What Caused the Bitcoin (BTC) Weekend Crash?

#

The rapid, unexpected price move last Sunday looked frightening, as it happened near peak Bitcoin (BTC) prices. The event sent waves through the trading ecosystem, exposing some of the vulnerabilities. BTC crashed as low as $40,000 on some markets, while preserving a significant premium on the Coinbase spot market.

There is no one reason for the crash, which happened during times of low activity and lower trading volumes. But there are indicators that the market is still easily swayed.

Bitcoin Money Laundering Allegations

Early on Sunday, the price of BTC tanked by thousands of dollars, from its levels above $60,000. The price crashed in less than an hour, after a cryptic tweet suggested the US Treasury would investigate financial institutions for money laundering through BTC.

The very limited information has not been elaborated further, but it looks like the triggering event for Sunday’s price drop.

Turkey Banning BTC Payments

Turkey, a country plagued by a dropping currency exchange rate, is one of the hotspots for cryptocurrency usage. Unfortunately, the government does not approve of this workaround for inflation and insecurity, issuing a new bill to ban crypto usage, payments and exchanges.

It is uncertain how this ban will be enforced, as it is generally difficult to censor Bitcoin nodes. Turkish hosts run a total of 18 Bitcoin nodes, and can still handle pseudonymous transactions.

The ban will take hold from April 30. The Turkish crypto community is so large that Binance International built a Binance.tr exchange to host the demand in the country, complete with a fiat on-ramp. The Turkish community has noted that crypto trading may continue, though with more stringent taxation.

Did Mining Cause the Price Crash?

In the past few days, a power outage in the Xinjiang province in China also affected one of the large mining operations in the area. This mining anomaly effectively removed an estimated 40% of the network’s hashrate, adding to the market panic.

One of the reasons for the dramatic charts, however, is that Bitcoin hashrate is not reported on a unified standard. So while the actual drop is reflected in the chart, the Bitcoin network has not suffered any double-spending.

Some transaction lag was noted, as pending coins were left in the mempool, but the congestion started to clear in the past days.

Even with the disruption, Bitcoin block production preserves its usual patterns, where the four leading pools produce just a bit more than 50% of all blocks. F2Pool is still in the lead, producing on average more than 24% of blocks. Block production still depends partially on luck, as some pools manage to grab more blocks in a given 24-hour period.

May is also a traditionally strong period for Bitcoin mining in China. Barring unusual weather or flooding, the increase in hydropower electricity may boost the hashrate and offset the operations powered by coal power plants.

Was it All a Trading Glitch?

One of the explanations for the BTC crash is that the market was once again over-leveraged. The most dramatic events in terms of price action happened on the Binance Futures exchange. Even a small price move may trigger a cascade of events, through bots or even smart contracts, which deeply affect both BTC prices and the entire Ethereum ecosystem of DeFi projects.

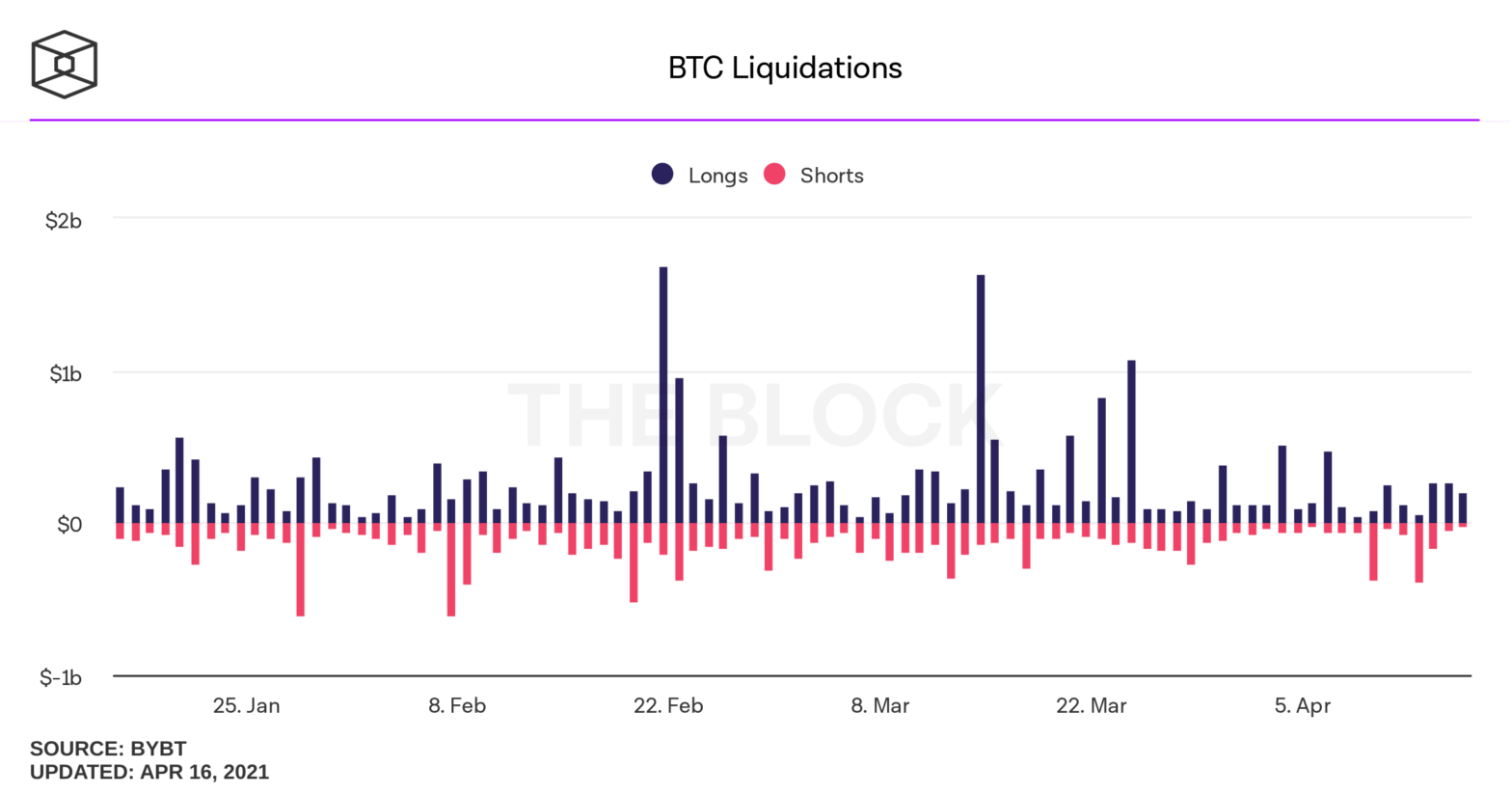

The rapid price moves of BTC have been caused by over-leveraged positions. In the past few weeks, liquidations for BTC slowed down, at least until Sunday’s trading event.

Since then, the BTC market price recovered to about $57,000, with altcoins regaining their positions.

Market Soon Returned to Exuberance

One of the side effects of the crash was the anomaly in the Tether (USDT) market price. At one point, rising demand for the asset lifted the prices to $1.02. Later, the price fell to $0.99, effectively further sinking the BTC fiat market price. USDT, with more than 45B tokens in circulation, is often used to take fiat-like positions during periods of price volatility.

The BTC market price started a recovery on Monday, rising to above $57,500 on volumes above $72B. The market price still fluctuated by hundreds of dollars as the market returned to normal. The Bitcoin Fear and Greed index remains at 74 points, fully in “Greed” territory, with little change from the past few weeks.

The market remains highly irrational overall, with the rise of Dogecoin (DOGE) continuing in a deliberate drive to push prices up. DOGE dipped to $0.23 before rising again on Monday to $0.36, remaining one of the few altcoins with strong gains. Still, DOGE trading is a small market with the potential for even wilder fluctuations, and may be a short-term deliberate move by Binance traders.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A review of the many options for crypto exchanges and what the main differences are

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.