Can Bitcoin (BTC) Recover Above $40,000

Bitcoin (BTC) took just days to climb closer to $39,000 and re-spark hopes of a rally above $40,000. The upward move is seen as potentially forestalling a drop to $30,000 once again and shortening the slide for all assets. In early 2022, some of the fears are for another longer bear market.

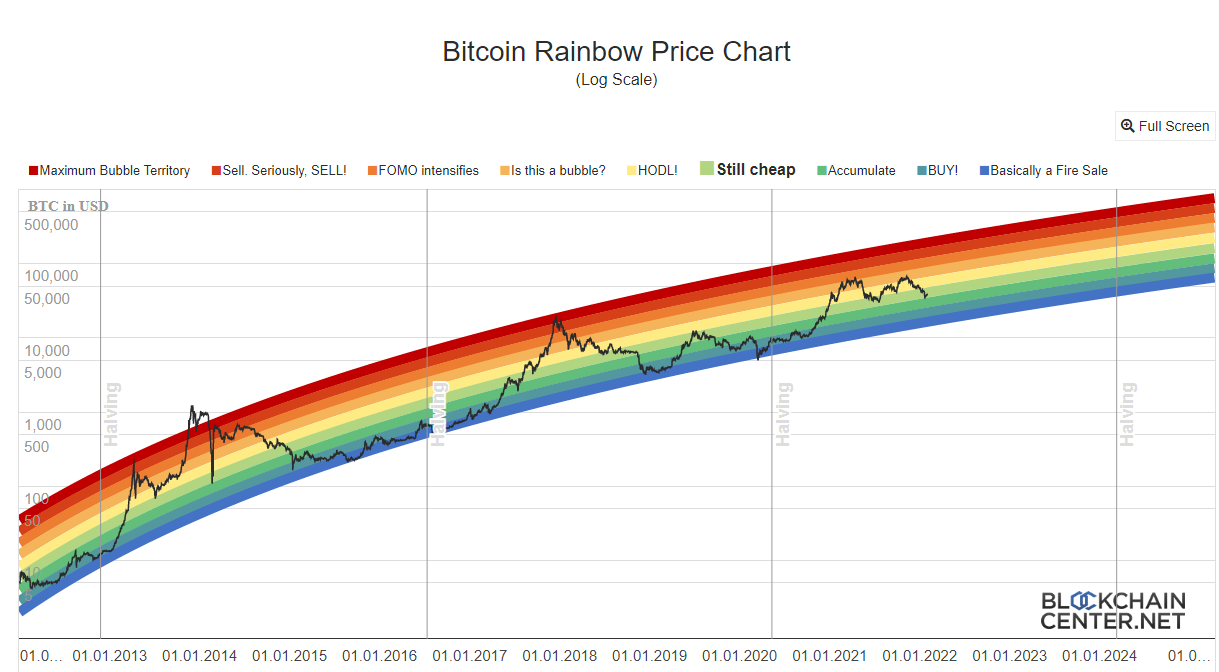

Late on Tuesday, BTC broke to $39,045.87, extending the day’s gains, but kept that position only briefly, sinking again closer to $38,000. Based on the Rainbow Chart, BTC is still relatively cheap, but not at levels to invite active accumulation. Some of the predictions is the next all-time high is more probable only after a return above $50,000.

Ethereum (ETH) recovered close to $2,800. ETH gets support from having about 9M tokens in total locked, with another 1.5M burned. DeFi protocols also lock in a significant amount of ETH, managing to balance the increasing supply that is, for now, without a fixed ceiling.

Will BTC See Selling Pressure

Older BTC wallets or those with locked coins that cannot be moved continues to increase, showing early adopters are either unable or unwilling to sell.

At the same time, some short-term turnover affects the spot price. Another anomaly is the movement of coin away from the Bitfinex hack wallet. Over the past years, there were several attempts to move coins, and about 79% of the stolen BTC have been sent out to undiscoverable addresses.

Using anonymity wallets or coin mixers, the person or persons controlling the Bitfinex hack haul have apparently implemented a plan to move or hide the assets. For now, no significant selling is expected from that wallet, as it would raise suspicions.

It is probable the coins were moved using the Wasabi wallet and other services that prevent the linking of addresses and mapping the transactions.

Can BTC Stop the Recovery

There are almost no factors that would guarantee the current breakout. For the more bearish analysts, one possible scenario is a breakdown and renewed liquidations, sending BTC to a lower tier.

The current rally happens on low volumes of $20B in 24 hours, and a still fearful sentiment. The renewed addition of long and short positions may lead to new attacks on leveraged trading. The price slide also coincided with a drop in the supply of Tether (USDT) below 78B tokens. At the same time, most USDT stays on exchanges as outflows decreased, possibly waiting for more buying opportunities.

BTC Mining Remains at a Record

Bitcoin network activity is mostly linked to using coins as a plain means of payment. This means BTC fees remain relatively low.

Over the last three years, the Bitcoin network grew from about 10,000 nodes to around 14,000 nodes across the globe. At the same time, Ethereum led in fee generation, mostly due to token transfers and fees.

However, fees do not necessarily translate to coin value. ETH continues to be a utility asset, with the added use case of being used for staking.

Solana (SOL) Returns Above $100

Solana (SOL) is one of the faster recoveries, jumping by 15% overnight to trade above $110. SOL got a boost from the recent news of Phantom wallet launching on Apple store, potentially reaching a wider audience.

The Solana ecosystem continues to grow and SOL is used to buy NFT images or in-game items, digital land and other tokens for startups built on the Solana protocol.

Additionally, Solana Pay was introduced as the new payment protocol for fast, cheap and decentralized transactions. Solana Pay aims to connect merchants and users and send USDC dollar-denominated crypto assets, while settling all fees.

Solana Pay will not only be about paying with crypto, but using its protocol to also transfer fiat currencies seamlessly, as with other fintech and payment apps.

While SOL rose on the short-term news, there are also warnings the asset may stop the climb and resume the downward trend along with the rest of the market. Whether the current level of crypto assets is a definite buy is still uncertain, but SOL showed the prices under $100 invited more accumulation.

Terra (LUNA) with Slower Recovery

Another asset gaining attention in the past days was Terra (LUNA). LUNA only recovered to around $52, still away from the expectations of a rally above $100.

LUNA is now pressured by renewed doubts about the feasibility of Anchor Protocol, the DeFi passive returns pool. Anchor has to keep up the staked assets to provide returns above 19% annualized.

For the more optimistic scenario, the LUNA ecosystem can continue to grow and invite collateral to ensure the value of DeFi protocols.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Learn how to keep your crypto secure and the different types of wallets you can use.

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.