It is Make or Break for Bitcoin?

##

As they say – expect the unexpected is precisely holding true in the cryptocurrency market. Not once, but several times Bitcoin token and altcoins have played out different from anticipation.

For instance, as the crypto market was booming for the second time at the beginning of 2021, analysts turned towards the trend and predicted the BTC market to head all the way to $100,000 in the second quarter of the year. But with the updates showering from China, Tesla, and Elon Musk, the entire cryptocurrency market shed off its gains within a month or so.

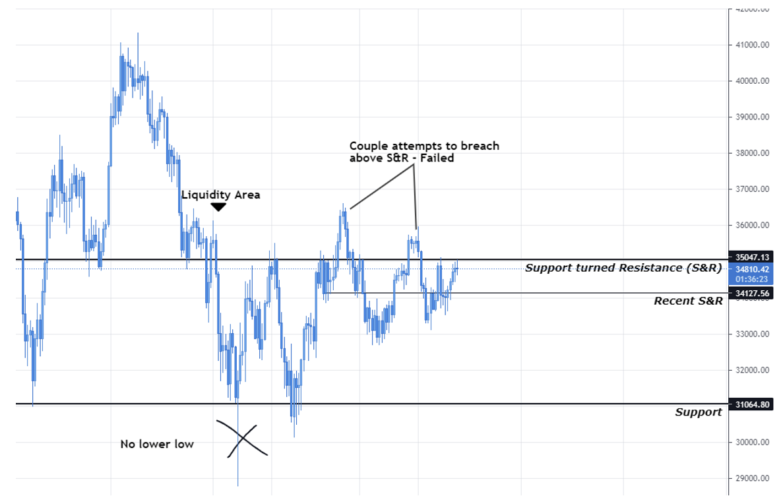

That being said, the prices are still maintaining at technical Support areas indicating that the buyers have not thrown off the towel yet. The consolidation has lasted for almost fifty days, and the price action is shrinking every step of the way.

Bitcoin, which was firmly holding as Support at $35,000 with multiple touches, turned into a Resistance in late June. As BTC and other top cryptos are holding at similar key breakout levels, they are on the verge of breaching in either of the directions.

Wyndham Hotels Brings Bitcoin into their Service

The world-famous Wyndham Hotels and Resorts, based in New Jersey, has brought Bitcoin into its ecosystem in the form of a loyalty program. Recently, the company entered a partnership deal with Bakkt – a well-reputed Intercontinental Exchange-based crypto startup. The Bitcoin reward program set up by the Hotel will run on the Bakkt platform.

What makes the program significant is that the reward program will have an outreach of 50,000 hotels and resorts.

The program is quite simple. Users will now be able to claim their earned loyalty rewards in the form of BTC coins by connecting their account with the Bakkt app. Also, the claimed rewards are flexible – as users can convert their Bitcoin rewards into cash, promotional gift cards, or points in their choice of loyalty currencies.

The loyalty program would not only give Wyndham users exposure to Bitcoin and an extended user base for Bakkt but also widely help in the mainstream adoption of Bitcoin.

Bitcoin ETF Approvals Delays Yet Again

In June, the Securities and Exchange Commission (SEC) delayed an acceptance application of Bitcoin ETF yet again. Like always, the US regulatory board swept the matter under the carpet by saying that it would require more public consultation before jumping to a conclusion on the same.

Including the recent application last month from Cboe Global Markets Inc., a total of 13 Bitcoin ETF applications are pending approval, according to a report from Market Insider.

A Bitcoin ETF that follows the price action of the Bitcoin (BTC) spot market, allowing investors to find exposure in the Bitcoin market without really having to buy the cryptocurrency, has left the regulators on double standards.

The SEC commissioner, Hester Peirce, also in slight favour of Bitcoin ETFs, commented that her regulatory matter was outdated – and said that the ETFs must have been approved long ago.

Moreover, speaking on the concerns in the Bitcoin spot market, SEC chair Gary Gensler expressed vulnerability in terms of frauds, volatility and manipulations. And comparing with the traditional markets, he recently told CNBC that the crypto spot market does not offer the same or adequate investor protection as the stocks or derivative markets do.

“Investors should be aware, I’m saying this in my own voice, that the underlying Bitcoin cash markets, there’s not the robust oversight that you have in the stock markets or in the derivatives markets…”

Bitcoin Price Action is Finally Interesting!

As mentioned previously, it has moved from consolidation to a much deeper consolidation. However, enough time has passed that few technical levels are failing to react anymore – which brings opportunities to us investors to grabs the breakouts.

The market found support at $35,000 for a solid 30 days and finally broke through the south on 24 June. The pressure from the sellers, however, was not sufficient to breach through the Support at $31,000 – indicating the presence of bulls in a consolidating sellers’ market.

Thus, with the existence of both buyers and sellers in the BTC crypto market, the price action ended up in another range between $35,000 and $31,000.

Two attempts made by the buyers to break and hold above the S&R was neatly taken down by the sellers at their liquidity area – as shown.

That being said, the market began to leave higher lows, fighting the S&R twice already.

Given the current price action, either of the couple scenarios can play out very soon –

- If the price crosses below the recent S&R strongly, the sellers could possibly drive the price back to the Support levels or even lower

- If the buyers continue to leave higher lows and successfully breach the S&R, we could expect the market to trade around $38,000 in the near term.

While the market is preparing for a breakout, get your favourite crypto from our list of reputed and certified cryptocurrency exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.