How Terra (LUNA) is Becoming the Biggest Holder

Terra (LUNA) is already known for building an ambitious stash of Bitcoin (BTC), with a goal of spending $10B on the leading coin. This is in addition to the value locked within the Terra protocol, which roughly doubled in the past month. Terra is also purchasing BTC every few days, with its last tranche at $176M.

Terra now holds more than $28.9B in notional value, of which more than 52% is locked within Anchor Protocol. The chief reason for Terra to seek more reserves is the issuance of Terra USD (UST), backed by various assets.

The last move for Terra is to start buying up the assets of Avalanche (AVAX) and add them to its portfolio of collaterals. AVAX is valuable, as the project’s C-Chain is building up a vast system of blockchain apps. AVAX also keeps a robust market price around $100.

Do Kwon, founder of Terra, announced the plans for riding on the success of Avalanche.

The decision exposes Terra to some risk as well, as DeFi platforms become increasingly entangled in a circular economy.

Stablecoin Staking Taking Over the Crypto World

High-yield offers for USDT and other stablecoins are currently becoming more and more popular. Exchanges and various DeFi protocols offer rather high yields for staking USDT or other dollar-denominated assets.

The staking or deposit facilities come from exchanges like Binance or Gate.IO, but also from up and coming and much riskier protocols. Some projects even promise as much as 3,000% annualized, suggesting significant risk.

USDT and USDC remain one of the most actively staked tokens. More than 7B of the USDC supply is in various passive earnings mechanisms.

One of the tools for extracting value are decentralized pairs between two stablecoins, which can grant earnings through arbitrage. Stablecoins have the advantage of having only minimal slippage and fluctuations of $0.01, and are thus less risky for liquidity mining compared to other tokens.

The chief risk is that the high earnings may continue during a bull market, but lead to deep losses if the prices of major coins start to fall. Some of the newly created stablecoins, like USDN, are also immediately finding their way back into the ecosystem for staking with more than 7% annualized gains. USDN is Neutrino’s stablecoin, which despite the recent breakdown to $0.69 managed to close in on the $1 fixed rate. Staking is still small for USDN, but may catch up with more influential stablecoins.

Will LUNA Hold its Value

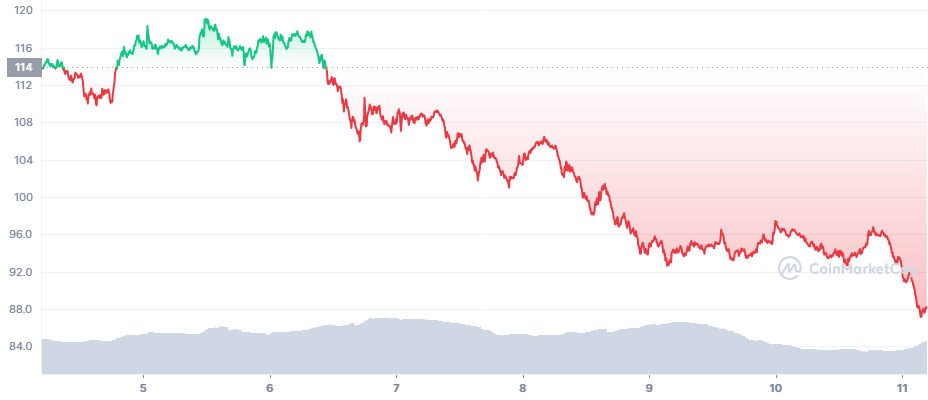

LUNA sank to $87.75 after a volatile weekend with a small recovery, and raised questions on holding up its value. However, LUNA is one of the assets where buyers are ready to hold for the long term and are less willing to sell. More than 41% of all LUNA, or around 312M tokens, are staked to produce blocks, with the remaining 354M in circulation.

LUNA expects to be supported by the growth of its project, but also by building a portfolio of collaterals. Additionally, LUNA is one of the most liquid assets. Recently, it added new liquidity pairs through Binance’s decentralized feature.

Terra Form Labs is also a dedicated holder. Each month, 3M LUNA get unlocked from Project Dawn, but the organization behind Terra has vouched not to sell the tokens or tank the price. Similar transactions of LUNA are expected on a regular basis, but are unlikely to affect the market price.

What is LUNA’s Trading Profile

LUNA has a relatively balanced trading profile, with some predominance for Binance. But the asset is also presented on OKEx, KuCoin and Huobi, grabbing a share from some of the biggest markets.

More than 67% of all LUNA activity is in pairs with USDT, with an additional share of BUSD close to 10% of volumes.

Will LUNA Survive a Bear Market

With Bitcoin (BTC) prepared to slide to lower support levels, LUNA may face another challenge. In the past, LUNA has managed to keep its positions or even rally higher while other assets fell.

In 2022, LUNA had more than 390K unique active addresses per month, showing significant growth of adoption. LUNA also exists on several networks, along with UST. Terra has partnered with ThorChain (RUNE), Near Protocol (NEAR) and the recent decision to buy $100M worth of AVAX is considered one of the most important developments.

The Avalanche project has also proven resistant to bear market pressures and has expanded with new DeFi value and games. AVAX has also remained relatively stable and has stabilized around $100 in the past weeks.

In three months, the supply of UST also expanded from 10B to 16B tokens , flowing into several ecosystems. LUNA and UST may be exposed to exploit risk in bridging between protocols.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.