Can Ethereum (ETH) Reach $3,000 Soon?

#

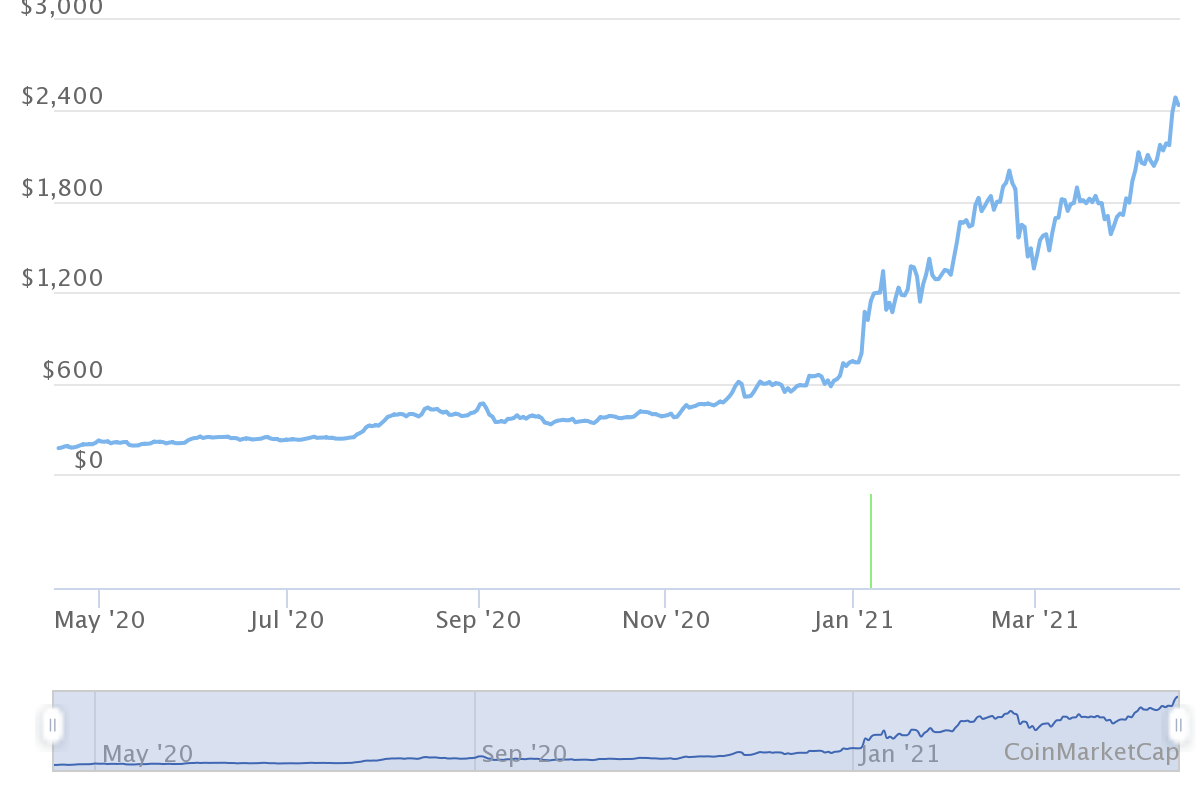

Ethereum (ETH) trades with heightened activity, with signs of anticipating higher valuations. ETH kept above the $2,400 level and tested $2,500, while predictions diverged on whether the asset would dip or continue to appreciate.

The Ethereum network went through the Berlin upgrade this week, another milestone to turning the network into a proof-of-stake blockchain. For now, the final goal is still more than a year ahead in the future. But in the short term, the upgrade caused inconveniences, as token transfers were halted on big exchanges.

Despite claims that all wallets are operational, there may still be delays of deposits or withdrawals for some of the assets. For now, the Berlin hard fork has not affected DeFi projects and trading.

In the short term, the hard fork may delay deposits for hours or days, until confidence increases. But ETH availability on Coinbase may be constrained, similar to the Bitcoin (BTC) scarcity of the past weeks.

Is ETH Becoming a New Reserve Coin?

ETH buying has several avenues of interest beyond DeFi and pure crypto speculation. As an older digital asset, ETH already enjoys mainstream interest and is a staple in the Grayscale funds based on crypto fractional ownership.

A recent US SEC filing shows interest in crypto has extended to Rothschild Investment Corp., which has acquired shares of the Grayscale Bitcoin and Ethereum funds. The allocation is for 250,000 shares of the Grayscale Ethereum Trust, each containing a fraction of an ETH.

ETH remains one of the most high-profile coins, and when it comes to mainstream investors, it is not loaded with some of the negative attitudes of the crypto community. Instead, ETH is viewed as an asset with a significant upside.

High Fees Still Hamper Network

Instead of just a few cents to send ETH or tokens, fees for ETH vary between $5 and $34, although they can run up into the hundreds of dollars on some days. The gas fee conditions remain unpredictable, and require users to track their gas usage and plan their transactions.

The world of DeFi, however, is still highly active, locking in nearly $60B in value in the past few days. The growing ETH prices and the upside potential mean more projects can continue to promise high gains.

Despit? DeFi being one of the most speculative parts of crypto trading, it is also gaining mainstream attention.

The inflow of additional funds may continue to boost ETH positions, as currently more than 90% of all value in DeFi hinges on the Ethereum network and the price of the ETH token.

How High can ETH Go?

The price action of the past few days saw ETH touch $2,500 on Binance International. The most immediate predictions see ETH testing the $3,000 range. Both active traders and longer-term investors see the upside potential in the coming weeks. ETH trading also happens on the Bitforex exchange, which is not included in the Coinmarketcap reporting for its unreliable data and unrealistic trading volumes.

The longer-term predictions envision ETH reaching $10,000, possibly until the end of the year. Part of the growth hinges on the performance of BTC, but ETH is also growing its own ecosystem of projects and gaining in value independently.

ETH still looks weaker against BTC, though it has made gains to 0.039BTC in the past few days. For now, ETH is yet to claim ground in satoshis, with some expectations it will continue to lag the BTC performance. Yet ETH is in a much better shape and with more bullish expectations in comparison to previous years, where the asset was viewed as a declining coin with a price potential to hover around $400.

Is ETH Scarcity Coming?

Unlike BTC, ETH does not have a pre-programmed cap on its supply. Creation of new coins continues, and there are more than 118M ETH available. Initially, the supply was supposed to diminish at around 104M ETH, but mining and new coin creation continues, with two new ETH mined every minute.

There is even a proposal to boost the block reward to 3 ETH temporarily, then phase it out to 1 ETH per 1-minute block. ETH mining is more profitable at the current price, and miners do not want to give up on the gains.

In the future, some of the ETH fees may be burned instead of going to miners, thus curbing the supply of coins. Additional limitations may come from ETH getting locked for staking, as the network evolves its block production.

Currently, about 9% of coins are locked into some of the top DeFi projects, with wrapped ETH (WETH) alone removing 6% of the supply from circulation.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

How do cryptocurrencies stack up against popular stocks and shares?

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.