Why Monero (XMR) Broke Above $200

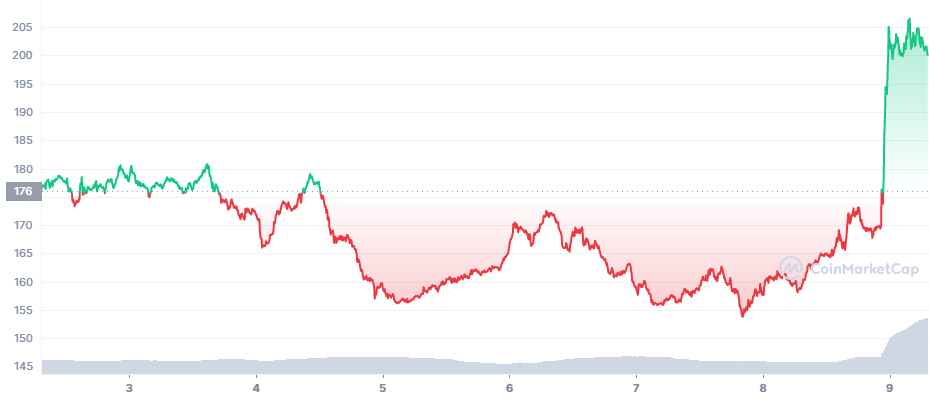

Monero (XMR) is rising again while all other assets remain stagnant, for yet another highly active session. XMR had several days of rapid gains in the past week, and continued the trend on Wednesday. XMR gained 27% in a single day to $201.53, while Bitcoin (BTC) recovered above $41,500.

XMR remained a partially forgotten asset, still far from its peak above $475 achieved during the 2021 bull market. Because of its relatively volatile markets and slippage on Binance trading pairs, XMR is still unstable, achieving rapid climbs and steep corrections.

Are Anonymous Tokens Back in Demand

One of the reasons for the popularity of XMR is the increasing scrutiny of blockchains. The Monero transaction history is not that transparent. However, users can de-anonymize transactions, especially when sending XMR to exchanges. But otherwise, using XMR is not as easy to track.

With the growing surveillance and potential bans of Bitcoin addresses, Monero’s veiling capabilities may increase the demand for anonymous coins.

XMR is also raising some hopes of returning to new highs, or regaining its importance as the original anonymous coin. It is impossible to gauge how many addresses are there on the Monero network, since this is one of the chief elements that is not displayed.

How Active is the Monero Network

The Monero network hashrate has stagnated in the past months, falling slightly from a January peak. Monero mining was specifically created to only perform on CPUs, to avoid the armament battle of ASIC farms. For that reason, the Monero hashrate is small compared to Bitcoin, but cannot be attacked sufficiently with specialized machines.

Despite the secrecy, Monero reveals some data about the raw count of transactions. Since 2019, daily XMR transactions have risen between 5 and 10 times, to a peak above 40K transactions per day in late 2021. Since then, the transaction count has fallen toward 20K transactions per day.

The Monero usage is still about one-fifth of that of Litecoin (LTC), but comparable to the usage of the Bitcoin Cash network (BCH). However, with good exchange representation, XMR may be making a comeback.

Is Monero Traceable

Using XMR on the Monero blockchain is untraceable, even after withdrawing from exchanges. However, ownership of exchange wallets is no longer anonymous.

XMR can also be swapped for other assets through anonymous services. However, some services require the coins to be unveiled, or the deposit may be lost. One of the disadvantages of Monero network usage is that depositing coins on exchanges may be made more difficult.

Can XMR Break Out

XMR remains near lows against BTC. But the past week has set some expectations the asset may start a more significant breakout.

One of the chief concerns for XMR is that it may be delisted from all exchanges. At one point, US-based markets and some Japanese market operators shed coins like XMR and DASH. But XMR has stable trading pairs on the Binance and Kraken exchanges, and there is no sign of an upcoming delisting. XMR has survived the 2018 bear market and has turned into one of the predictable coins with privacy options.

Another sign of XMR heating up is the recent rise in social media mentions, signaling renewed interest in the project.

As awareness of XMR rekindles interest, there have been calls for the FTX Exchange to list the asset, exposing it to its rapid growth that displaced even Binance as a hub for spot and derivative trading.

Are Other Anonymous Coins in Vogue

ZCash (ZEC) had a recent breakout to $128, gaining more than 12% in a single trading day. ZEC aimed to become a high-priced asset for business, but turned to obscurity as its team was blamed on an oversized pre-mined stash.

DASH has constantly lost power over the past 12 months, sinking to about $90 with a loss of nearly 80% since its peak in 2021.

Verge (XVG), a low-priced high-supply asset, is almost forgotten, due to its high volatility and issues with mining attacks.

Litecoin (LTC) has promised to build anonymous features, but so far, the asset has been used as a regular coin for value transfers, and has remained relatively stagnant. Anonymous coins are mostly met with skepticism due to the specific requirements for information transparency on exchanges. Forks of Monero and ZCash are also almost unused. ZClassic (ZCL) is almost forgotten with a price of $0.06, despite peaking above $230 during a brief hype period when ZCL owners were eligible to receive another asset forked from BTC.

XMR, like other assets that ran hot in the first bull market, now looks to regain its position, especially among a new crop of hot coins and tokens. Crypto assets are inherently unstable, but XMR may be an exception at least for a short-term rally.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

From Airdrop to Wallet we look at all the crypto jargon and what it really means

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.