Markets Are Dropping, But Who is Showing The Hardest Bounce?

##

It has indeed been rough months for cryptos since the downtrend took over in May. Despite the consolidation in June for three weeks, the buyers failed to keep up with the strength carried by the sellers. As a result, they plunged yet again – for the second time. However, not all cryptos faced a massive dip like the previous push.

All cryptocurrencies are witnessing red candles in the past four days, until today where there is sharp bounce incoming. For instance, yesterday, both Bitcoin crypto and Ethereum fell 8-10% in price but ended up closing slightly in the positive by the end of the trading day. While few other altcoins experienced a similar price action and bounced off, some cryptos made new recent lows with no major pullback.

Analyzing the markets technically, it is not the percentage drop/rise that matters. Rather, it is the levels at which the price is trading that holds much value.

Though Bitcoin and Ethereum token faced a relatively shallow drawdown and a decent recovery, it cannot be concluded that the buyers are the strongest there. There are examples where some cryptos faced a deeper push south and are now holding at better levels.

Solana Maintains Grounds – Reasons Listed

Tuesday’s crypto plunge brought the Solana (SOL) crypto to significantly low levels. However, the price managed to climb higher and maintain grounds above technical points – proving that the ball is still in their court.

Looking at the price action in the much earlier stages as well, the impact of China banning crypto mining seems to be minuscule. While many cryptos are quite far away from their all-time highs, SOL cryptocurrency was trading much closer to it.

Following are some reasons that could have led to keep the buyers’ interest in Solana intact.

Solana Indirectly Adds a Data Provider to its Network

Coinciding with the market plummeting yesterday, Solana-based Pyth, a decentralized financial market data distribution network, has joined hands with an institutional exchange operator named LMAX Digital, as its data provider.

To elaborate, Pyth works on the Solana proof-of-stake, public base-layer protocol optimized for scalability. What makes Solana unique is that it allows developers to create decentralized applications (Dapps) without having to exclusively work on the scalability design.

In the recent partnership with LMAX, the Solana-based Pyth will now receive foreign exchange data and crypto trading data on its blockchain. Additionally, the oracle network would then feed the institutional data to DeFi projects.

Solana with its Strategical Inflow

In this trend of Initial Coin Offerings (ICOs), Solana has raised up to $26 million in token sales to date.

Last weekly, the protocol itself led a round of funding for PARISIQ, a blockchain monitoring platform, and raised $3M. When asked about the investment, to the founder of Solana, Anatoly Yakovenko, said that having PARISIQ in their ecosystem would give them “fewer headaches” in building their stack.

Furthermore, Solana is expected to raise another $450 million in the development of an Ethereum killer. But there is no official statement from Solana’s side as of yet.

The updates popping up as China reiterated on crypto kept the price relatively stable. Surprisingly, SOL crypto held at better (higher) levels than BTC or ETH did.

Besides, Solana, attending its ecosystem as well, recently allocated over $20M to support projects that fall in its network, including assistance from MATH Global. The firm also deployed $60 million in blockchain-enabled projects in countries including India, Brazil, Russia, and Ukraine.

SOL Chart at Critical Price Area

The price action of Solana is rather interesting than other replicative cryptos, with the sellers trying to push the market down as much as the buyers trying to rise it higher.

In the recent past, the last bull came in mid-April where the price shot up over 100% from $24 to $48. Thereafter, there hasn’t been any real higher high as such.

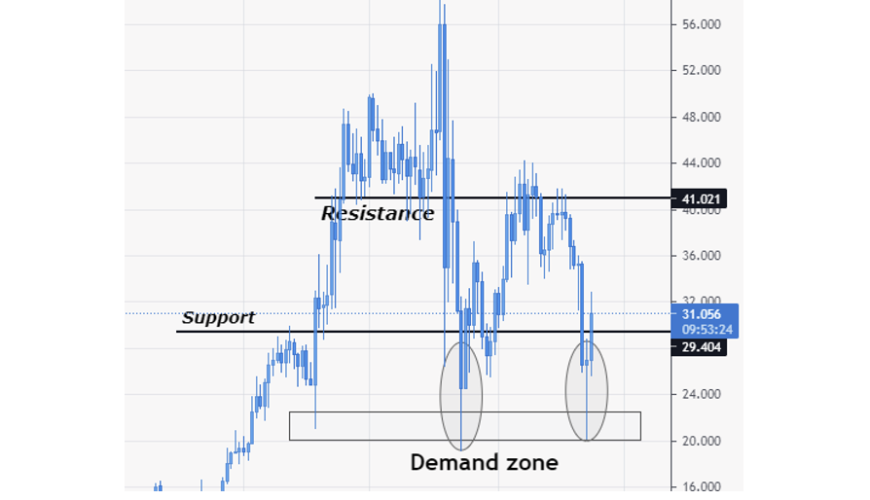

The uncertainty in cryptos brought the market to the psychological Support $31, and the buyers did react from it quite strongly indeed. But, at the same time, the sellers showed activeness at the Resistance at $41. As a result, the market entered a ranging state as ascertained.

Shedding light on yesterday’s move, the market bears attempted strongly to breach below the Support. However, the demand zone at around $20 brought the price right back up, as represented by the tail at the candle’s bottom.

Currently, the price holding above the Support is an indication of the presence of buyers in the SOL market. But, with the candle is still in action, it is false to conclude that the bulls are alive and strong.

As the buyers are starting to show interest in Solana, you definitely do not want to miss the opportunity to ride with them. So, grab them cryptos from our list of reputed cryptocurrency exchanges right now! Happy investing!

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.