BTC Regains $5K, Recovery Still Shaky

##

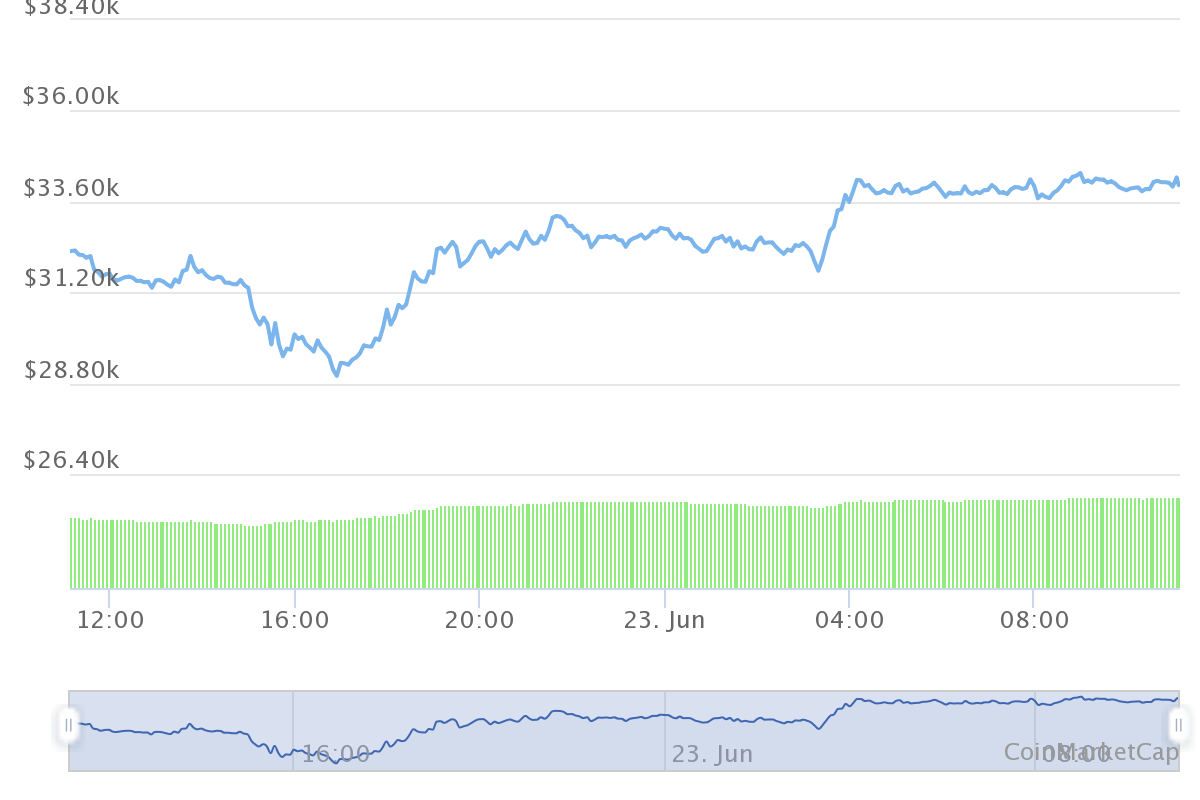

The Bitcoin slide brought prices down just below $29,000, causing extreme market fear. The worst-case scenario saw a dip to $25,000, possibly with continued price weakness. In that scenario, the advice to “buy the dip” is still highly risky for new retail investors.

In the short term, BTC managed to recover just as fast, adding more than $5,000 in less than 24 hours. BTC rose to the $34,000 range, on trading volumes nearing the monthly high and reaching above $64B in the past 24 hours.

Altcoins followed, bouncing off their bottom, with most assets adding more than 10% to their price. But most traders moved back to BTC, expecting a continued recovery. The recent activity brought BTC market cap dominance to 46.8%, while altcoins continued to lag.

In sympathy, ETH recovered to $2,082, after falling to the $1,800 range.

What Caused the Volatility

The chief driver of the fear was the uncertainty surrounding Bitcoin mining in China. A series of farm shutdowns were immediately reflected in the network hashrate, which fell to near two-year lows. BTC mining keeps slowing down, so far with little effect on the network.

Now, it remains to be seen if the period of fear was an anomaly, and BTC prices could continue to rally in the longer term.

More Dips May be Coming

Some traders still expect a further crash to $25,000 or even $21,000, levels not seen since the fall of 2020. The trends of long-term accumulation have not been broken, and some buyers may continue to buy at that rate.

For BTC holders, the stock-to-flow model (S2F) remains one of the leading long-term predictions. The current short-term capitulation to $28,000 levels is a slight deviation from the model.

The biggest fear is that the loss of 50% from peak values would lead to another “crypto winter” similar to the three-year bear market and stagnation since 2018. During that period, it took years for BTC to return to an all-time high, and then the crash happened soon afterward.

Short-Term Speculators Leave the Market

While there are signs of a capitulation similar to the 2017 peak, there are also indications of a new range of investors in BTC.

Glassnode data keep proving the model of large-scale owners riding out volatility for the longer term, while recent selling pressure may be coming from short-term buyers.

While it is still possible to make bets against BTC in derivative markets, data is showing that actual BTC for sale is much more scarce. Glassnode reveals a general stagnation of OTC sales, with large-scale owners preferring to hold onto their coins.

At the same time, there may be pressure from big enough owners that send coins directly to exchanges, potentially tanking the spot price.

And while there are some data miners are abstaining from selling, they are also sitting on significant BTC holdings.

Will the Recovery Last

The BTC market price remained volatile, once again retreating to the $33,000 range. The latest price moves suggest a falling trend, with more opportunities for price slides toward $30,000.

Previous models predicted a climb above $40,000 could trigger a more significant recovery. But with the continued price slides, BTC may dip lower and take longer to recover previous price ranges.

The waves model suggests the summer of 2021 may see new yearly lows, while taking time to improve sentiment.

Grayscale Fund Still at Discount

The Grayscale Bitcoin Trust once again trades at a discount, the equivalent of a $29,300 BTC market price. On June 21-23, a significant unlocking of GBTC shares is expected, with the potential to further drive the premium down.

Then, on July 17-19, another unlocking of GBTC backed by 16,000 BTC is scheduled, potentially further hurting the asset’s price. However, the exact effect of the unlocking remains unknown, as there are multiple confounding factors on the market.

Still, GBTC trading at a discount to BTC spot prices shows decreased mainstream interest. This also means institutional investors are less likely to buy BTC to lock into the GBTC Trust.

BTC Derivatives Set the Pace

BTC markets still carry enough leverage to lead to significant price volatility. The latest rapid dip liquidated positions worth $523M.

BTC price moves are capable of liquidating both short and long positions, with some attempts at concerted short squeezes. But for now, the strong downward price pressures remain riskier for long position exposure.

What is the Worst Case Scenario

The current range of BTC is still not a guarantee for a recovery of higher price levels. Analysts warn of the potential for a continued slide and a new capitulation.

The $25,000-$20,000 dip is not excluded, but the worst potential capitulation can take prices down to $15,000.

The current price dips already took some of the big corporate purchases out of the money, though some of the MicroStrategy purchases are still in the money.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

From Airdrop to Wallet we look at all the crypto jargon and what it really means

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.