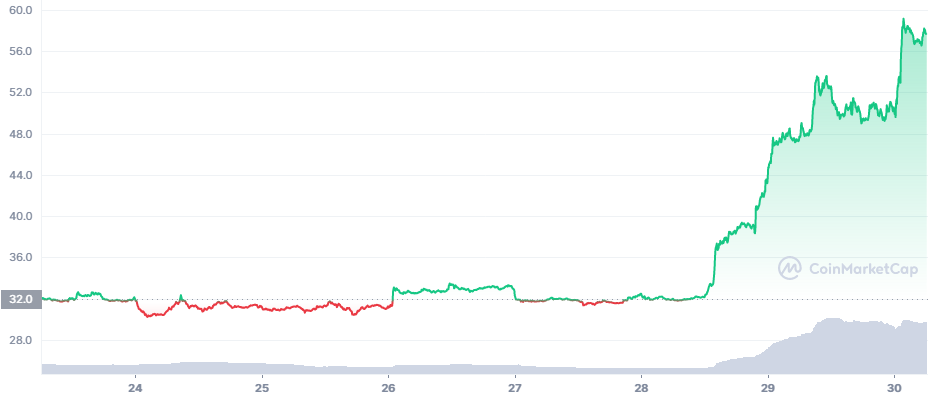

Waves (WAVES) Extends Rally to All-Time Peak Near $60

Waves (WAVES) broke a series of records and broke above $50 for the first time on Tuesday. WAVES has been one of the lagging altcoins that is making its way into becoming a leading DeFi asset.

WAVES traded at $58.18 a day later, rising by another 22% in a day. The trading pairs for this token also broke the all-time volume record, with $4.4B equivalent changing hands in the past day. This time, WAVES outperformed other assets as the Bitcoin (BTC) rally stopped and only outliers continued to gain.

WAVES Rally Awaited for Years

For the Waves protocol community, a price hike to this range is not only logical but long overdue. WAVES was a promising protocol that remained in the sidelines, now hoping to regain adoption and line up with the likes of Terra (LUNA), Solana (SOL) and Avalanche (AVAX).

WAVES started its rally from under $20, and had awaited this kind of price move for years. The rally was caused by a mix of factors, including the overall bullish moves of the entire crypto market.

In the past few weeks, WAVES continued to build up value in it DeFi protocols. Waves now holds more than $4.3B based on DeFi Llama data, and close to $5B according to other counters.

The chief protocol that uses WAVES as collateral is Neutrino, locking in more than 68% of all value. But the WAVES platform hosts a total of five decentralized projects with more prominence, which also grow by leaps in the past weeks.

TVL is a notional measure, and the actual dollar valuation hinges on the market price of WAVES.

How High Can WAVES Go

At these prices, WAVES is not even in the top 30 of coins, but may soon join that list. The protocol has a market capitalization of just under $5.5B, with much potential growth. Given the low trading volumes and pickup in activity, this rally may establish a higher price range and a more liquid market for the token.

While WAVES has seen extreme price predictions, the current rally is also somewhat puzzling. For skeptics, it may be an anomaly, and it was quite unexpected. One of the reasons for the rapid spike in price action may be the fact that traders are attempting to short WAVES.

Causing a short squeeze has led to liquidations and a short squeeze. The expectation for WAVES to drop rapidly caused continued bets while the actual price rallied.

In the short terms, WAVES is expected to move back to around $45 before deciding on a new price direction. WAVES is expected to top out at around $52.

The asset is now up 400% in a month, becoming one of the big gainers in what looks like the beginnings of an altcoin season.

WAVES remains risky, and the current rally may be cut short, with an expectation of resuming a downtrend.

Is WAVES a Stagnant Project

The most skeptical view of WAVES is that it is actually a dead project and this is exit liquidity. However, the growing inflows of locked tokens in the Neutrino protocol and talk of an algorithmic stablecoin may provide real value.

There is also real buying from the Neutrino protocol, which cannot be explained by an exit pump. The demand for WAVES-USDN swaps will continue to cause scarcity and boost prices. Additionally, Neutrino protocol shows value inflows happen within days.

The WAVES rally was caused by the high liquidity on Binance trading pairs. The asset actually traded at a premium above $51 in the WAVES/BUSD pair on Binance. The pairs allow for significant liquidity, though not enough to forestall a correction.

When is Waves 2.0 Coming

Another boost for WAVES may come from the expectations set on Waves 2.0. The protocol does not plan a single launch event, but has planned a series of upgrades until the end of the year.

Waves 1.0 was an alternative to Ethereum and worked as some of the basic proof of stake networks. As such, the protocol saw slow activity and was forgotten for years despite the hype in 2017 and 2018.

Now, Waves 2.0 will be compatible with the Ethereum Virtual Machine (EVM) and will introduce DAO-like governance. The project will also have a corporate side, with a newly established US-based entity and an accelerator program.

Waves will also try to become a hub for metaverse projects and other side startups. At this point, it is uncertain how far Waves will be able to compete with other more developed DeFi and NFT hubs. But a rapidly appreciating token with a potential upside may attract renewed attention to the Waves ecosystem and the growth of value.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Learn how to keep your crypto secure and the different types of wallets you can use.

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.