How Major Bitcoin (BTC) Perform in 2021

##

Bitcoin (BTC) recovered above $59,000 while also giving a boost to altcoins. But there is another class of assets gaining attention – the hard forks of BTC, some of which will soon be four years old. Forks may be in for a rapid revival and speculative trading.

BTC forks have the advantage of being listed on most major exchanges, as well as significant prominence on social media. The social media acceptance of BTC forks ranges between significant enthusiasm and scorn at the attempt to replace the original network.

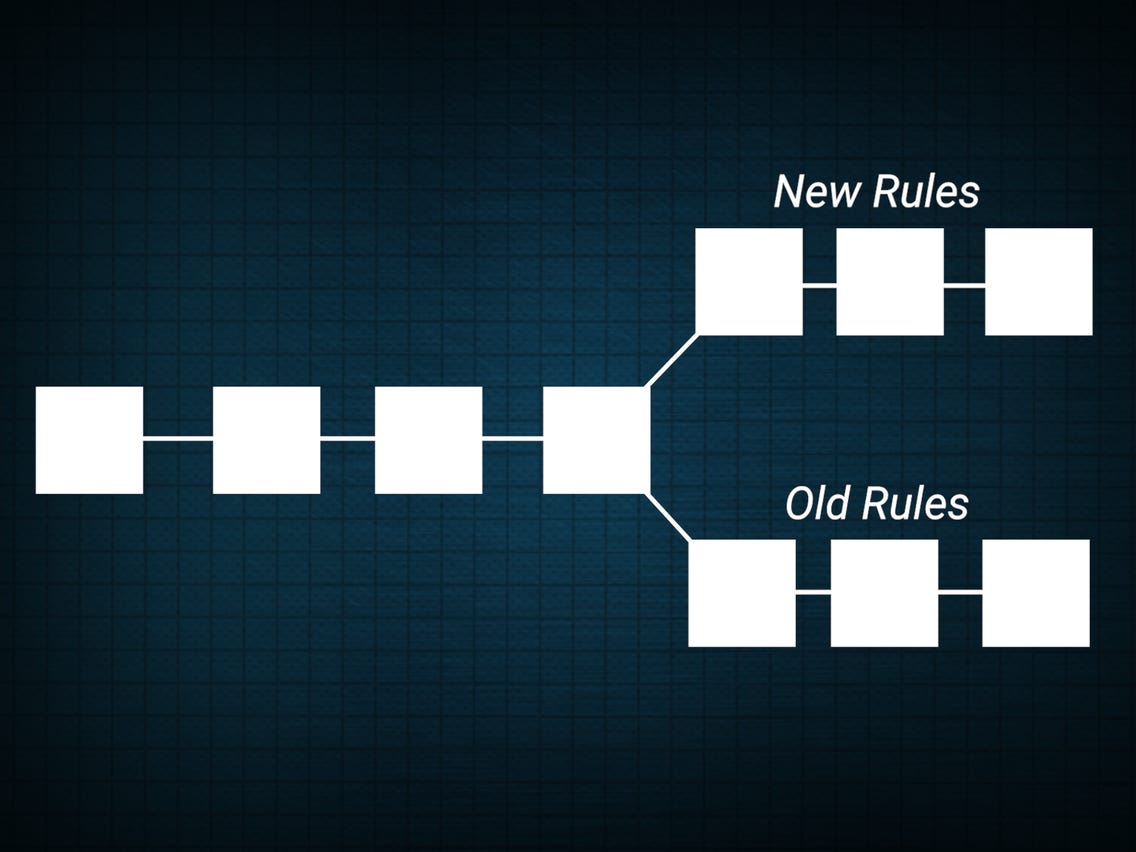

In 2017 and 2018, multiple types of Bitcoin appeared, claiming to improve on the initial protocol. One of the last assets in the “forking season” of Bitcoin was Bitcoin SV. The most prominent forks include Bitcoin Cash (BCH), Bitcoin Gold (BTG), and BSV. There are also minor ones like Bitcoin Red, Bitcoin White and Bitcoin Diamond, in addition to attempted scams like Bitcoiin.

BCH Recovers $1,500 Range

BCH, the currently most high-priced fork, expanded in the past day, adding 13% to its price to reach a high of $1,555. BCH is one of the most widely adopted assets, as it was automatically listed on most exchanges that also carried BTC.

BCH is still far from its highs above $3,600 in early 2018, when the asset climbed vertically. At one point, BCH attempted a “flippening” of BTC, but exchange freezes caused the trading to stop.

BCH expanded in Satoshi terms in the past month, doubling its value against BTC from 0.01 BTC to 0.022 BTC.

For now, BCH continues to attract new interest while forgetting some of its old crises about implementing network changes. Despite the criticism from the BTC community, BCH is having another season of expansion, similar to Ethereum Classic (ETC) which spiked on perceptions of being a cheaper version of ETH.

Bitcoin SV Gets a Boost

BSV is one of the BTC forks with the most aggressive social media presence. This coin split from BCH and even tried to steal its ticker before exchanges assigned it as BSV. BSV trades at $372.32, after multiple attempts to expand to a higher range.

BSV remains more unpredictable, and is not yet a top 20 coin by market capitalization. BSV boasts relatively lower fees, but this is in part due to its specific node mechanisms. Instead of relying on anonymous miners, the BSV network aims to process very large blocks, while creating a network of well-known miners with significant computing resources.

The BSV network resembles a more centralized type of blockchain, once again drawing criticism from the BTC community. Not the least, the BSV supporters are very invested in presenting Dr. Craig Wright as the real Satoshi Nakamoto, while still running a protracted lawsuit to prove that fact. So far, no overwhelming evidence has been presented that Dr. Wright has access to Satoshi Nakamoto’s private keys and was the author of Bitcoin in 2008.

Bitcoin Gold Attempts Recovery

BTG already did a 10X climb this year, expanding from $13 in January to levels above $130. This relatively cheap fork of BTC is also a potential competitor for new price discovery.

BTG, however, has suffered multiple attacks due to the relatively small network and low-power mining. BTG is still accessible to graphic card mining, and attempted to recreate the early days of BTC when creating new coins was accessible to consumer electronics.

BTG is available on most Asian exchanges, but for now EU-based and US-based brokerages are reluctant to offer the fork. Still, a presence on the Binance International exchange may boost the BTG trading pairs.

Bitcoin Diamond Posts Record Volumes

BCD, a relatively small fork of BTC, has a supply of 210M in total and is designed to be cheaper than BTC. BCS posted peak volumes on Binance, and expanded above $8.90 in the past few months, after trading below $1 in January.

This fork hardly gained prominence as it arrived relatively late and crashed by 99% just months after its trading launch. But the recent rapid gains and active trading may see risk-takers flock for another chance at price discovery.

Stack “SATS” or Real Sats?

The Bitcoin social media introduced the concept of “stacking sats”, or buying even small amounts of BTC regularly. For BTC, a dollar will buy about 1,800 Satoshi, with each BTC containing 100M Satoshi.

SATS, however, is a new ticker riding on this trend. For now, the price of SATS mimics that of BTC Satoshis, while promising expansion to $1 per SATS.

However, SATS have nothing to do with the real BTC. SATS only appeared about a month ago and have no real liquidity or exchange representation. Exchanging BTC for SATS is a highly risky move, possibly acquiring an asset with no mechanism of price discovery or exchange. Because SATS only trades in one pair, it is possible for the price to be manipulated.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A beginners guide to candlesticks, trend line, indicators and chart patterns

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.