Altcoins With Utmost Growth This Week | STX, QTUM, SOL & More

##

While the price action of top cryptocurrencies in the market is moving sideways, a few of the altcoins rallied over 30% making huge profits for their holders. We felt that it is important to cover the technical analysis of these coins as their bull run is yet to halt. For all we know, the buying market in a few of these altcoins could just be starting. Therefore, it is recommended to keep a watch on the price action of these cryptos for now and take appropriate trading/investing decisions. Let’s get started.

Ripple (XRP)

Despite their SEC lawsuit woes, XRP has defied all odds and gained over 385% since January 2021. XRP opened the year at $0.23 and hit highs of $1.12 on April 6. The recent 3-year high of $1.12 can partly be attributed to the decision by the Courts to allow over 6000 XRP holders to join the lawsuit as third-party defendants.

XRP/USD Price Outlook

Although the SEC lawsuit is far from over, the tide seems to be going Ripple’s way. In its recent bullish trend, XRP failed to breach beyond $1.12 (3.618 Fibonacci extension). However, it has formed a strong support level at $0.92 (2.618 Fibonacci extensions); but since it has rebounded from this level twice, we anticipate the next resistance at $1.21 (4.236 Fibonacci extensions). In the longer term, we expect XRP to breach the $1.52 mark.

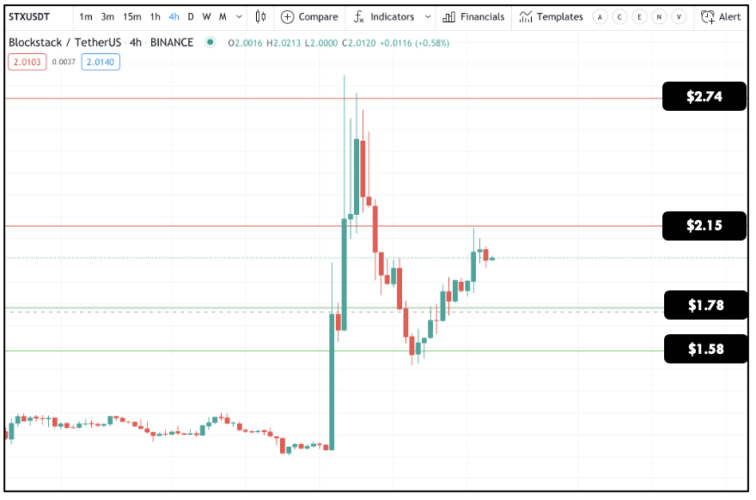

Blockstack (STX)

So far, in 2021, STX has gained over 440%. STX opened the year at $0.48 and reached highs of $2.7 on April 6, 2021. Most notably, the STX gained over 130% within the 48 hours leading to April 6. This rally is primarily attributed to the increase in the STX trade volume, which saw a ~950% increase during this period.

STX/USD Outlook

As the first Altcoin trading season kicks in, STX seems to be the biggest beneficiary so far with the increase in the volume traded. In the short term, we expect this rally to continue. Going with this bullish momentum, we expect STX to breach $2.15 (Fib Extension 1.618) with a longer-term outlook of $2.74.

In the short-term price pullback, STX could hit $1.78 with a firm support level at $1.58.

QTUM (QTUM)

QTUM opened the year at $2.23 and rose to hit an all-time high of $17.95 on April 6, 2021. This represents over 724% gain in under four months. In the one month to April 9, QTUM has been on a sustained uptrend gaining over 248%, reaching historic highs along the way.

QTUM/USD Outlook

In the short-term, QTUM has a downside of $14.65 – around Fibonacci extension 0. In the longer term, the downtrend could reach $8.22.

However, with the projected bullish trend in the alt season, we forecast that QTUM will hit $19.03 at a Fibonacci extension of 0.5

Solana (SOL)

Barely four months into 2021, the Solana crypto has gained a little over 1800%. Solana opened the year at $1.52 and has since been on a sustained bullish trend reaching an all-time high of $28.99 on April 9, 2021. In the past two weeks, SOL/USD has experienced a steep uptrend gaining over 150% while printing new historic highs daily.

SOL/USD Outlook

On April 9, 2021, SOL/USD is attempting a breach above the 3.618 Fibonacci Extension at the $29 mark. We expect that it will hit the $30.62 mark around the 4.236 Fibonacci extensions with the current bullish momentum.

However, the short-term pullback could reach a little under $24 and hit $18.41 around the 1.618 Fibonacci extensions in the longer term.

VeChain (VET)

VeChain has gained over 610% in the three months into 2021. VET/USD opened the year at $0.019 and hit 0.13 on April 9, 2021 – the highest since August 29, 2018. This is on the back of increased VET trade volume throughout the year.

VET/USD Outlook

On April 7, 2021, VeChain completed a bullish Cup and Handle pattern accompanied by a massive increase in trade volume. In the short term, we expect VeChain to hit $0.132, aligning with the 0.786 Fibonacci extensions.

In the short-term pullback, VET/USD will hit the $0.109 mark at Fibonacci extension 0.382 and $0.095 in the longer term at the 0 Fibonacci extensions.

Enjin Coin (ENJ)

From January to April 2021, Enjin has gained over 4500%. ENJ/USD opened the year at $0.13 and, thanks to a sustained bullish market, hit highs of $3.99 on April 9, 2021. This is the highest since its launch in December 2018.

ENJ/USD Outlook

From April 7 to 9, ENJ has gained over 98% breaching the 1.618 Fibonacci level. We have our sights at ENJ/USD hitting the $4 mark, counting on the continued uptrend in the short term. The price pullback is expected to hit $3.15 in the short-term, around 0.786 Fibonacci retracements, and up to $2.58 in the medium term.

You can easily invest in/buy the coins mentioned above at the lowest prices in some of the most premium crypto exchanges. Don’t forget to check them out.

If you have observed the price action of a few coins mentioned above, the buying market has resumed after a moderate pullback. This means that buyers managed to overshadow sellers, and as a result, the price continued to go further. Consider keeping a close watch on those cryptos as you could find more buy opportunities while trading them.

We hope you find this article useful and informative. In case of any other questions, please let us know in the comments below. Cheers.

##

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.