Why NEM (XEM) Outperforms Short-Term

##

NEM (XEM) is the latest altcoin to break out from recent lows. XEM trading is contingent on Asian markets sentiment, and often goes against the general trend of cryptocurrency investments.

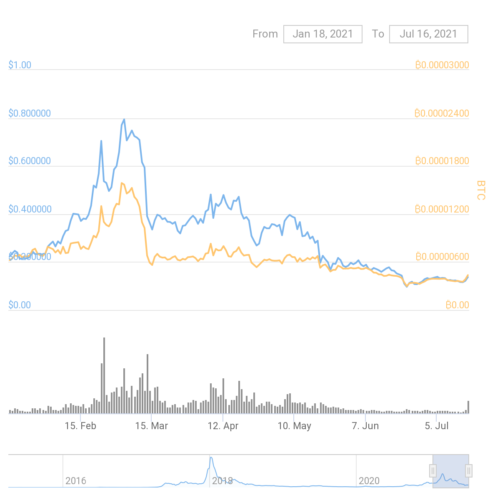

XEM peaked earlier this year, then returned to prices not seen since 2020. This position makes the coin a potential candidate for a breakout. XEM has reached its peak during the 2017 bull run, touching $1.65 in January 2018 before losing most of its value.

In 2021, XEM attempted another rally, peaking at $0.77. Since then, XEM fell again, only to hover sideways above $0.10. XEM now remains a volatile, speculative asset, which nevertheless offers the opportunity for short-term rallies.

XEM added 18% to its price while other altcoins lagged, and BTC slid again below the $32,000 mark. For a brief period, XEM touched $0.14 before retreating to the $0.13 level. The asset is still far from the most bullish predictions, but at a low per-unit price may be a risky bet on future appreciation.

Extreme predictions on XEM prices see it rising to $5 in the coming years, given favorable market conditions.

NEM Boosted by New Symbol (XYM) Project Listing

The success of the XEM token in the past day may be an echo from the listing of Symbol (XYM). Symbol is the proof-of-stake secondary project built by NEM. Recently, XYM got added to Bithumb, potentially adding value to the entire network.

XYM started trading in March 2021, and has so far drifted sideways. The asset is relatively new and may lag in adoption. XYM trades around $0.11, and is yet to gain a Binance International listing. Still, the asset presents a new option for passive gains through staking and delegation.

XYM tokens have a limited distribution, and there are reports that US buyers may be blocked from buying the token. XYM also faces reported problems with transfers to and from Binance. XYM is available for the international community, though some restrictions may apply for the US versions of exchanges.

The Symbol network will be the attempt to turn NEM into a project with cross-chain token swap capabilities, potentially building decentralized swaps between assets. For now, Symbol adoption is relatively slow, with the hope that the new asset will be added to exchanges and expand the NEM and Symbol economy.

The XYM asset price is also very volatile, capable of rising up to 20% per day, before crashing once again.

XEM Bounces Off Lows

XEM is a long-term presence in cryptocurrency trading. The most recent breakout is part of the trend to seek out potential for fast movers, as well as potentially undervalued assets. XEM is currently close to its lows both in dollar and BTC terms.

The NEM project remains relatively active, promising to offer decentralized solutions to businesses. So far, NEM has not managed to compete with Ethereum directly, but has added to the list of notable decentralized networks. The NEM network has lagged in adoption, and little is known about the decentralized apps it hosts. The XEM asset does not participate in the current DeFi boom, with only limited offers to be used as collateral in crypto lending.

NEM Offers New Wallet for XYM

The NEM Foundation recently updated its desktop wallet, which is necessary to access the Symbol network. The new wallet launch added to the token hype, potentially adding to the price appreciation.

XEM tokens are also cross-compatible with the Ethereum network. The NEM network allows its tokens to be staked through a wallet, as a way to delegate the production of blocks and secure the network.

Can the XEM Rally Survive

The recent XEM appreciation may be a short-term move. Cryptocurrency trading and the BTC market have shown fear is an overwhelming sentiment, and altcoins are more volatile.

The XEM token has a relatively lower liquidity and higher slippage potential in its leading Binance pair against the USDT. More active and liquid XEM trading is concentrated in the XEM/BTC pair.

The value of XEM may be heavily influenced by Binance trading. XEM activity has always been relatively lower in comparison to other large-cap projects. Currently, XEM trades at about $357M equivalent in 24 hours, still comparatively higher even than the volumes during the 2017 peak.

NEM Project Still Bears the Marks of the Coincheck Hack

The NEM project lived through a shock after the hack of the Japanese Coincheck exchange. The theft of $500M in cryptocurrency led to the exchange’s closing. Owners of XEM were compensated at prices above $0.80.

XEM trading was then hurt by the bear market that started in 2018, leading to low activity. In 2021, XEM is once again attempting to reinvent itself and position its new Symbol network as a bid to renewing market share.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A review of the many options for crypto exchanges and what the main differences are

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.