Telcoin (TEL) Pushes for Top 50 Market Cap Spot

#

Telcoin (TEL) is a digital asset that recently saw dramatic price action, getting closer to the top 50 coins in terms of market capitalization. The project aims to grab a market share based on the ubiquitous presence of telecoms, by becoming the coin for mobile-based payments.

Telcoin is an outlier since it was first created as a company with crypto features, instead of a purely crypto-based startup. It relies heavily on complete KYC and regulatory compliance and has no goals in terms of confidentiality. Instead of an ICO, the funding for Telcoin came through a seed and venture round by an investment partner.

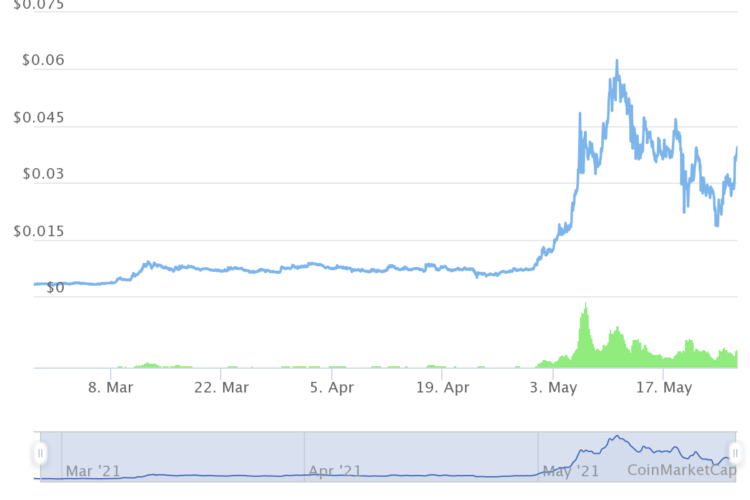

TEL reached an all-time peak at $0.05 before the market crash in May, and has now recovered to $0.03, gaining more than 23% overnight. TEL volumes just picked up in 2021, after years of sideways movement at just a fraction of a penny.

The success of TEL hinges on both its KuCoin listing that taps the Korean market, and on the recent rise of decentralized algorithmic trading on platforms like Balancer. TEL is currently in a price discovery stage, with a total supply of 100B coins but only 51,888 coins for trading and speculation.

Telcoin Team Pushes US Crypto Legislation

The Telcoin team expects to see the approval of Legislative Bill 649 in the state of Nebraska. The bill will open a banking charter for crypto-based and DeFi companies. Thus, Telcoin solves one of the issues of the crypto space, access to reliable banking partners for a bridge between digital assets and fiat for buying and selling.

The bill will not only benefit Telcoin, but turn Nebraska into a crypto-friendly hub for fully transparent projects seeking wider adoption.

What is Telcoin’s Utility?

Telcoin aims to combine the remittances market with the demand for mobile-based wallets. While the market is already served by multiple fintech platforms, and telecoms have launched wallets, crypto projects have always attempted to take a piece of the market.

TEL thus has competition in the face of assets like Ripple’s XRP, as well as NANO and the in-app payment token, KIN. In Europe, the Gulden payment app is also showing some adoption. TEL arrives at a time when Bitcoin (BTC) is put under scrutiny for its heavy electricity usage, raising demand for lower transaction costs.

Telcon is a layer 3 solution on the Ethereum (ETH) network, using the mainnet only minimally and performing most of its computations outside the main blockchain, with no gas fees.

TEL Serves Remittances Market

Telcoin goes a step further to remove complexity. Its V3 mobile app aims to combine crypto swaps, storage and remittances in one wallet. Unlike other assets, there is no need for bridging from the MetaMask wallet, or taking additional steps to use crypto.

Telcoin thus solves one of the chief issues of adoption, a one-stop wallet for all functions. Using Telcoin, however, will not be anonymous. The wallet itself will require a verification, thus becoming immediately compliant with international financial regulations. While TEL loses on anonymity, it gains in the potential for hassle-free adoption and regulatory surprises down the road.

Telcoin also focuses on the Philippines market, receiving a Virtual Currency License in the country. TEL can be used as a payment gateway for remittances from Canada, one of the biggest sources of transactions for the country. Telcoin also partners with the widely used GCash fintech app for wider credibility and adoption.

Is TEL a Good Investment?

TEL is currently a new and highly active arrival on the crypto market, finally making a splash. It is possible the asset will make significant gains in the short term. However, TEL remains risky and volatile.

TEL also faces investment limitations due to its current trading profile. Balancer, its most easily accessible borderless exchange, is exposed to the risks of decentralized finance. KuCoin places limitations on investors outside South Korea. Uniswap is one of the project’s partners, but the algorithmic pairing may be volatile in the short term.

The biggest boost to TEL trading may be a Binance International exchange listing. TEL may expect wider adoption on exchanges, to compete with more established digital assets. The Telcoin project has existed since 2017, and so far avoided the high publicity of most crypto startups. At this point, the project has shown it puts adoption and use cases before attempts to pump the market price, with the potential to line up among large cap cryptos once trading expands more.

Telcoin to Start Marketing Push

The outlook for TEL may hinge on its expanding popularity. The project will boost its marketing starting June 1, with the potential for higher trading activity and valuations. The V3 wallet is also coming soon with the potential to expand both adoption and visibility.

Predictions for TEL envision price levels as high as $0.70.

As altcoins recover, TEL may attract attention in the short term. But it must be remembered that TEL is to be used as an asset for remittances, thus potentially having a high circulating supply and significant selling pressure as it is converted to fiat. In the future, Telcoin may add a stablecoin feature to do away with unpredictable exchange rates.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.