Top 5 Reasons Binance Coin (BNB) is Mooning

#

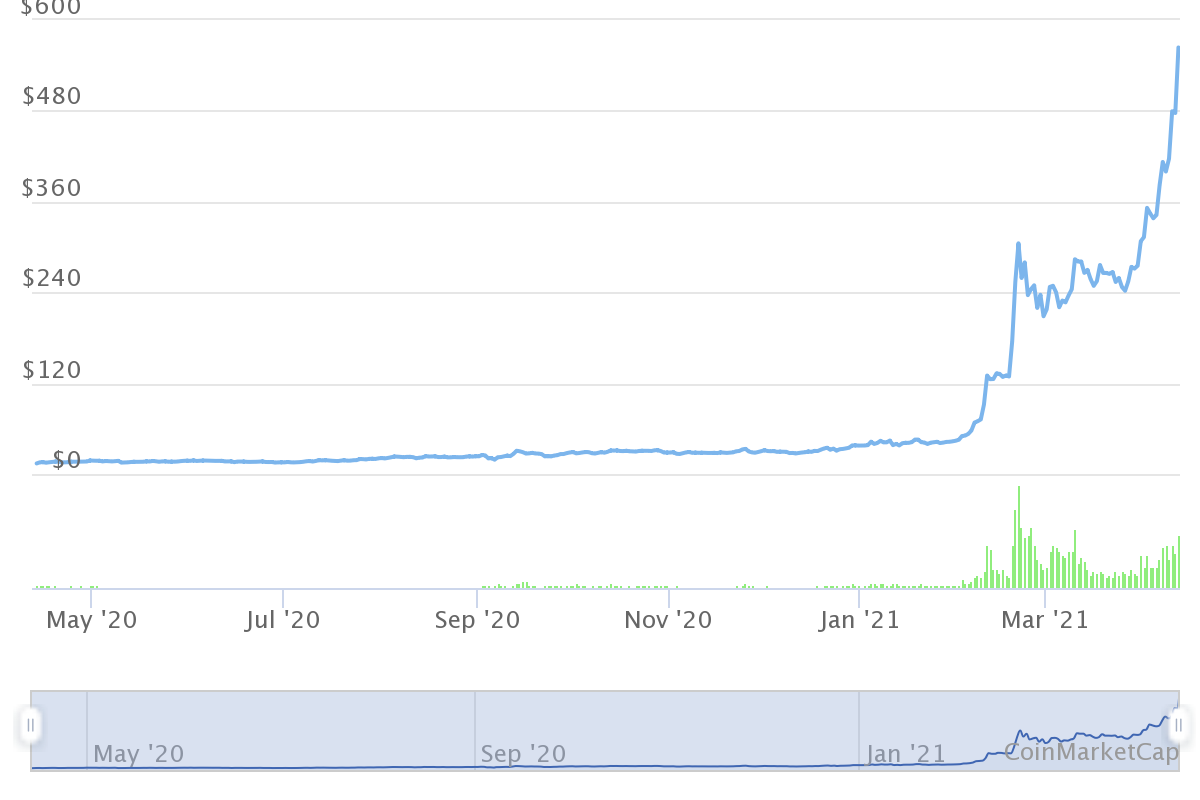

Binance Coin (BNB), the native asset of the Binance exchange ecosystem, is setting record prices both in dollar-denominated terms and against Bitcoin (BTC). The coin, which is used as a trading pair basis, and has additional functions to finance and support additional projects on the Binance Blockchain, has reached much higher valuations fast.

BNB traded at a peak of $571.67 on Monday’s session, reflecting the usually strong performance of markets over the weekend. The asset continued its climb to above $590, on the verge of taking over a new price range.

BNB recently peaked at 0.0097 BTC, breaking out nearly 10 times above the range of the 2017 bull market. For BNB, the price spike is more complex than simple market moves, and indicates a major investor behavior shift.

Here are the top 5 reasons for heightened demand and hype for BNB.

Binance Now Competes with Ethereum

One of the biggest sources of growth in the crypto market is decentralized finance. The series of projects achieve significant turnover, locking in more than $50B in value. Most of those projects are built on the Ethereum network, because it is the oldest and best-known tool for quick token creation.

But the high and unpredictable fees for ETH and token transfers are making users seek alternatives.

Binance’s decision to run both Binance Chain and Binance Smart Chain means there is now an additional platform to build decentralized trading, and seek passive income. Pancake Swap, one of the most recent projects, brought DeFi to Binance Smart Chain. The CAKE token has also taken off, from $0.65 at the start of 2021, to new highs above $26.

The PancakeSwap trading pairs are now locking in BNB for liquidity, meaning less coins to go around. DeFi is still in its early stages, building up awareness, and may tap new markets in the near future. Since most events in crypto space can happen within the span of a few weeks, this is one possible scenario for BNB adoption.

Exchange Coins are Booming

BNB is not the only asset expanding right now. As traffic and retail interest returns to exchanges, their native tokens are having a revival. Especially active trading in Asia is boosting the native assets of OKEx and KuCoin, some of the highly active marketplaces.

The arrival of an altcoin season means additional demand to trade lesser known assets, which have representation on those exchanges.

KuCoin Token (KCS) is on track to repeat its 2017 peak, after it started below $1 in January. The asset starts Q2 with peak prices above $19.50.

OKB, the native token of OKEx, is at an all-time high at $23.51. And Huobi Token (HT) is on another upward spike at $21.90. Almost all exchange-based assets were depressed only a year ago, as demand crashed, and traded at single-digit prices or below $1.

Hype and High Expectations

Despite its relatively humble beginnings as an ICO token, the BNB asset is now under the spotlight. There are some expectations the coin may continue to climb and even trade above $1,000.

The hype in crypto may always work as a self-fulfilling prophecy, and lift the asset to another level, locking in more value in Binance’s projects.

BNB Trading Has a Feedback Loop

Most of the BNB trading is, not surprisingly, concentrated on the Binance International exchange. About 67% of that volume is on one market, meaning the price is very amenable to investors rushing in and creating a pump.

The most active pair, BNB/USDT, is responsible for more than half the trades. This is the reason why BNB is decoupling from BTC, and creating its own price trajectory. BNB is not an asset that can be dumped for more Satoshis, but a platform coin in its own right, with an emerging economic logic.

The Binance Exchange has added another dollar-priced asset, BUSD, which also adds to the volumes and activities of the BNB pair.

It’s Finally Altcoin Season

One of the reasons for the increased interest in BNB is that, until recently, it somehow lagged the success of the leading coins, BTC and ETH.

As Traders of Crypto previously wrote, BNB had a chance for a rapid price discovery move, to reach the $500 range. Now that this has happened, there is less doubt that 2021 will give more leeway to altcoins, and will not be ruled by BTC price moves.

Curiously, search interest in “binance coin” is booming in the UK. After Brexit, the economic space is now not limited by EU laws, and may start to build its own crypto trading ecosystem. For now, Binance Smart Chain and its DeFi projects are limited to US traders, and reflect mostly international demand. US-based traders are only able to use Binance.us and only withdraw to the older type of Binance Chain wallets.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.