of extreme fear to extreme greed of 79 points as of August 23.

The recent rally sparked hopes of a move above $51,000 in the short term, with the potential for $75,000 as the next possible price move.

Leveraged Trading Returns Tentatively

After a significant crash of leveraged trading, positions are gradually returning. Now, BTC trading is back again close to the May 18 levels in terms of derivative leveraged positions.

However, exuberant retail trading and leveraged risk-taking has not returned to full speed, and is still expected as a price factor for BTC.

Binance futures trading is currently the leading source of positions. The coming months, however, will reveal how Binance’s approach to de-risk the market will hurt leveraged trading.

Miners Return at Fast Pace

One of the recent shocks against BTC was the abrupt shutdown of Chinese mining farms after a governmental crackdown. Now, the reported hashrate of BTC has grown consistently over the past months, suggesting the shutdown was temporary and other miners are filling in the niche.

Miners are also one of the significant hubs of coin accumulation. Despite the price growth, miners are holding onto their coins, with only modest selling to cover costs. Currently, about 30% of the BTC supply is held unmoved in various wallets, and some is presumed lost.

This behavior from miners adds to the exchange outflows, which accelerated since the end of June. An additional 194,623 BTC is locked in as Wrapped Bitcoin (WBTC) and participates in the DeFi ecosystem.

Lightning Network Breaks New Records

The Bitcoin Lightning Network, an experimental structure to send BTC off-chain, has continued to evolve and expand.

The network, which consists of nodes and channels, is not in a fixed state and constantly adds payment gateways. The network now carries more than 2,300 BTC stored in various nodes.

The Lightning Network is envisioned as one of the solutions to high on-chain fees, which can grow unexpectedly during periods of network overload. LN contains nodes that carry significant payment channels, as well as personal nodes for small payments.

The BTC held in the Lightning Network is also a growing store of coins that are taken off exchanges and used as digital cash.

USDT Stablecoin Gets Another Boost

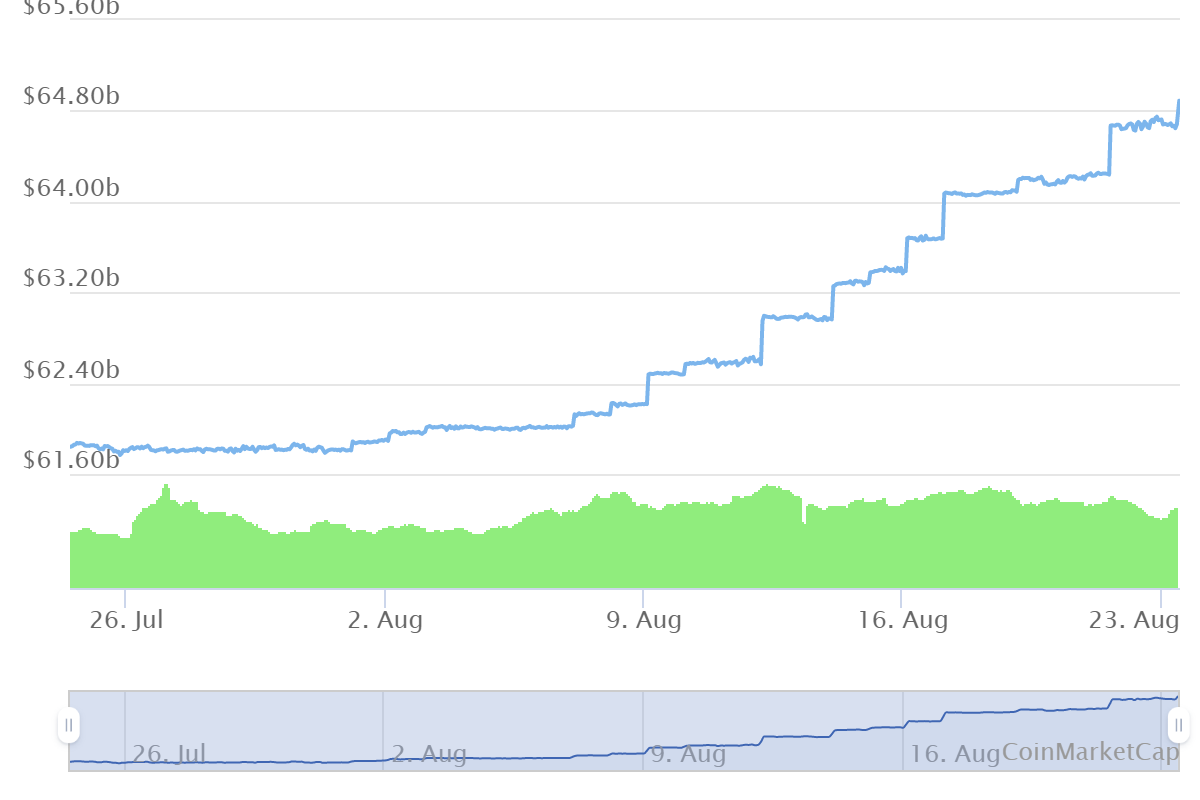

An important factor for the latest BTC upward move is an uptick in supply for Tether (USDT). The leading stablecoin lowered its supply during the June sell-off, to nearly 60B tokens. Now, another expansion has lifted the supply to above 64B tokens.

USDT now carries more than 89% of all crypto trading, and about 59% of all BTC trading activity. BUSD is the second most important stablecoin, supporting some of the BTC trades on Binance.

The importance of USDT has once again been attacked in the past weeks, with suggestions that Tether, Inc. may be a point of failure for all digital coin markets. However, USDT still holds up as an important factor in BTC price discovery.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

We look at where to buy and how to buy including limits, fees, security, and verification

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.