ETH Transaction Fee Burning Pushes Ether Price Higher

The present crypto bull run does not seem to stop as of yet. The world’s top two cryptocurrencies, which never let the sellers break through the higher timeframe Support levels, are now witnessing better momentum and volume on the buy-side. The long-held technical Resistance has been cleared successfully as the interest of the sellers took a hit.

The levels $40,000 and $2.900 have stood critical for Bitcoin (BTC) and Ethereum (ETH), respectively, for the past few months. However, the current price action depicts the level to be irrelevant anymore. In fact, other altcoins, too, have breached through major technical levels, paving the way for the buyers to head to the subsequent Resistance zones.

Talking about the strength of the markets on their way up, most cryptos are making healthy higher high and higher low sequences. Bitcoin, Ethereum, and few others have moved into an uptrend, while the rest are gradually transiting from a downtrend to a sideways market. On a bigger picture, the altcoins, especially, are bouncing off strongly.

That being said, few fundamental factors of the world’s largest altcoin are not in sync with its price action.

Current Ethereum Burn Rate Could Erase $5 Billion Every Year

The Ethereum London upgrade that launched only a week ago has burned over 20,000 ETH. The deflationary properties in the suit last week observed almost 800 blocks (deflationary) on the blockchain network.

On August 05, one of the most anticipated events – the London hard fork, was brought into action. Additionally, a new fee-burning program was introduced as part of the upgrade.

A minimum of 25% and a maximum of 75% of the base fee is to be destroyed in an ongoing event – turning the Ethereum ecosystem potentially into a deflationary form of an asset after the major algorithm proof-of-work goes live.

As of writing, already 20,600 tokens have been destroyed in the burning process in the last week. In terms of dollar amount, around $64 billion has been burnt with a week or so.

There are several popular marketplaces to burn the transaction fees. Some of the marketplaces that have destroyed the highest fees include

- OpenSea NFT – 735 ETH burned

- Uniswap v2 – 348 ETH burned

- Axie Infinity – 318 ETH burned

It is ascertained that over $4.5 million has been destroyed in transaction fees, only from the top three.

Considering the average over the past 24-hours, Ethereum has reported a burn rate of 3 ETH per minute. Digging deeper with the burn rate, around 4,320 ETH would be burned per day, 30,240 ETH per week, and approximately 131,000 ETH per month. Going all the way to the yearly figure, 1.57 million ETH would be burned, equivalent to a whopping $4.9 billion considering the current market price of Ether.

Note that the above stats and figures are, to an extent, hypothetical, as the transaction fees vary based on the demand for the crypto and the network, which is completely dynamic in nature. However, considering the current trend and demand for the Ethereum network, the burn rate is most likely to stay the same or increase in the next couple of years.

ETH staked on ETH 2.0 Crosses $20 Billion Mark

In the present crypto world, trading is only one part of the major chunk. The growing usage of decentralized finance (DeFi) and non-fungible tokens (NFTs) has led the staked value to increase dramatically.

According to a recent report from ETH 2.0 Launchpad, over 6.8 million ETH has been staked on the Beacon Chain.

Fee on the Ethereum Network Stays High

The Ethereum cryptocurrency has become crypto for the wealthy public. With the fees rising too high, the Ethereum blockchain is certainly not the preferred choice of the network when dealing with smaller amounts.

“#ethereum fees are going insane with the #nft markets pumping like crazy!

We are now seeing spikes in gas fees that make ETH basically unusable for all but the richest users.” — Lark Davis (@TheCryptoLark)

Ethereum Approaches $3,300 Earlier than Expected

The Ethereum market is arguably one of the best crypto performers since the beginning of the recent bull run.

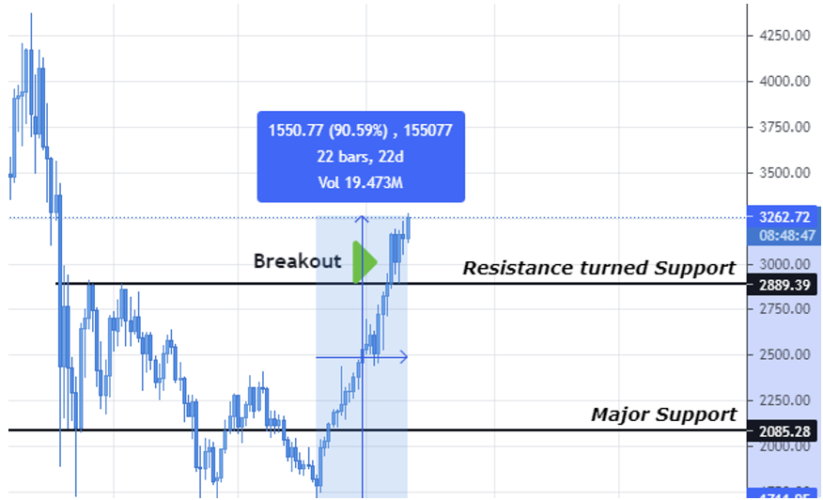

After the crypto crackdown in May, ether went into a consolidation phase ranging between $2,000 and $2,900. However, the entire overextended price action took place in the buyers’ zone (above $1500) – indicating that the bulls are still holding grounds.

Finally, after a couple of attempts from the major Support level, the market strongly headed to the Resistance at $2,900. And with the reaction left void at the bearish zone, the buyers smoothly breached the Resistance and turned it to a potential Support level.

In a matter of twenty-two days, the world’s second-largest crypto has rallied over 90%. Currently trading at $3,250, the price is barely 25% below its all-time high.

Now get these three cryptos and several others from our list of reputed cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.