These Factors May Renew the Bitcoin (BTC) Price Rally

##

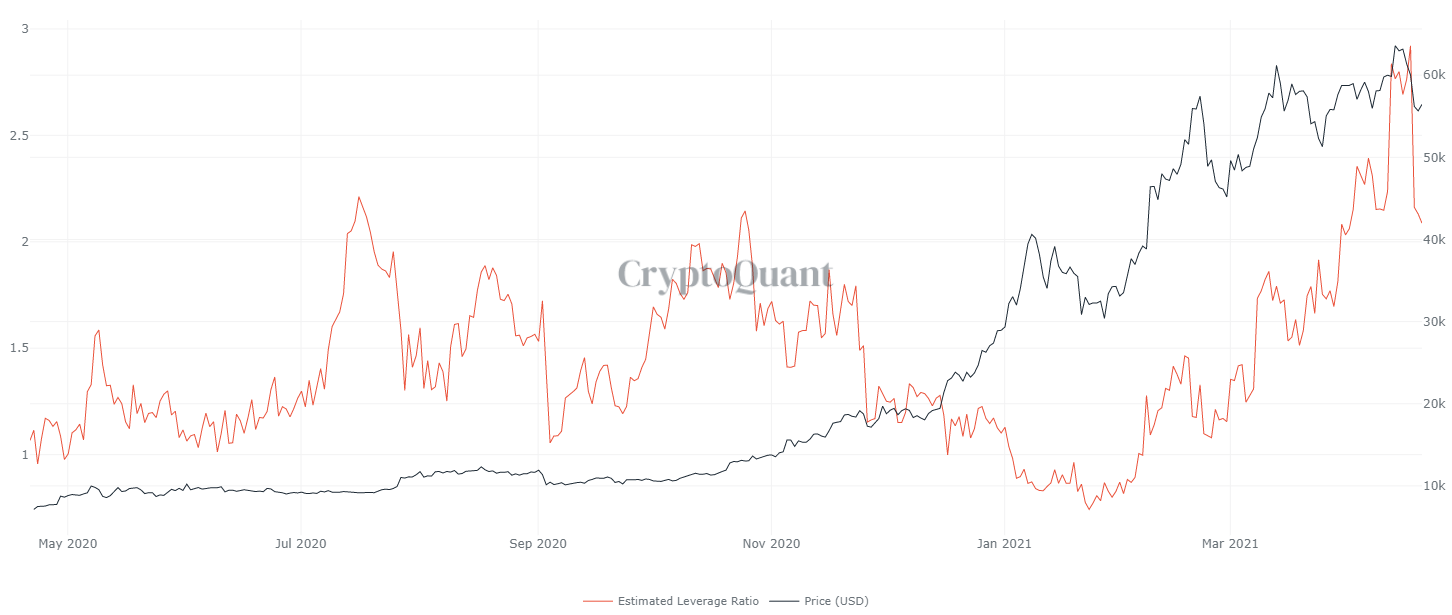

Bitcoin (BTC) retreated further to a price range under $56,000, once again shifting both the bullish and bearish predictions. For now, the retrace is not unusual and repeats past patterns. Social media consensus views last weekend’s price drop as a sign of overly-leveraged positions that caused mass liquidations.

BTC traded at $55,618 on Monday, with trading volumes shrinking to $64B in 24 hours. The BTC market cap dominance is now just above 51% of the entire market, giving weight to both old and new altcoins. One possible scenario is for BTC to stagnate, while the altcoin season continues with renewed force.

The behavior of BTC may rely on additional factors to choose its next direction.

Venmo Adds Cryptocurrency Payment Options

One possible bullish factor for crypto adoption is the Venmo app, which has added cryptocurrency for micropayments as low as $1. The payment app, popular with social media users and especially Millennials, will use another mechanism of sending funds, and will not serve as an off-ramp to withdraw the assets.

Venmo, which follows in the steps of its parent company PayPal, has added only large-cap cryptocurrencies to its mix.

With this move, Venmo joins Circle app, as well as Abra in offering a new payment pathway for digital assets. However, most of the transactions will be off-chain, and not rely on the same immutability and security as on-chain BTC transactions. Crypto enthusiasts warn buying those assets is not the same as acquiring them on the spot markets, then moving them to a secure wallet where the user controls the private key.

Venmo has not disclosed its purchases of BTC or other assets for cold storage. But the move remains reassuring as another sign of wider retail crypto adoption.

Additionally, WeWork, the SoftBank backed company for shared office space, has announced it will accept BTC from partners, and keep the assets on its balance sheet.

BTC Sentiment Almost Unchanged

Despite the BTC liquidations of record long positions last Sunday, trading behavior once again indicates a mood of “greed” based on the Crypto Fear and Greed Index.

The Bitcoin volatility index changed to 3.51%, but remains well below the fluctuations in 2020. The past few days lifted the overall volatility score, which had fallen to 2.62% on average, near an all-time low.

BTC market prices also reveal a disparity between markets. There is a premium of a few hundred dollars when buying from the Coinbase or Coinbase Pro markets. The Kraken exchange BTC/EUR pair also trades at above $55,800.

The BTC/KRW premium on Upbit remains high, as the asset trades above $62,000. The price disparity shows Tether (USDT) based markets, and especially futures, may drive short-term volatility, but other markets show strong demand and expectations of higher valuations.

Summer Peak Still Expected

BTC market prices may revisit lower positions, but with predictions of another upward move. For now, the range of BTC raises predictions for a dip below $52,000, or a direct recovery to above $57,000.

The current price moves happen on relatively subdued trading volumes. The issuance of new USDT has slowed down, and the current stablecoins in circulation have slowed their turnover. In the past, BTC has stagnated around a price, performing months-long sideways moves before a more dramatic shift in sentiment.

But the longer BTC remains above $50,000, the more traders express belief this was not the market top and upward moves are still to be expected.

BTC Euphoria Still Ahead

At the price range, full euphoria is still not present for BTC. Spot buying and taking coins off exchanges continues, and right now, the asset seeks direction and is still within the range of hopefulness.

The expectations of a hike to $70,000 are intact, with a summer price hike to $80,000 and possibly a market top toward the end of 2021. In the short term, however, the BTC price will remain volatile and possibly be swayed by over-leveraged positions.

Models Envision Different Market Tops

The BTC price rainbow model allows for a price hike to a top of $100,000 before the next retreat or bear market. This model relies on the idea that sentiment drives price action.

The S2F model is more optimistic, allowing a market top between $100,000 and as high as $600,000. The S2F model takes into account the increasing scarcity of BTC, which is right now accelerating.

The next BTC halving of the reward will happen at the start of 2024, when only 450 BTC will be produced each day. But even in 2021, more BTC is taken into cold storage and not re-sold in expectation of further adoption and influence.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.