Ethereum Makes A Move – Who Is Next?

As long-term bulls return to the game, the crypto market is on a huge run to the north. The entire market went into consolidation after the cryptocurrency environmental crisis in mid-May. But interestingly, cryptocurrency prices started to correlate within sectors. For example, during the consolidation, decentralized exchange tokens surged in the same direction. Other domain-specific cryptos, such as DeFi, Oracles, Interoperability, Ethereum layer-2 scaling solutions, and many others, followed a similar pricing trend.

Most of the cryptos are making a push to the upside, but there are a few of them that are still holding under the major seller’s areas. Similarly, there are cryptos that are even moving in sync with Bitcoin and Ethereum.

Looking at the price action of the current charts, Ethereum seems to be blasting to its ATH as the prices have finally breached through long-lasted consolidation. The ETH market that was facing resistance at $3300 for over three weeks was broken by the buyers as the demand kicked after a long wait. In a matter of three days, the prices rose over 25%, as the ETH market trades at $3950. And with the ATH at $4200, Ethereum crypto is only 5% away from reaching it.

How are Institutional Players Buying into Cryptos?

As mentioned earlier, the cryptocurrencies did make a move to the upside, but in sectors. Initially, we saw the store-of-value coins, including Bitcoin and Terra, lead the market. But later, as these markets took a halt, cryptos such as Solana and Cardano began to proceed with their bull run. In fact, both the market successfully made a new ATH as well. As these markets slowed down a few days ago, Ethereum came into the run after breaching through the supply levels that were rejecting the prices for almost a month.

With the buyers getting back in Ethereum (ETH), it is evident that the world of smart contracts is finally being taken into account by the institutional buyers. Now that ETH has made an impulsive move, the scaling solutions of Ethereum can be the next target for the big buyers and help better the performance of the Ethereum network.

What are Scaling Solutions, and why are they important?

When Ethereum first appeared after Bitcoin, it was seen to represent competition to the original Bitcoin blockchain technology. The Ethereum blockchain, of course, shed new light on the growing blockchain technology and provided numerous use cases, but it was not without flaws.

One of the most significant challenges was scalability. It was critical to have answers to the difficulties with the existing Ethereum network in order for the Ethereum technology to continue to prosper as it did since its inception. To solve these difficulties, Ethereum layer-2 scaling solutions were created, which allowed the Ethereum market to remain operational.

Scaling solutions’ cutting-edge solutions attracted people’s curiosity. Due to the obvious particular benefits that layer-2 projects provide, developers who previously worked with Ethereum to build apps switched to layer-2 projects. As a result, the tokens that enable scaling initiatives have grown in popularity and demand.

One such example that has gained traction in recent times is the Polygon token (formerly Matic Network). With an intention to efficiently scale the existing Ethereum blockchain, this layer-2 solution has succeeded and has been thriving since the very beginning.

Polygon Prepares as Ethereum Breaks through $3300

The price of both Ethereum and MATIC crypto usually go together. Of course, MATIC being relatively newer, has higher volatility, but the trend on the bigger picture is quite the same. Hence, analysts expect them to perform in the same trajectory through a precise correlation between the two would not exist.

Ethereum, the so-called king of smart contracts, had a lagging start to the bull run that began in August. However, after tokens like SOL and ADA had their run to the north, ETH followed.

As the market breached above the resistance of $2800 initially, the price took the next resistance at $3300. But this latest resistance lasted longer than anticipated.

Finally, as the bulls from the support levels got momentum on their attempt, the price managed to break out from the resistance. And currently, the price is barely 5% from touching its all-time highs.

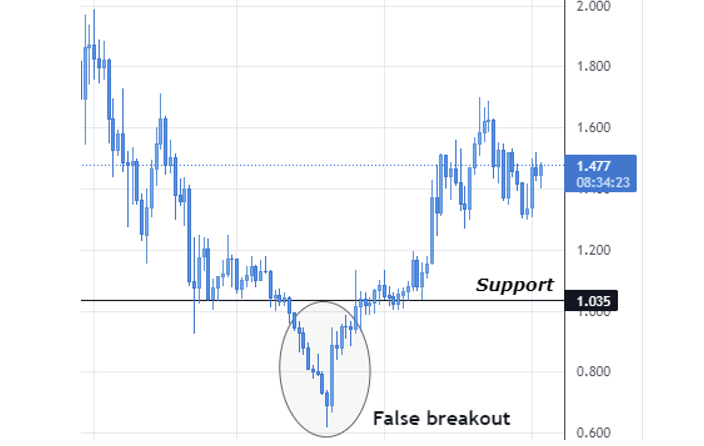

Polygon’s MATIC token has performed very well in terms of pricing. Launching its bull run at $0.04 in Feb 2022, it went on to reach a peak of $2.7 in a period of only three months. The support, as demonstrated, stayed firm despite the fall that drove the price back to a dollar. The market’s strong reaction to demand zones plainly demonstrates the market’s presence of buyers. Eventually, in August, the MATIC market rose from $1 to the resistance at $1.6 in a matter of weeks, owing to solid fundamental updates and bullish price movement.

Now you can get ETH, MATIC, and several others from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Who are the biggest influencers in the NFT space across the various social media platforms.

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.