Market Stress Continue with DEI Stablecoin Failure

The latest market downturn stressed multiple stablecoins, with minor ones not returning to their peg. The latest casualty was DEI, the dollar-denominated asset of Deus Finance. For more than two days, DEI hovered under $0.60, so far unsuccessfully attempting to return its peg.

The Deus Finance project attempted to issue a form of bonds to raise assets and support DEI. However, the proposal has not managed to affect the markets yet.

DEUS, the native token of the protocol, is down from above $650 a month ago, to a rapidly declining price position just above $200. DEUS may not be sufficient to support DEI, especially after moving down from its peak above $1,000 in April.

DEI has not affected the market much, despite the 4.3B market cap. The reason is that DEI was mostly part of decentralized exchanges and protocols, and had not spread to major exchanges.

Other recently de-pegged stablecoins include NUSD supported by WAVES, Terra’s UST, and the coin of FEI protocol. So far, only UST has completely failed to recover and DEI is still at an uncertain position.

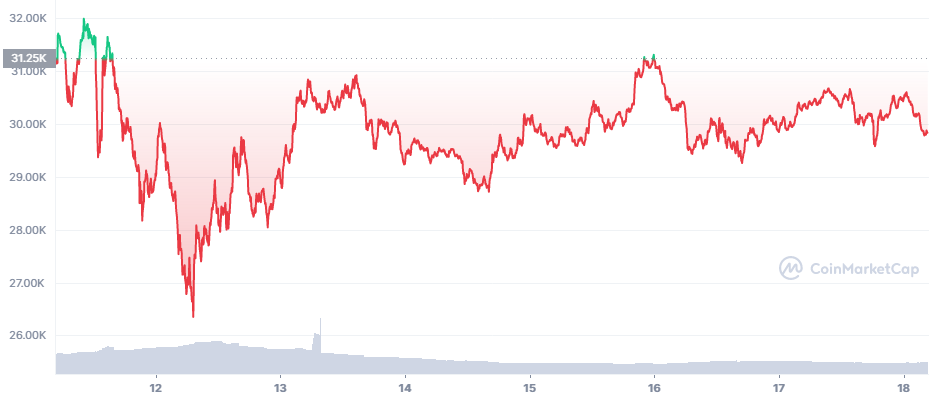

BTC Attempted $30K as Support

Bitcoin (BTC) started to take steps above $30,000, reaching $30,553.85 on Tuesday. BTC later sank again, trading at $29,844.63, again returning to an uncertain week.

Ethereum (ETH) returned above $2,000 with ease, reclaiming the $2,100 range. Several assets tied to the Terra ecosystem are recovering. Solana (SOL) returns close to $60. Avalanche (AVAX) is more affected, still clinging to the $35 level.

Altcoins remain more volatile and some tokens with social media support recover even faster. Among the earners was Apecoin (APE) to $9.01 after adding 11.9%, as well as STEPN (GMT) up 11% to $1.60.

Will BTC Meet Macro Factors

BTC came down from its peak last November in what looked like price moves complying with the general logic of crypto markets. BTC was expected to continue rallying in 2022, possibly to a new all-time high.

But BTC will have to face a new reality of potentially diminished liquidity and less appetite for risk. Despite talk of inflation insurance, in the short term deep 85% losses for BTC are much riskier, thus removing some of the retail buying.

Additionally, BTC actually needs inflation to keep boosting the price, in addition to easy liquidity supply. But the predicted interest rate hikes from the Fed may signal a lowered potential for the growth of risky assets.

Even the lowered amount of BTC on exchanges may not be enough to keep up a new price peak. BTC can also move sharply with a very small supply, thus invalidating the models predicting a constant price climb. BTC may be looking at a liquidity crunch to decrease the available funds and appetite for risk in the coming years.

In the short term, however, BTC has a challenge to overcome the extreme fear of traders. The Crypto Fear and Greed index fell to 8 points, a level comparable to the crash of March 2020. Only a day ago, the index was at 14 points. But this time, there is added uncertainty whether the current lows are a good buying position, or if BTC will take up a different scenario.

DeFi Stress Puts Pressure on Altcoin Season

After the crash of Terra LFG and the disappearance of LUNA, altcoins also took a step back. Funds flowed back to BTC and even with prices just around $30K, BTC still had a 44.3% market cap dominance. At the same time, ETH dominance remained constant at 19.3%. The market share of smaller altcoins plunged from its usual levels around 20% down to 16% as demand for riskier assets disappeared.

With Terra LFG, there is even more awareness of the risk of some DeFi protocols, with the potential for panic runs and the breaking down of leverage.

ETH prices holding above $2,000 help the DeFi sector stay liquid, in addition to better algorithmic protections to avoid liquidations. But a bigger market correction may affect more of the collaterals for protocols like Maker, as well as all ecosystems using wrapped ETH (WETH). The delay of ETH 2.0 is also testing the patience of all that deposited funds in the smart contract and now have to wait until launch to make use of their coins.

ETH is also weighed down by a demanding NFT economy, with big-scale projects like Bored Ape Yacht Club also tied to the value of APE tokens. Blockchain gaming is also getting tested during the bear market, with most games now having much-diminished earnings. Projects are giving signs of returning to “bear market mode”, with building for the coming years with the goal of creating true Web 3 projects.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.