What Pressured Bitcoin (BTC) Under $40,000

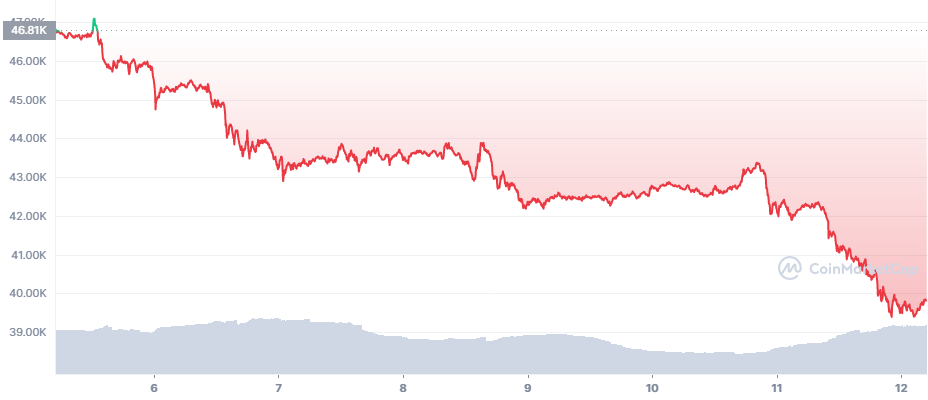

Bitcoin (BTC) started unraveling in the new week, after losing several levels of support. As predicted, the latest price move took BTC under $40,000, with some predictions seeing the leading coin revisit $36,000.

BTC slid to $39,820.00, erasing more than 5% in a day to extend Monday’s losses. After what looked like a period of accumulation in the past days, BTC crashed in one day after holding above $43,000. More than 87% of positions liquidated on the Binance exchange were long, expecting an immediate rally. In the short term, the price action sparked immediate BTC predictions for a dip as low as $39,000.

The asset also lost trading volumes down to $29B in 24 hours, though it preserved its ratio to other coins and tokens, with a dominance of 41.5%.

All other assets extended their slide, with Ethereum (ETH) just under $3,000. Solana (SOL) broke down after recently reaching $120 again, and retreated to $101.37.

The issuing of new Tether (USDT) led to the creation of more than 82.5B tokens. But in the past weeks, the rate of minting slowed down. During the latest BTC hike from recent lows, USDT added around 3B tokens to its supply, along with other stablecoins.

USDT now not only directly supports liquidity to BTC spot and derivative markets, but is also used in arbitrage trading with other stablecoins, and as a form of deposit for passive income.

Can BTC Enter a New Bear Market

Predictions for BTC do not exclude a long slump in the coming months, revisiting the $30,000 range once again. In the past months, BTC was also showing a correlation to high tech stocks, possibly following similar investor attitudes.

In 2022, BTC performed in a way that seemed to invalidate the widely used stock-to-flow (S2F) model. Proponents of the model see it as still holding, though failing to predict the exact price move. BTC also failed to reach $100K during its latest rally, instead going for a series of crashes.

The recent price move raised new questions whether an immediate recovery would be the next step, or further unraveling.

The latest crash also caused a series of liquidations, erasing $23.41M in BTC positions. During the latest rally from $30,000 to above $48,000, BTC leveraged positions grew at a slower pace, with relatively smaller liquidations as well. At the same time, demand was fueled by spot buying with the goal of long-term holding.

Futures trading was also shifted to the hands of large-scale market movers, while retail buyers prefer the option of “stacking sats”.

A mix of inflation and uncertainty has caused an attempt to exit cash positions and wait out even rather large market volatility.

BTC Stacking Continues

There are signs that large-scale miners are aggregating their rewards in some of the newly created “whale” wallets. The biggest pressure to buy comes from the example of Terra (LUNA), which has already spent more than $1.5B to buy BTC at any price.

Miners are also growing the hashrate in the past month, with levels above 206 EH/s.

Exchange balances only briefly showed a dominance of deposits, but returned to net withdrawals in the past day.

At the same time, some very early wallets with more than 12 years of history have woken up, moving some of their coins. Those wallets contain the original 50 BTC per block reward.

Sellers Reappear Near Local Peaks

Despite signs of demand and growth of long-term holders, there are also signs of some selling. CryptoQuant data shows the trend has turned and some are choosing fiat or fiat-like positions to wait out the current price move.

BTC also started April with almost touching a positive trading signal, but is heading for the middle of the month with significant losses.

Trading signals remain bearish, with still 57% of buyers in the money. There is some slowdown in on-chain movements.

Previous Winner Coins Take Deep Cuts

Previous winner Waves (WAVES) is now among the biggest losers, unraveling to $23.14 after recent highs above $60. WAVES traders face conflicting opinions on what caused the price move. One scenario was a deliberate attack that crashed WAVES from a real rally. The other explanation is a short-term pump and dump event.

Another rallying token, Avalanche (AVAX), retreated to $75.26 and lined up among the biggest losers in top 10 tokens. AVAX also erased the recent boost from having Terra spend $200M on buying the token as collateral.

Dogecoin (DOGE) remained relatively stable, erasing around 10%. DOGE retreated to $0.14, still a robust level of support.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A beginners guide to candlesticks, trend line, indicators and chart patterns

How do cryptocurrencies stack up against popular stocks and shares?

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.