Cryptocurrency Market Update: BTC | ETH | SOL | XTZ

After a month of up trending, the cryptocurrency market has returned to consolidation. As sellers seek to take over the market, the two largest cryptos, Bitcoin and Ethereum, are maintaining the prices at critical support and resistance levels. Despite the bears’ present strength, the bulls are buying back the discounted prices, demonstrating the validity of the current rally.

Altcoins, on the other hand, are divided into groups, with some outperforming Bitcoin (BTC) and Ethereum (ETH) and others behaving in line with them. For example, despite the fact that the whole crypto market has been under bearish pressure for the last week, Solana’s native coin SOL has been pushing to the upside.

BTC and ETH Slowly Inch Higher

Both Bitcoin and Ethereum have been slow over the previous two to three weeks, as the markets have encountered resistance at every step upward. The fact that the bulls’ momentum on the way up has remained unchanged is a strong indicator that purchasers aren’t ready to give up just yet.

From the price perspective, BTC crypto has hit $40750 as a barrier, while Ethereum has been trading below $3341 for more than a week. On a larger scale, the market is not in a range since buyers are buying at greater levels, resulting in higher low sequences.

IMF Claims Bitcoin Risky, but the Crypto Community Disagrees

The International Monetary Fund (IMF) recently took to Twitter to say that Bitcoin token and altcoins are issued privately with considerable risks and that assigning them the value of a state currency is strongly discouraged. However, the crypto community appears to be entirely opposed to the IMF’s remarks. They find it odd as the primary idea behind Bitcoin is that it is public, open-source, and highly transparent in working.

Ethereum Transaction Fee Burning Hits the $400 Million Mark

With the new EIP-155, the ETH transaction fee is being burnt at an alarming pace. After the network’s last upgrade, the network has now burnt almost $400 million worth of ETH. Today, over 200 ETH is destroyed every hour, which was formerly distributed to miners as an incentive. The figures hit new heights on August 27 when a staggering $35.8 million in ETH was scrapped. The upgrade aims to stabilize ETH’s highly fluctuating transaction costs and get the system closer to switching from the existing Proof-of-Work consensus method to Proof-of-Stake, which is more friendly to the environment.

Altcoins Picks Up Momentum

During crypto bull runs, altcoins have always been a winner. And, once again, the past event has repeated itself. Though the market began out to Bitcoin’s advantage as prices ripped through resistance levels with ferocious force, the altcoins ultimately took control as purchasers switched their focus.

Solana Keeps the Lead

Solana crypto is the first project that leaps into mind for the impressive bull run it is currently witnessing when it comes to cryptocurrencies. Since its debut, the relatively new coin SOL has been rising. It is presently gaining a lot of attention since it has been the standout performer in this bull market.

The extreme bullishness in SOL cryptocurrency has put it out of correlation from Bitcoin and most altcoins. In May, the crypto crash had brought the market down from $60 to $20 in one week. But, at no point in time, the uptrend was hindered – the buyers stood as firm as they were in the previous impulsive push. After a few months of consolidation, the big buyers entered the market and took the prices to all-time highs. In fact, currently, the prices are far away from the previous ATH, as it is trading 85% higher.

Tezos Ties to Catch up the Leaders

Even while the bulk of currencies are holding back, Tezos (XTZ), a proof-of-stake technology that lets developers rapidly construct dApps and other finance-related services, has been breaching through a few strong resistance levels. The latest upgrade ‘Granada,’ which began in early August, might be a key factor in its inexorable upward trajectory. The block duration has been reduced from a minute to a half, and the payable gas price for running smart contracts has been significantly reduced.

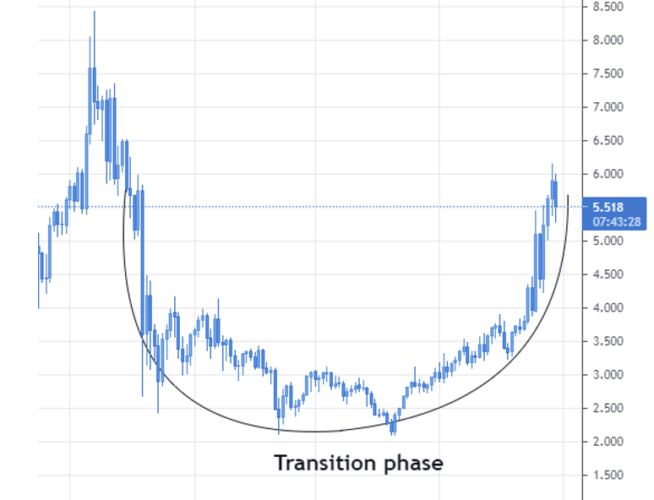

Tezos cryptocurrency has been a volatile market since the very beginning of its launch. The uptrends have been massive, but so are the downtrends as well. In its previous bull run, Tezos crypto made an ATH to around $8. The crash in the prices took it to levels around $3, which was right at the higher timeframe demand levels. As prices accumulated at these levels, the market transited from a downtrend to an uptrend. As of writing, the market is trading at about $5.5 and is on the verge of breaking through it as well. But since XTZ usually goes in correlation with BTC, the upcoming push is to an extent dependent on the price action of Bitcoin.

Now you can get these three cryptos and several others from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Learn how to keep your crypto secure and the different types of wallets you can use.

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.