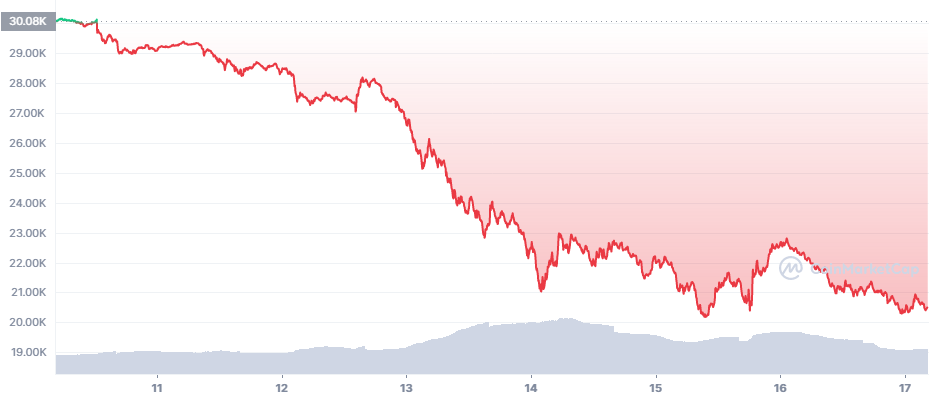

Bitcoin (BTC) Sinks Closer to $20K Again

Chaos still reigns on crypto markets, with trading again happening with a mood of extreme fear. Bitcoin (BTC) managed to recover above $21,000, but there are more expectations the price drop has not ended. Attitudes remain bearish as there may be more collaterals to liquidate. BTC traded at $20,465.05 ahead of the weekend.

The latest BTC crash was caused by the buildup of significant whale wallets by several protocols. Those BTC were set aside to secure other assets, but ended up crashing both BTC and the asset price.

Will Liquidations End

There may be more liquidations ahead, affecting both BTC and ETH. One of the bigger stories of unraveling loans is the liquidation of Three Arrow Capital, or 3AC, which was caught in several large transactions on June 15.

Bit 3AC may have more exposure and more liquidations at ETH under $1,030 and $1,014. The fund is reportedly in talks to secure extra lending to avoid those liqudiations. The market is still watching addresses belonging to the fund to see if a lowering ETH price would lead to more liquidations. ETH sank to $1,077.24, threatening to dip to lower ranges and accelerate liquidations.

Celsius itself managed to top up its collateral and protect against a BTC dip under $16,000. But 3AC may have left some positions to expire, while also using client funds to answer some margin calls. 3AC was at one point performing trades for 8BlockCapital, on the agreement of not trading the funds without permission.

The traces of liquidations affect multiple exchanges, including FTX and the spot Binance market.

BTC Survives Liquidations

The encouraging position is that for now, the series of liquidations has not caused a deeper cut to the BTC price. Additionally, previous big BTC whales have now sold their collaterals and the market has de-leveraged.

A relatively new unknown wallet also appeared with 117,844 BTC, which received a large transaction and on June 16 started spending it in installments between 150 and 200 BTC.

There are also signs of miners selling coins due to high production costs.

At one point, BTC production costs ranged between $3K and $10K depending on electricity prices. But with more aggressive investment in rigs, not all miners are breaking an easy profit and are more willing to sell and cover costs.

The question for BTC is whether it would have another big capitulation event before recovery. Most indicators show BTC is historically near its lows, especially when touching the 200-day moving average line. However, worsened macro conditions and fears may mean BTC will not recover as easy. Glassnode also notes a significant sell-off, three times larger than the March 2020 capitulation.

While some long-term holders are ready to wait out for better prices, there are also signs of spot selling on Binance and attempts to move to fiat positions waiting for new BTC lows. On the other hand, accumulation is still happening and whales are holding for the long term.

Even with the bottom not yet in, the price recommendation based on the rainbow chart is still to buy and accumulate.

In the short term, a drop under $20,000 may be amplified by leverage and stop-loss positions. Currently, BTC is threatening to go under its previous cycle high of $20,000, a still unprecedented event. But BTC is also in unknown territory and with a relatively high price, making it possible to not conform to charts from previous years.

Is ETH Building Another LUNA-Like Scenario

One possibility for abusing ETH is the potential to swap it for stETH, or “staked ETH”. This product, built by Lido Finance, reflects the upcoming ETH 2.0 beacon chain launch. The price of stETH is supposed to be the same as that of ETH, though it deviated in the past days and is about 5% lower.

The problem is that stETH can be used to get an ETH loan, which can circle back and be deposited for more stETH.

The one positive thing is that stETH cannot go to zero, as it reflects actual ETH tokens. Once the Beacon Chain on the main net emerges, all stETH will convert to actual ETH. However, in the short term, this can create speculation and cause price disparities.

Shaking down the price of ETH may also lead to a deeper cascade effect of liquidations. This scenario is weighing down on the price of ETH, raising expectations for a dip under $1,000.

The unraveling price of ETH means DeFi still holds $39B in notional value, returning to the pre-boom levels of February 2021. Other protocols also lost as much as 75% of their notional value as the market continues to de-leverage. The ETH market cap dominance is now down to 14.9%.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

How do cryptocurrencies stack up against popular stocks and shares?

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.