Is Celsius Still in Danger After Terra Crash

Celsius (CEL) claimed to be safe from exposure to Terra (LUNA), withdrawing all funds from Anchor protocol just days before the crash. However, Celsius is still raising skepticism on projects that hold Bitcoin (BTC) and other assets on behalf of investors. Celsius expanded its DeFi loans portfolio from February 2022, while adding new digital assets to deposit for passive returns.

The immediate concern was raised by the fact that Celsius Network skipped its weekly report for May 13-19, while offering no reason. The report is a transparent overview of available balances and types of assets. Those figures could at least calm down any fears of insolvency. For now, Celsius has not set a date to release the new report.

The previous report also showed a disparity between inflow and outflows. The outflows were about three times higher than deposits, sparking some doubts about an attempt to exit Celsius.

The project itself gave no signs of relenting, and actually expanded its asset portfolio. Celsius added Maker DAO assets into its portfolio. New users will be able to stake MKR on Celsius Network to receive higher returns. There are still risks involved in this form of staking, as Celsius Network is a custodian of all deposited funds.

Users have also reported delayed withdrawals and blocked accounts. This adds to the concerns about Celsius, where the terms and conditions suggest all assets may be held in the case of bankruptcy with no resort for depositors. Not even the Mt. Gox exchange had a clause that let it keep the reserves, and most failed exchanges at least try to make a list of losses and seek redress. In this regard, holding funds on Celsius is much riskier.

Even if Celsius is healthy, the fears may continue to hurt the CEL market price. There is a potential scenario of a concerted attack, similar to the one against WAVES, which also tried to become a DeFi project.

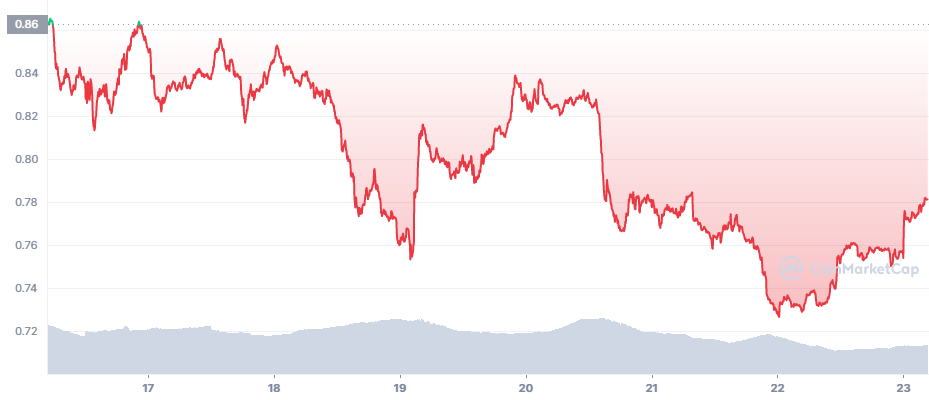

CEL had a volatile week, moving between a high of $0.98 and a low of $0.72. The token remained above $0.75 over the weekend and overall ended the week with a small gain. CEL trading volumes are also relatively low compared to more prominent DeFi hubs, at $2.36M in 24 hours.

Despite lacking a report, Celsius managed to perform its weekly token burn.

CEL did not initially intend to burn tokens, and it is uncertain if the removal of supply will help preserve market prices. CEL is moving far from its peak from the end of 2021, when the token reached above $8.

Will Terra Complete the Network Relaunch

While the markets started a tentative recovery, some ideas were thrown around to revive the Terra network. The new project was supposed to continue without the UST mechanism, hence removing the chief source of instability. In that case, Terra would become just another Layer 1 network on which to build distributed apps.

A new proposal is getting voted to decide on the relaunch of Terra 2.0 with a rebuilt ecosystem.

The Terra team also warned against malicious entities posting voting proposals. The low price of LUNA helps buyers set up proposals for voting, but with injected malicious links. Linking Terra wallets to new or unverified sites may be extremely risky.

LUNA remains extremely volatile, rising by 70% on speculative trading. LUNA is now at $0.000182, with unexpected peaks and drops. At this point, it is difficult to say if LUNA has any value, as the network snapshot may extend back before the days of the crash.

BTC Revisits Positions Above $30,000

BTC aimed to end the week with a small net gain, breaking a seven-week losing streak. Late on Sunday, BTC traded at $30.022.61, after briefly touching levels above $30,100.

Another week closed with a loss, extending the BTC streak to eight consecutive weeks of losses, an unprecedented price action in the coin’s history.

BTC is now in a range where accumulation can happen. However, some of the previously dormant wallets reawakened, moving some of the supply.

The expectation of falling to new yearly lows has not abandoned traders, and fear remains the predominant sentiment. BTC dominance also stepped back slightly to 44.6%, from nearly 45% of the total crypto market capitalization. There are also signs of big wallets cashing out, diminishing the number of big “whales”.

Ethereum (ETH) was once again above $2,000, remaining stable and so far keeping up the collateral for most DeFi projects. Total value locked (TVL) has fallen from above $70B to about $56B in notional value, also showing an exodus of ETH.

DeFi remains at risk for sudden losses due to collaterals flowing between projects and creating value that cannot be sustained easily in a bear market.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.