The Graph (GRT): Is the Rally Sustainable

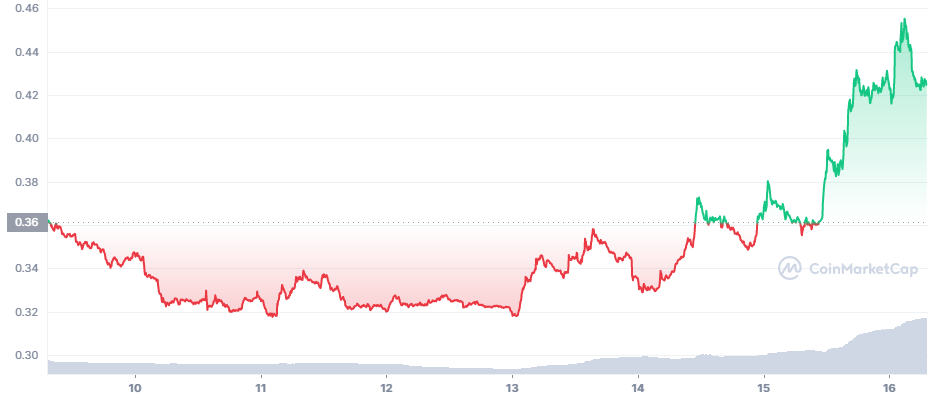

The Graph (GRT) was the next altcoin to stage a short-term rally with steep appreciation. GRT is trying to recover previously lost levels, bouncing off the $0.30 range lows. Late on Tuesday, GRT rose to $0.42, with a significant acceleration in the past three days. GRT is still down more than 85% from its all-time high.

The GRT rally arrived while Bitcoin (BTC) continued to recover above $39,000 and helped all other coins and tokens inch up in the green.

GRT is the asset of The Graph, a project aiming to unify the search and display of blockchain data. For this reason, The Graph is called “the Google of blockchains”. The queries and indexing are also recorded on a decentralized protocol, while GRT is used as a utility token to cover network fees.

The price peak for GRT was reached shortly after the asset started trading, and rallied to above $2.40. But in the past 12 months, GRT has mostly unraveled, to lows under $0.30. GRT is a relatively new project and may yet recover previous highs.

Is the Current GRT Rally Sustainable

The relatively small rally for GRT happened at a moment when most other assets remained stagnant. The recent rally invited caution, as it may not be sustainable.

On a more optimistic note, GRT above $0.43 was seen as an attempt for a more extended rally, with no cap on short-term gains.

Is GRT Accessible

The Graph was one of the projects to gain immediate listings across major exchanges. GRT is thus available on Binance International, but also Coinbase, with no restrictions for US-based traders. GRT achieved wide acceptance similar to that of the Internet Computer (ICP).

The GRT market has relatively high liquidity, though the price may move by 2% for each $500K in trading volume.

GRT is also carried by the Exodus multi-asset wallet, and exists as a token in various forms, on Ethereum, Solana, Avalanche and on its native blockchain. The Graph is a complex system of subgraph networks belonging to various other blockchain startups, as well as a decentralized network consisting of Indexers, Curators and Delegators.

GRT is thus accessible for investment as a token with the potential for a breakout.

GRT Rises on Social Media Hype

The rise of GRT prices caused a feedback loop and a drive to try another token for its potential to repeat its previous highs.

GRT started moving after a series of altcoins and tokens broke out. The likes of Waves (WAVES) and ThorChain (RUNE) showed there is high demand for risky tokens that may appreciate. GRT is also potentially moving forward as a more widely used protocol, going through its usual growth stages.

What’s New for The Graph Project

The Graph project itself has big plans for updates in 2022. After a year of adding partners, The Graph pre-announced an event expected in June – Graph Day.

Graph Day will be a three-day hackathon event focused on the Graph network capabilities. This project will extend its reach into the nascent Web3 space, NFTs, blockchain gaming and crypto collectibles. The Graph protocol aims to build a true, more decentralized Web3 technology,

The Graph continues the trend of blockchain-centered conferences after a two-year break. The Graph Day will arrive a few weeks after the Avalanche event in Barcelona.

What is the Trading Profile of GRT

GRT is a token that may fall under heavy selling pressure. Currently, 81% of GRT owners are out of the money and the overwhelming attitude is bearish. However, GRT has not reached significant price appreciation and may revisit its range above $2, especially given the highly active social media presence.

Smaller altcoins now collectively make up about 20% of the entire crypto market, with some assets moving more actively. GRT has a market cap just under $2B, with plenty of space to grow and line up with higher-ranking projects. GRT is now ahead of EOS, a former top 10 asset.

GRT is closing in on the valuation of RUNE at $2.5B in total, displacing other tokens that have lost some of their appeal. The biggest growth driver may be the attempt of The Graph to take the Web3 app idea and gain new partners and startups. With gaming and decentralized content heating up, The Graph is positioned well to gain from the hottest topics for 2022.

More than 61% of all GRT activity is in its trading pairs with USDT, and relies on its representation on Binance. This allows for the GRT/USDT pair to go through concentrated pumps targeting that top pairing.

GRT is a relatively scarce token, with around 4.2B tokens in circulation out of a total supply of 10B. The token has strong incentives for staking and long-term holding.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

A beginners guide to candlesticks, trend line, indicators and chart patterns

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.