Zilliqa Price Analysis | Is this an end to the downtrend in ‘ZIL’?

#

Zilliqa is a blockchain initiative that aims to assist developers in creating high-quality decentralised apps such as DeFi and Non-Fungible Tokens (NFT). Zilliqa brings sharding theory to life by creating a protocol that overcomes the scalability limitations of some current blockchains. Due to the network’s sharded design, concurrent chains may process transactions simultaneously, thus increasing the network’s overall capacity. Sharding enables the platform to grow and fulfil the demand of its miners by giving them rewards.

The primary goal in creating this solution was to create a platform capable of executing smart contracts on a large scale without jeopardising core blockchain principles such as decentralised node management. The greatest features, according to developers, are the sharding algorithm, the schnorr signature, and Scilla. Transaction costs are likely to drop under this system because of Zilliqa’s much higher operational capacity than Bitcoin or Ethereum. The estimated cost of a Zilliqa transaction is $0.000023, compared to $1.79 for Bitcoin and $0.016 for Ethereum.

While Zilliqa token has gotten favourable reviews, developer adoption has been very restricted. Also, the majority of them choose popular initiatives like Ethereum and Polkadot Ecosystem. Thus, on the occasion of the project’s fourth anniversary, we’d examine how it’s doing today and consider where it might go from here.

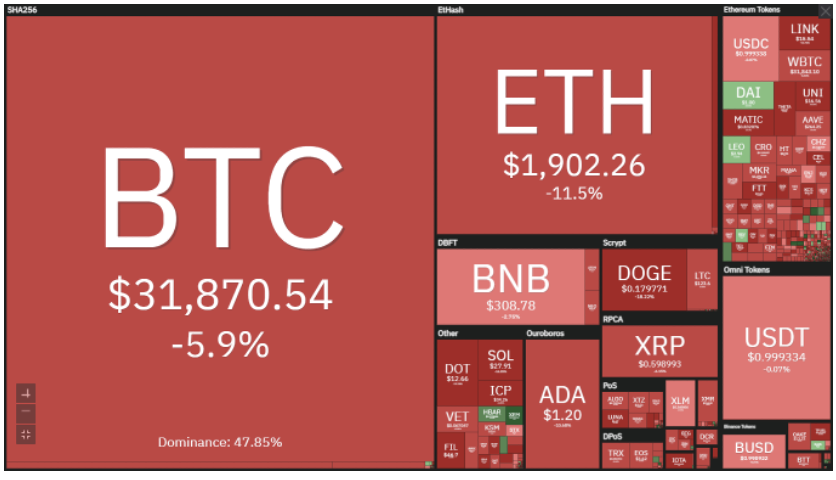

Recently, Zilliqa’s price has suffered due to the cryptocurrency ecosystem’s general deterioration in prices. Recently, Bitcoin and other cryptocurrencies have underperformed. This is partially due to widespread concern about rising interest rates and regulatory restrictions. The graphic above depicts the past week’s heatmap for Bitcoin and the other main cryptocurrencies. As can be seen, almost all of the major currencies were in the red, indicating a decline in value.

The chart below illustrates the price of Zilliqa over time since it entered the trading landscape. Despite its ups and downs, Zilliqa was a profitable venture for early adopters and those who invested from the start. Those who invested later have also benefited from strong returns, as Zilliqa (ZIL) maintained a constant upward trend until it peaked in March 2021. Later in the game, it lost momentum and continued downhill, making lower lows.

Where could it go from here?

Zilliqa crypto has provided little resistance to the sell-off during the past week, resulting in a continuous decline. Now, ZIL must break through a critical barrier if it is to have any hope of moving higher. It eventually achieved a price of $0.0650. It is now rising at a significant support level, as shown in the chart below.

As can be seen, the negative trend has reached the critical support level of $0.064. Additionally, we can observe from the graph that this level previously had a psychological effect on the traders. As a result, we may use this line to forecast whether a bullish or bearish breakout is likely.

Moving averages and also oscillators such as the Relative Strength Index (RSI) also support the downward trend. The graph above illustrates the falling RSI, and the number “33” indicates how oversold the market is.

Additionally, we can see that the 200-day Moving Average has surpassed the 50-day Moving Average. This is referred to as a “Deadly Cross” in trading jargon, and it indicates that the market has been very negative recently. As a result, there is a reasonable chance that the coin will shortly see a significant bearish breakout. If this occurs, the next critical support level to monitor will be $0.04

On the other hand, a break above the falling trendline could invalidate this forecast. Therefore, in this alternative scenario, investors should take notice that a rapid rise to $0.023 and above indicates the presence of buyers and opens the door to a 50% upswing to $0.05.

Suppose you assume that bullish momentum continues to build after this rise. In such a scenario, Zilliqa’s price may reach the Fibonacci retracement levels shown above. In certain instances, ZIL may sweep over this level in order to gather liquidity, indicating an impending pullback ahead of another move upward. If the market is positive, Zilliqa’s price will accelerate toward the 50% Fibonacci retracement level at $0.1.

So to conclude, even though we agree that Zilliqa has a good potential to make it big, given its applications and speed, we think that it still has a long way to go. Considering their recent efforts, such as the ambassador’s program, to increase the coin’s popularity, investors may get some confidence that the management is really committed to driving the price upward. However, if we look at the present situation from a pure price action lens, we can see that the currency may be on the verge of a bearish breakout.

You can instantly trade Zilliqa (ZIL) and all of your favourite cryptocurrencies from our list of reputed cryptocurrency exchanges. Do consider checking them out. All the best!

Investment Disclaimer

This article is purely for educational purposes, and this doesn’t include any investment advice. Readers are requested to do their research before they consider investing.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We analyse the most popular eco friendly cryptocurrencies looking a their energy efficiency and usage

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.