The Blockchain Revolution

Blockchain technology goes beyond cryptocurrencies and sending payments to other people. Which sectors will blockchain technology disrupt and why?

First, there was Web 1.0. Slow-loading sites that you could only read. Contributing was difficult. Then, there was Web 2.0. The internet went from read-only to users actively contributing to it, from pages to blogs and social media.

Blockchains will be part of Web 3.0. A decentralized, individualized, and immersive experience. However, Web 3.0 will encompass more than just blockchain technologies and cryptocurrencies. This lesson will look at:

- The backdrop to the revolution that cryptocurrencies are bringing about

- How blockchains are different from the infrastructure we use today

- How this revolution has started disrupting the financial sector

- What other sectors and societal aspects blockchains could impact in the future

The state of affairs at the beginning of the blockchain revolution

Two societal aspects are of high relevance when we look at how blockchains are going to shape the future: The financial system and the labor market.

The financial markets

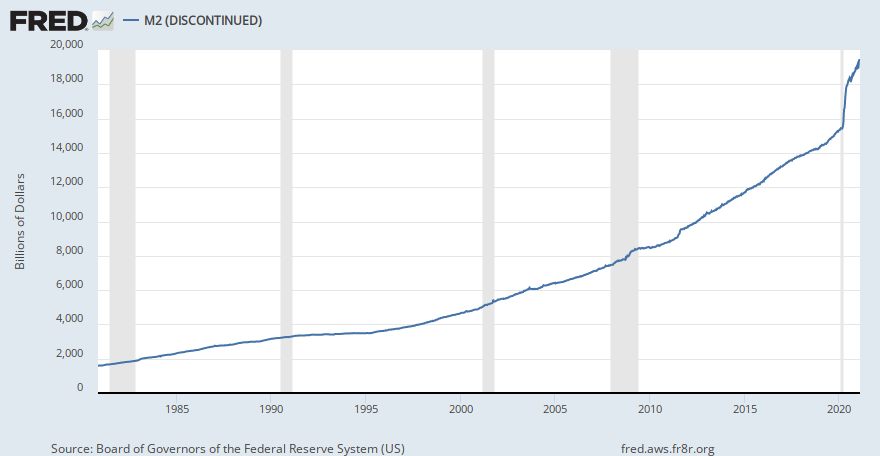

Finance first. After years of quantitative easing, the US government recently expanded its money supply even more. Look at the graph below:

This graph shows US money supply up until 2021. The Fed discontinued counting M2 money supply at that point, but let's leave possible reasons for that aside for now. You can tell with your bare eyes how much the money supply has been expanding. This expansion has also accelerated in recent years.

This monetary expansion, coupled with recent spending programs by the US government, looks like it will finally bring about higher inflation. In fact, inflation will likely exceed levels seen as tolerable by economists, and how bad it will really get depends on who you ask.

Regardless of how high inflation will be, asset prices have been ballooning in recent years. The S&P 500 has shaken off its 2020 COVID scare and is putting in all-time highs at the moment:

The introduction of deflationary assets like Bitcoin is very interesting in this regard. For the moment, Bitcoin is still highly volatile, and its status as a store of value is more penciled in rather than reality. This became especially evident in March 2020 when COVID hit and all asset prices, including Bitcoin, crashed badly. However, it will be interesting to see at what point investors start seeing Bitcoin as a deflationary asset instead of being a means of speculation. Once it really sinks in that bitcoin is as scarce and valuable as land, its price development should decouple somewhat from other assets. However, this will likely happen only in the long run.

The labor market

The labor market is in as much upheaval. STEM degrees (science, technology, engineering, mathematics) are more in demand than ever. The following graph illustrates how technological, social and higher cognitive skills are directly correlated with earning a higher wage:

At the same time, we can observe a migration to remote work, which has only been accelerated by COVID. High-skilled employment like management, financial services, or IT can operate remotely without being much less effective.

This shift isn't happening only out of necessity. Employees have taken a liking to remote work and are pushing for hybrid models where part of their working hours are done remotely. Another testament to this is population change in US cities away from bigger cities like New York towards smaller ones like Salt Lake City. On top of that, you have a shift in consumer preferences, with e-commerce crowding out brick and mortar stores and an ever-increasing share of time spent online and with on-demand services.

How blockchain technology is changing the game

With all this change happening, we can distill two major trends:

- There is more money, and it's moving around faster.

- People's lives are getting more distributed.

More money on the market means more resources that can flow into high-risk assets like cryptocurrencies. Furthermore, with people’s lives getting more geographically distributed, they are mentally more predisposed to accept technology that advances this shift (like blockchain technology does).

These broader trends, coupled with a technology whose architecture is on the brink of going mainstream leads to the situation we have today: blockchain technology permeating and disrupting the first industries. Finance happens to be the first since it has seen comparatively little innovation in the last decades. A bank in 1920 worked pretty much like a bank in 2020, only with more paper and less internet. Compare that with the way you communicate or access information, and the difference becomes strikingly evident.

The difference between traditional infrastructure and blockchain technology

Blockchains move trust from the company to the network. Instead of trusting your bank to let you withdraw your salary, you trust software code to be secure enough not to be hacked.

| Advantages | Disadvantages |

|---|---|

| Decentralized governance | Hard to scale |

| Permissionless | Security bugs |

| No one owns your data | Consensus mechanisms |

| Verifiable data | Hard to transfer to blockchain |

There is no one authority calling the shots, and anyone is free to join. Your data also belongs to no one. These are all characteristics Bitcoin exhibits. On the other hand, it is hard to scale, a classic problem of many early blockchains. Scaling comes at the expense of security or increased centralization. Security itself depends on how well-constructed the blockchain architecture is. Legacy blockchains like Bitcoin and Ethereum are highly secure but inadequate for many advanced use cases that go beyond payments. Consensus mechanisms are also a problem because they are either resource-hungry (proof-of-work) or untested and potentially not as decentralized as you would want them to be (proof-of-stake). Lastly, blockchains enable unique digital verification of data but transferring and codifying that data from existing sources onto the blockchain is challenging. Most private and public data is stored in different registries that can be offline or online. Even before creating a publicly verifiable record on the blockchain, data would need to be standardized and categorized.

Decentralized finance - the first sector to be disrupted?

Cryptocurrencies are trying to solve the trade-off between having the efficiency of a centralized system without giving up the security and privacy this new technology offers. Most progress has so far been made in the financial sector, for the societal and technological reasons discussed above. While cryptocurrencies themselves disrupt peer-to-peer payments, decentralized finance (DeFi) targets the entire financial sector and changes happen in a number of ways.

First, DeFi is improved by the wider community, whereas innovation in centralized finance can only come from the top. You cannot just add a new feature to Morgan Stanley, but you most certainly can build on top of an existing DeFi project. This open nature leads to a culture of "move fast and break things," which is very similar to the tech sector as a whole. As a result, a lot of useless stuff is churned out, which is why people say "99% of cryptocurrencies will fail." But that 1% that survives will have an outsized impact.

Next, anyone can join DeFi, and it costs nothing. It is permissionless. In fact, to participate in any cryptocurrency is open to anyone. Compare that to currencies with capital controls and banks with KYC procedures and account closures. Blockchain technology as a whole could, once it gets past its growing pains, be a blessing to people in developing countries and provide financial and other infrastructure to them.

Information on the blockchain is transparent and public. Bitcoin gets accused of being a useful tool for illicit activities, but how many backroom deals are getting done in and by banks that you never hear about? Think of Wikileaks and the Panama Papers, and you will quickly come to the conclusion that information on the blockchain is hardly less transparent than information hidden by banks.

Transactions on blockchains are immutable, meaning they cannot be reversed. As such, it is censorship-resistant because there is no central authority that can ban you from donating money to someone. Maybe a more familiar application of that would be chargebacks. You currently hear about Bitcoin being used for ransomware, but chargebacks and fraudulent transactions are a real problem for many small online and offline businesses.

Finally, DeFi is without doubt vastly less resource-hungry yet more efficient than the current financial system. Again, Bitcoin's energy consumption is a welcome scapegoat, but no one puts it into perspective and compares that to how much capital and labor banks need to function.

This isn't so much a case of DeFi being better since it has its own problems: the applications have a poor user experience, are clunky, and not capital-efficient. But you can improve an app's user experience and capital allocation easier than you can operate a bank with a dozen people.

What blockchain technology could disrupt in the future

Decentralized finance is the most tangible example of innovation through blockchain technology. Payment systems, Bitcoin being the most prominent example, are another. You can argue, though, those are two apples from the same tree. There are a few more use cases that are still at very early stages of development or even just being conceptualized.

Real estate

Currently, the real estate market is not open to everyone. Low-income households cannot participate because of a lack of assets or inability to receive credit. Receiving loans, though, is complicated because a positive credit score requires collateral and/or a stable well-paid job. The market is fragmented and centralized and data is handled by a variety of third parties that all have their own databases and don’t collect data in a standardized fashion. Banks, notaries, attorneys, and land registries are only a few that come to mind.

Blockchain technology could minimize bureaucracy and reduce friction by providing a sole public ledger that all parties can use to verify and collect data. Real estate could be tokenized and the digital token of the real-world asset would provide a transparent way of verifying and transferring ownership, keeping a record of maintenance, and even fractionalizing ownership of real estate, i.e., giving low-income households the opportunity to own assets and participate in the market. While at least the latter is currently possible as well, tokenization would mark a great improvement in terms of market efficiency.

However, some challenges need to be overcome as well. First and foremost, the legal process needs to be Web 3.0 compatible. Second, ownership and access rights would have to be defined, as well as maintenance of building when it comes to communal ownership of entire blocks.

Art & Media

Fine art is another market closed to the non-wealthy with only limited market participation. Maintenance of traded goods is difficult and transactions need a lot of documentation. This leads to a system heavily dependent on middlemen.

Media suffers from a similar problem in that industries like music, film, and publishing are characterized by gate-keepers and centralized platforms that siphon off a lot of the value from creators.

Blockchain technology would democratize the market by introducing fractional ownership (for fine art), which could lead to better liquidity and market depth. Moreover, tokenization can make an asset’s provenance more transparent by introducing a complete ownership record, limiting counterfeiting, and improving rights management.

The media sector would benefit in the same way since artists, publishers, and any type of content creator would be able to receive funds from their audience directly. For instance, musicians could receive royalties when their content is consumed without relying on record labels or raise money for future projects through token ownership.

Automotive

With the emergence of connected mobility, cars are and will be producing massive amounts of data. Even today, car manufacturers collect a lot of data, although this is likely a fraction of what will be produced in the future. Data about energy consumption and battery charging, autonomous payments, tolls, car maintenance and usage will all be be of interest to manufacturers, cities, and service providers like ridesharing and taxi companies. Data will need to be easily verifiable and transparent, making it an ideal use case for blockchain technology.

Manufacturing & Supply Chain

Nowadays, supply chains are intransparent, difficult to keep track of, and distributed across databases between manufacturers. Blockchains could introduce a unique digital twin of each product that would allow to track and verify its provenance. A standardized ledger between manufacturers could reduce waste and boost the efficiency of supply chains by allowing cross-company sharing of data.

E-health

By creating a unique, verifiable online ID, healthcare providers could digitally collect and verify data about a person’s health in a transparent yet secure fashion. Patients would benefit from being able to use different providers and have their health monitored remotely.

Company structures

Company structures are another possible field for innovation. DAOs, decentralized autonomous organizations, are companies governed by code. Some cryptocurrencies use them already as governing structure, and in July 2021, Wyoming legally recognized the first DAO in the US. From there, governmental structures aren't far away. El Salvador recognized bitcoin as legal tender in 2021. While the outcome is unclear and the country faces backlash for its decision, it is an intriguing experiment and probably not the last of its kind.

Conclusion

Currently, cryptocurrencies are perceived as being different shades of the same color. However, blockchain technology will have applications that go far beyond mere peer-to-peer payments and will likely be an essential part of the information revolution.