Chainlink and Polygon Go Off Correlation

##

It is no doubt that there has been active participation in the crypto market in the past couple of weeks. Cryptos that typically consolidate and make a move in August is holding to be true in 2021 as well. Though Bitcoin crypto and its followers – altcoins have pushed it north recently, the fact stays that the market is sideways/down on the bigger picture.

Bitcoin regaining the $40,000 was an achievement in itself. After testing levels as low as $30,000, the bulls made the first attempt to hold above the psychological Resistance around $40,000. A slight retracement from these levels was inevitable, assuming some profit-taking came in.

As the Bitcoin market is hovering and trying to hold ground, the altcoin market is playing it no different. Like Bitcoin, most altcoins have reached their nearest major resistance level. The extended consolidation at the Resistance is perhaps an indication that they are waiting for Bitcoin to confirm the direction.

We have seen Bitcoin and altcoin head together, but few altcoins that are related to each other are moving out of sync in price action.

LINK Grows, While MATIC Suffers

In 2019, Polygon (MATIC) was integrated with Chainlink cryptocurrency to bring decentralized oracles on its layer-2 Plasma sidechain network. The integration has led to the comparison between the two in both token price action and protocol abilities.

Since 2019, surprisingly, both MATIC and LINK have been performing identically. But as the downtrend market began in the crypto space, a similar price movement got hindered. With the markets consolidating and making lower lows at a different rate, Polygon and Chainlink went off trend.

For instance, LINK is up a quarter of 100%, while MATIC token is trading at more or less breakeven with merely 5% gains in the last seven days. Additionally, LINK’s monthly returns stand at about +15%, whereas MATIC saw an unexpected decline of almost -10%.

On the fundamental front, the active addresses for MATIC are twice as that of LINK. But if we were to look at the 24-hour volume, Chainlink’s volume was double Polygon’s volume. However, the active addresses which were declining in MATIC, the numbers were exponentially rising in LINK. And considering the active addresses of Chainlink individually, it is at the monthly highs. Hence, we clearly observe that the interest is increasing in Chainlink relative to Polygon.

Moreover, the Gini coefficient, too, depicted a diverging trend in recent weeks. The Gini coefficient that is steadily rising with time in MATIC is extremely volatile in the case of LINK.

Gini coefficient that measures the dispersion of wealth in crypto evidently illustrates that funds are extremely concentrated in MATIC. Contrarily, a lower value in LINK indicates the holders’ funds are distributed more evenly. Thus, it is improbable for an individual or group of individuals to control the prices in the LINK market.

Technical Analysis and Comparison

From the above fundamentals, it is evident Chainlink is proving to be better than Polygon of market volume and Gini coefficient. To support the same bias, it is important for the technical aspects to display similar results.

The most recent down push from the buyers took the price of MATIC crypto all the way down to 6 cents, below the two-month low. However, the price shot right back up with buyers respecting the $0.7 demand area. The buyer’s move came in a couple of pushes. Though they had the momentum, the price failed to reach the recent S&R level at $2.

Polygon (MATIC)

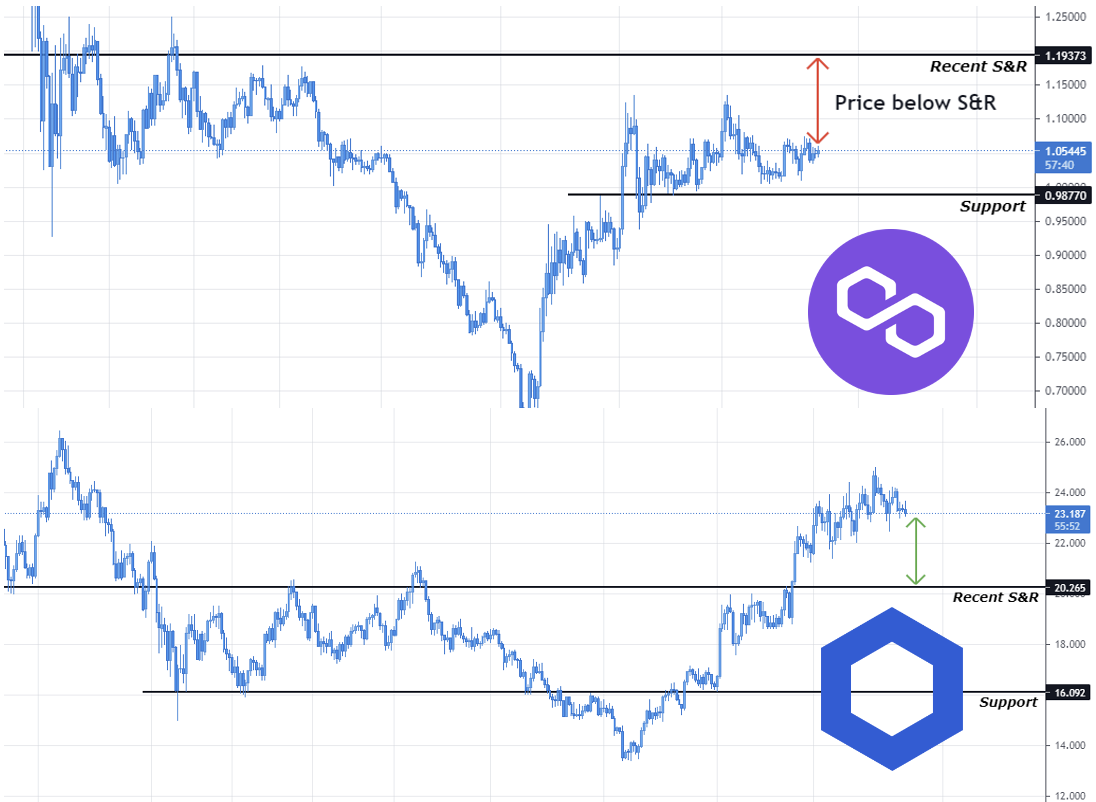

That being said, if we were to shed light only on the uptrend, it is highly likely for the market to continue further up. The current price level at $1.06 is, of course, causing issues for the bulls, but the Support holding firm could lead the price to push higher, at least up to the S&R.

Chainlink (LINK)

Chainlink (LINK), like most other altcoins, has been in a downtrend for over three months or so. However, as the price was inching closer to the higher timeframe Support levels, the speed and distance of the seller decreased on the way down. It was indeed an indication that the buyers are trying to step up. And the price failing to hold below the nearest Support at $16 proved the big bulls are back in business. The momentum of the buyers was, in fact, strong enough to breach above the recent S&R as well.

Looking at the current price action, the market has transited from an uptrend to a channel phase. Not denying the fact the market is at Supply levels, there could be some bearishness in the subsequent days before the buyers take it higher for another push.

Also, bringing back the chart of MATIC, it is ascertained that the buyers who were able to push through the recent S&R in LINK were unable to do the same in the case of MATIC cryptocurrency.

Now you can get BTC, LINK, MATIC and many other cryptos from our list of reputed cryptocurrency exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.