Why Cardano (ADA) Gets Closer to $1

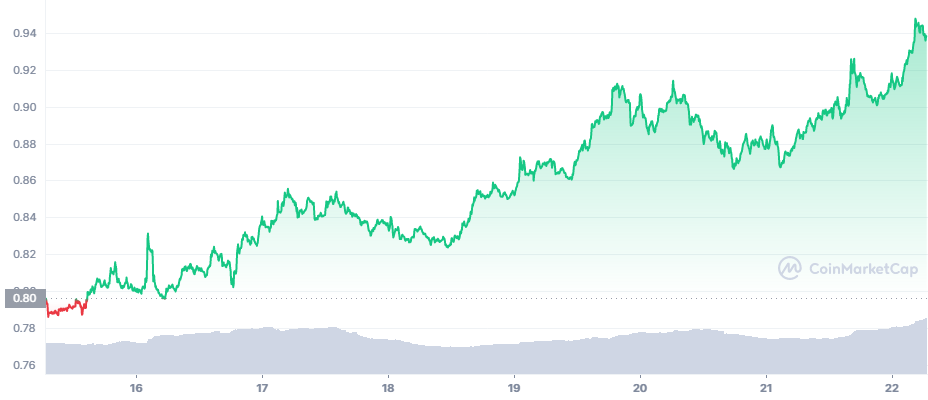

Cardano (ADA) made use of the latest market breakout, getting closer to $1. ADA reached $0.93 after more than 16% in weekly gains, showing more robust activity after BTC recovered above $42,000.

The Cardano network usage has grown, with newly proposed games and DeFi hubs. The expansion arrives after years of almost no traffic on Cardano besides simple ADA token transactions and block rewards. Now, the network is seeing a spike in new addresses and usage.

The Cardano network attracts game projects, NFT image collections and other passive earnings hubs which boost the overall transaction count.

Cardano Starts to Attract Value

Starting from almost nothing, the Cardano ecosystem now holds more than $291M in notional value, based on DeFi Llama statistics. The Minswap exchange is still the leading distributed app on this network, with new ones joining.

The exact list of projects is incomplete, and only the busiest ones contribute to most of the value within Cardano. More than 61% of that value is locked in the Minswap liquidity vaults. The inflow of DeFi projects is perhaps the strongest indicator of a potential price rally.

ADA May Support Algorithmic Stablecoin

ADA may move higher in case it is used to back liquidity or even produce an algorithmic stablecoin. Some of the most optimistic predictions see ADA moving as high as $5. For now, ADA has failed to repeat its previous high just under $3.

ADA still has a low per-unit price and is capable of significant rallies in percentage terms. The project’s visibility is also high, standing next to Terra (LUNA) and Solana (SOL). The asset’s price has also gone through weeks of relative stability, potentially accumulating before a more remarkable rally.

ADA Shows Bullish Signal

Because ADA looks like it is lagging, the current expectation is for a strongly bullish move. At this point, more than 80% of ADA buyers are in the red, though expecting a relatively easy correction once ADA sets the pace.

ADA rallied as BTC stabilized and stopped its own rally for a while, and Ethereum (ETH) also stalled under $3,000. The asset is now ready to show it is more than a speculative altcoin and may line up with some of the most active platform tokens.

There is also some skepticism that Cardano can deliver all the expected distributed apps fast enough. Older networks are barely carrying one or two truly successful and active games, while others hinge on one or two DeFi hubs.

For now, Cardano is far behind the value locked in Terra and Solana, with the chief reason being that there is still no native algorithmic stablecoin on the network. This type of stablecoin can mop up excess tokens and lead to significant scarcity.

For ADA, this will only add to the already significant scarcity where around 72% of all tokens are staked to secure the network. In the coming months, the effect of DJED, the new algorithmic coin on Cardano, may be felt as price increases for ADA.

Even at around $1, ADA is seen as an asset where an early stake can be acquired with significant ease. In a way, ADA has taken the spot of Ripple’s XRP, which has had its trading limited by a removal from Coinbase.

ADA, however, is available without limitations and may start to attract demand soon.

Will ADA Go Through Bull Market

The current year holds many potential price twists, with uncertainty whether a bull market is to be expected. Still, ADA may break out at a moment where lagging altcoins are still retaking lost ground.

The ADA rally arrived just a day after the breakout of Ethereum Classic (ETC) close to $40. However, most climbs in the past days were followed by a retreat. ADA has not broken any significant resistance levels yet, and remains close to its three-month lows.

Still, it is precisely the low position that sets the expectations for a bigger rally. ADA has easily revisited the $1.50 range in the past quarter, and may yet recover those positions. The recent rally happened on relatively low volumes, with more exchange activity potentially extending the gains.

At the same time, Cardano on-chain activity shows a pickup in transactions. However, the Cardano community expects the real DeFi boom and price rallies may happen around June, when a hard fork is scheduled to improve the work of the network.

Cardano also boasts of having met with no hacks or exploits. But smart contracts and services arrived to the network just a few months ago, and the technology is yet to go through real-life stress tests.

The recent price revival is yet to erase the negativity, especially after Cardano fell for months following a peak in September 2021. Now, the expectations are renewed for both technical charting reasons and because of real use cases.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

From Airdrop to Wallet we look at all the crypto jargon and what it really means

Who are the biggest influencers in the NFT space across the various social media platforms.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.