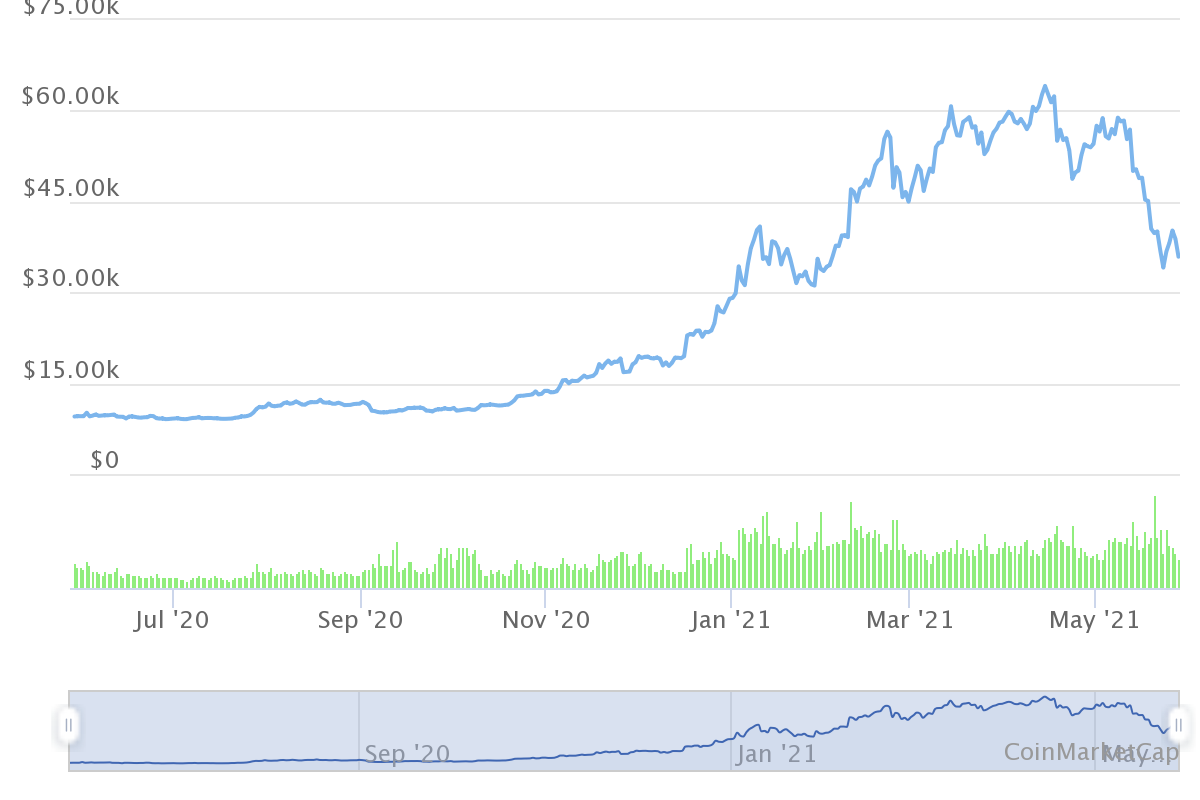

BTC, Altcoins Touch Record Volumes Despite Capitulation

##

Crypto markets are not only gaining media popularity but are constantly adding to their liquidity. In 2021, trading BTC, ETH or new up and coming assets has a totally different trading profile. While in the early days of crypto only a handful of spot exchanges set the price, now trading is a mix of futures markets, spot markets and decentralized algorithmic trades.

Spot markets showed significant liquidity even during the sell-off around May 19. In the past month, spot trading reached $2T based on aggregated exchange data.

The data also coincides with a trend toward buying BTC to hold, instead of using it for short-term speculation. The recent spike in volumes was achieved despite the temporary outages of most crypto exchanges during the May 19 sell-off.

What Supports the High Volumes?

One of the staples in crypto space are the dollar-pegged stablecoins. Despite criticism over the years, the expansion of USDT supply and the minting of new types of dollar-equal assets has not stopped. Those assets made their way into exchanges, ensuring sufficient liquidity and limiting potential price slippage.

The stablecoin market is now in excess of $100B, with most coins turning over several times in 24 hours to support peak volumes.

Moreover, there are more incentives for funds to remain within the crypto space, moving between exchanges or DeFi protocols.

The effect of Tether (USDT) is especially strong, as the asset is ubiquitous in Binance trading. USDT supports both BTC bull markets, but also altcoin trading. USDT supplies exchanges with billions of liquidity, but about $1.2B equivalent of the coin is going to the DeFi sector. Stablecoin supply has grown more rapidly in the past months, and USDT is now available in nine different blockchain versions.

Additionally, USD Coin (USDC), the Gemini exchange dollar-pegged asset, saw more active supply minting in the past few weeks. USDC now carries more than 4.2% of all crypto trades, also boosting trading on Coinbase.

Altcoin Trading Proved Riskier

Altcoin season has led to significant asset appreciation. The combination of stablecoin inflows and ETH collateralization boosted prices across the board. But despite the high-level activity, altcoins were prone to much deeper corrections.

The second quarter of 2021 is moving in the direction of less leverage, especially after the deep capitulation event which erased nearly 50% off some assets.

The price of BTC is once again at a crossroads, as BTC prices sank under $37,000. Volumes have thinned out this time, with the potential to test the robustness of the spot market.

Outflows from exchanges became another indicator of the recent interest to buy Bitcoin on the spot market. The price crash toward $30,000 did not stop retail buyers from taking coins off exchange wallets.

The trend reveals readiness to buy and hold assets for the longer term, while highly active leveraged trading is taking a break.

Crypto Assets Saw Largest Capitulation in History

The recent liquidation and price crash event was indeed unprecedented in all previous market conditions. Crypto trading is fully unregulated, and activity continued despite dramatic shifts in market activity.

Prices remain unpredictable, with several possible scenarios. Some analysts see BTC prices move in a range, without touching new highs. In the past, similar selling events coincided with actual drops in stablecoin supply. This time, no minted stablecoins were retired, and in fact their supply increased, suggesting the market has sufficient liquidity for future moves.

Now, the question remains whether the BTC capitulation is a sign of a coming bear market, or conversely, that it has shaken off leverage and weak hands in preparation for a future upward move.

For some traders, the sell-off recalls the capitulation of March 2020, which was only a blip on the radar compared to the bull market in 2021.

Will BTC Go Higher?

In the past week, BTC only held above $40,000 for a few hours, often sliding back to the $36,000 range. In the short term, BTC prices will have to retake previous support positions before attempting a breakout.

The path for BTC may be less straightforward, but the new price moves will happen in conditions quite different from the last bear market. During the lows happening between 2018 and 2020, both trading activity and stablecoin supply easily shrank to very low levels. The Binance exchange activity slid as low as $1B per day in trades.

At this point, there are still beliefs BTC has not reached its peak price for the halving cycle, with potential to move to $100,000. However, predictions also include a lower bottom and more capitulation before recovery.

Data also show Google searches for “bitcoin” are near an all-time high, showing interest in the leading crypto asset, moving beyond the recent Dogecoin (DOGE) hype.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.